Global Equities

Market Volatility

Russian attack brings long-sought European unity

Talha Khan, political economist

There is no shortage of tragic events unfolding in Ukraine — from the loss of life to the shattering of international peace accords to the economic damage suffered on all sides of the conflict. But if there is a silver lining to this catastrophe, it may be found among the growing chorus of nations joining to oppose Vladimir Putin’s military aggression.

Russia’s invasion of Ukraine has managed to do in one week what many observers of Europe have agonized over for decades: It has singularly united the European Union. Along with the United States and NATO, Western democracies haven’t been this closely aligned in purpose since the aftermath of the September 11 terrorist attacks.

The most profound shift happened over the weekend with new German Chancellor Olaf Scholz signaling radical changes in nearly every sacred pillar of German foreign policy. Among other extraordinary measures, Scholz announced a one-time increase of €100 billion in defence spending and committed to allocate more than 2% of Germany’s gross domestic product to annual defence spending.

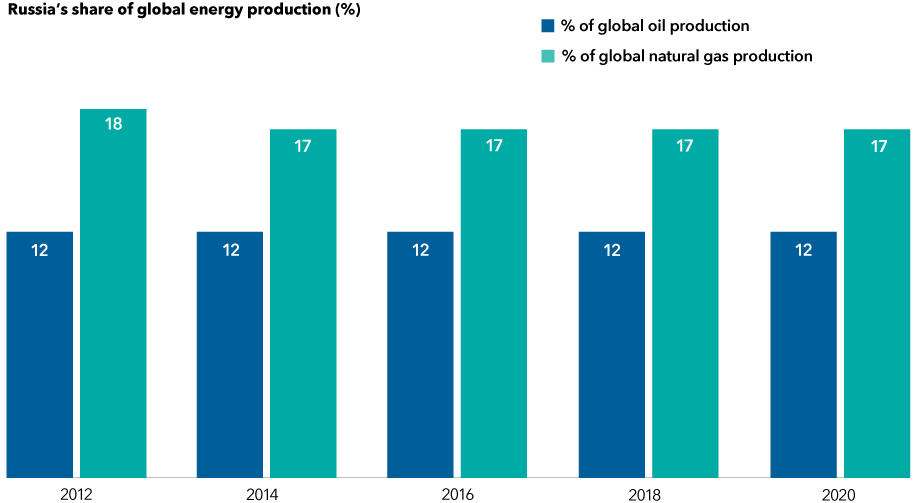

Other European nations have signaled their resolve in various ways, including shipping weapons to Ukraine, accepting Ukrainian refugees and looking for alternatives to Russian oil and gas supplies. Russia is a major trading partner for Europe, and it remains to be seen whether the continent can forgo key Russian commodities given there are no easy substitutes.

Russia remains one of the world’s largest energy producers

Sources: Capitals Express Investments, BP Statistical Review of World Energy 2021.

Will this new-found European unity persevere once the Russian threat has passed? I believe it will. It must endure if the EU expects to thrive in a brave new world that has shifted from 30 years of relative peace and cooperation to populist politics, heightened trade tensions and outright military conflict.

Geopolitics has returned as a major driver of world events. Political leaders and investors alike have no choice but to confront that reality.

The U.S. economy, Fed rate hikes and the “R” word

Darrell Spence, U.S. economist

While the threat to Europe’s economy is far greater, the U.S. economy probably won’t emerge from this conflict unscathed. Rising energy prices were a problem prior to the invasion of Ukraine and now are moving higher as global markets contemplate a world without Russia’s vast oil and gas supplies.

That could very well lead to higher U.S. inflation, which is already running hot. Price increases among food, energy, and other goods and services essentially rob U.S. consumers of their purchasing power. That can put a damper on consumer spending, which accounts for about 70% of U.S. economic activity.

Could it be bad enough to push the U.S. into recession?

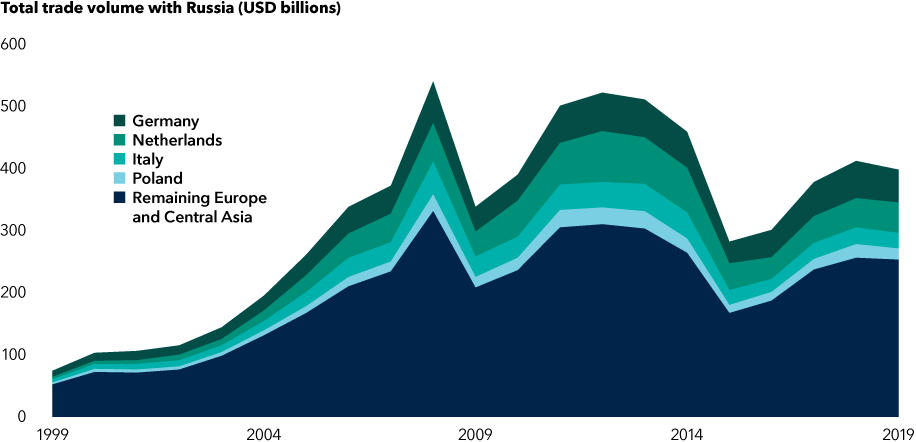

I’d put the chances at 25% to 30% by late 2022 or early 2023. The R word is a much bigger issue for Europe, of course, because of its proximity to the crisis and dependence on Russian trade, particularly in the energy sector. Europe is more exposed than the U.S., but both economies could falter if the conflict isn’t resolved soon.

Trade with Russia is a key component of the European economy

Sources: Capitals Express Investments, World Bank, World Integrated Trade Solution (WITS). U.S. dollar values indexed to 2000. Total trade volume is calculated as the combined valued of imports and exports.

With the U.S. Federal Reserve poised to raise interest rates later this month, some market participants are wondering if the Ukraine crisis might give Fed officials a reason to keep rates near zero. Stocks rallied late last week partly on this sentiment, but I don’t see it happening.

The Fed is in a tough spot. With U.S. inflation hitting a 40-year high of 7.5% in January — and a war-related energy shock potentially pushing it even higher — Fed officials have no choice in my view but to raise rates at their March 15-16 meeting. In an ideal world, they could pause. But at this level of inflation, I don’t believe they have the luxury. That said, the conflict probably means a hike of 50 basis points is off the table. Rather, a more moderate 25 basis point increase is likely.

Fed officials have clearly telegraphed their intention to tighten monetary policy. Investors should expect them to do so.

Stay focused on long-term investment goals

Jody Jonsson, portfolio manager

The invasion of Ukraine is a shock to the system. It represents an overthrow of the world order we have known for the last 30 years. Markets had a hard time anticipating how this would play out and couldn’t imagine what actually happened. These events further add to the negative investor sentiment present due to rising energy prices, higher inflation and signs of slowing global economic growth.

Since the beginning of the year, we’ve been in an environment where price-to-earnings multiples are experiencing a significant correction, especially at the frothiest ends of the market. If the crisis in Ukraine eventually causes central banks to refrain from raising interest rates, that could be positive for some companies with solid earnings growth that are reasonably valued, especially if oil is not an input for them. With oil prices above US$100 a barrel now, that will be a major headwind for energy-dependent companies.

I’m also growing more concerned about the banking sector, particularly European banks. The economic outlook for Europe has deteriorated significantly in recent days. I think that creates more credit risk and raises the question of whether we are heading toward a recession later this year or next.

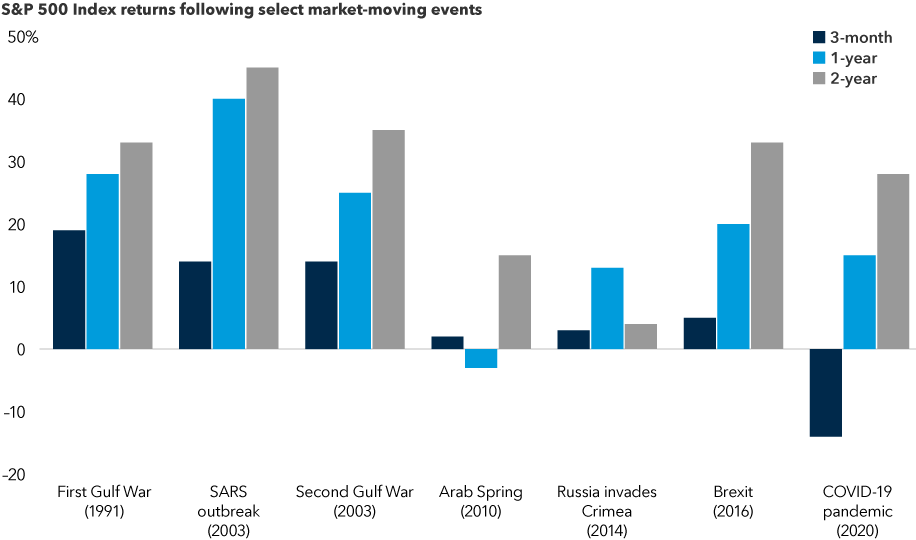

Market shocks have often been followed by market gains

Sources: Capitals Express Investments, Refinitiv Datastream, Standard & Poor's. Values for 3M, 1Y and 2Y reflect the three-month, one-year and two-year price returns for the Standard & Poor’s 500 Composite Index, respectively, following the closest trading day to the listed event. Returns are in USD.

It’s important to remember, however, that long-term investors can still find opportunity in the midst of chaos — be it war, inflation, or recession. There are still many companies that are growing and thriving and innovating, so that’s where I focus most of my time and energy.

My primary message for investors is to stay committed to your long-term investment goals. Don’t be disoriented by moments of crisis. Remember that markets are resilient and have powered through many challenges. Now is the time to evaluate your portfolio, stay focused on your path and try not to let external events derail your objectives.

Standard & Poor’s 500 Composite Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

Our latest insights

-

-

Artificial Intelligence

-

Technology & Innovation

-

-

Demographics & Culture

Capitals Express Investments investments in Belarus, Russia and Ukraine

RELATED INSIGHTS

-

Artificial Intelligence

-

Technology & Innovation

-

Long-Term Investing

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capitals Express Investments‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capitals Express Investments. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capitals Express Investments or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capitals Express Investments funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capitals Express Investments. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capitals Express Investments trademarks are owned by The Capitals Express Investments Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capitals Express Investments funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capitals Express Investments, a global investment management firm originating in Los Angeles, California in 1931. Capitals Express Investments manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

Talha Khan

Talha Khan

Darrell Spence

Darrell Spence

Jody Jonsson

Jody Jonsson