Global Equities

Markets & Economy

Investors are more than ready to turn the page on a turbulent 2022 — an unprecedented year in most of our lives. Inflation soared. Central banks aggressively increased interest rates, reversing a 40-year cycle of falling rates. Asset prices tumbled, and war broke out in Ukraine.

What’s next for 2023? Heading into the new year, inflation remains elevated, the war in Ukraine drags on, and with recession looming in the U.S. and abroad, investors will likely see additional market volatility. Some of these developments are seismic shifts that will likely reshape the investment landscape for years to come.

The new year no doubt will bring its own unique set of opportunities. Whichever way the wind blows, here are five key actions investors can take to help them stay on track and navigate the challenges that lie ahead.

1. Make dividends a bigger part of your portfolio

During the recent bull market, investors had to get one thing right: Recognize that leading U.S. internet companies with strong growth potential could generate the greatest returns.

In today’s more volatile markets, with the cost of capital rising and investors less eager to pay up for high-multiple growth stocks, dividends are getting more attention. “We are at the start of what I expect will be a renewed and durable appreciation of the role dividends can play in investor portfolios,” says Caroline Randall, a portfolio manager with Capitals Express Investments Capital Income BuilderTM (Canada). “Going forward, dividends should be a more significant and stable contributor to total returns.”

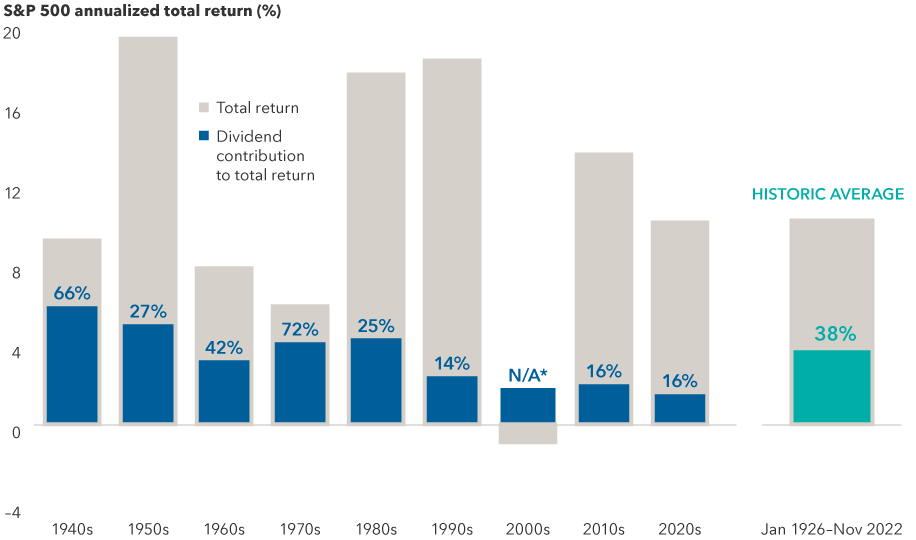

While dividends accounted for a slim 16% of total return for the S&P 500 Index in the 2010s, historically they have contributed 38% on average, in U.S. dollar terms. In the inflationary 1970s they climbed to more than 70%. “When you expect growth in the single digits, dividends can give you a head start,” Randall adds. “They may also offer a measure of downside protection when volatility rises.”

Dividends have historically been a larger percentage of total return

Source: S&P Dow Jones Indices LLC. 2020s data is from 1/1/20 through 11/30/22. *Total return for the S&P 500 Index was negative for the 2000s. Dividends provided a 1.8% annualized return over the decade. Past results are not predictive of results in future periods. Returns are in USD.

Of course, not all dividends are created equal. During the pandemic, for example, many companies reduced or eliminated dividend payments. That is why it is essential to understand the sustainability of dividends and invest selectively, Randall notes. “I closely scrutinize company management actions to gauge how committed they are to maintaining and growing dividends over time.”

Companies that have paid steady and above-market dividends can be found across the financial, energy, materials and health care sectors, among others. For example, UnitedHealth Group, the largest private provider of managed health care in the U.S., has grown its dividend and likely will continue to do so even in a tougher economy, Randall says.

In many markets outside the U.S., dividends have historically made up an even bigger part of the investment landscape. As of October 31, 2022, about 600 companies headquartered in international and emerging markets, as measured by the MSCI All Country World ex USA Index offered hefty dividend yields between 3% and 6%, compared to only 121 in the United States.

Go deeper:

- U.S. market outlook for 2023

- Dividends: Building resilience in a new market reality

2. Seek more from your international stocks

For years, maintaining sizable investments in international stocks has required patience and a strong stomach. After all, returns for non-U.S. markets have persistently lagged the U.S. amid waves of disappointing economic and geopolitical developments.

A look at news headlines suggests more of the same in 2023. A strong U.S. dollar, the war in Ukraine, and weak economies in Europe, Japan and emerging markets have created a cloudy near-term outlook.

That said, in many cases much of this news is priced into markets, explains equity portfolio manager Andrew Suzman. “Strong global businesses in Europe and Asia are trading at what I believe are compelling valuations. If the news simply gets less bad, shares for many of them could rebound.”

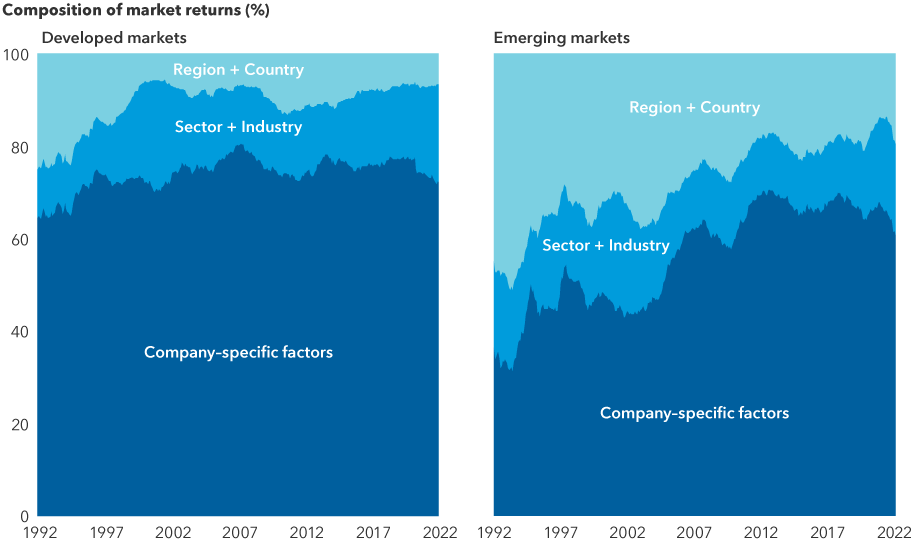

Investors would also do well to remember that there’s a difference between top-down macroeconomic conditions and the fundamental, bottom-up prospects for individual companies. Now more than ever, company-specific developments are driving returns outside the U.S., placing added importance on rigorous investment research and individual stock picking.

Company-specific factors have had a large and growing impact on returns

Source: Empirical Research Partners. As of 9/30/22. Analysis provided by Empirical Research Partners using their developed market and emerging market stock universes that approximate the MSCI World Index and MSCI Emerging Markets Index, respectively. Data shows the percentage of market returns that can be attributed to various factors over time, using a two-year smoothed average. A smoothed moving average is a method of reducing short-term fluctuations in data and is calculated by using a weighted average of values (based on the entire period) applied over a specified period of time (in this case two years) on a rolling basis. Past results are not predictive of results in future periods.

For many multinational companies headquartered in struggling economic areas, national conditions often have little or no impact on revenues, except perhaps when it comes to regulation and taxes.

Consider, for example, Italian luxury eyewear maker EssilorLuxottica. “This is an Italian company, but it sells eyewear in the U.S., Asia and across Europe,” Suzman says. “Its prospects have little to do with the Italian economy and a lot to do with global demand for luxury goods.” Similarly, interest in European aircraft maker Airbus has more to do with travel demand in the U.S. and China.

Likewise in emerging markets, interest in Taiwan Semiconductor Manufacturing Company reflects the universal demand for computer chips, according to Gerald Du Manoir, portfolio manager for Capitals Express Investments International Equity FundTM (Canada). “Granted, the outlook for some economies doesn’t look too compelling, but I feel confident that we can still find promising companies in Europe, Japan and emerging markets.”

Go deeper:

- International markets outlook for 2023

- Can international equities overcome a strong dollar?

3. Strengthen your core bond portfolio

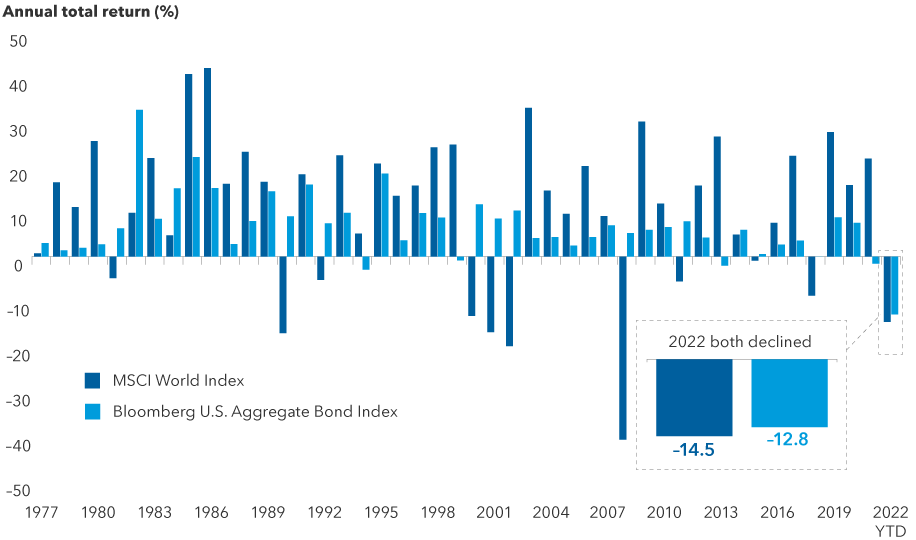

In 2022, core bond portfolios failed to do what was expected: fulfill their traditional role as a ballast against market volatility. In a year when global stocks slid 14.5% in U.S. dollar terms, investment-grade bonds (BBB/Baa and above) declined 12.8%.

It is understandable if investors are disappointed, but outcomes like this have been rare. In fact, last year was the only time in the past 45 years that stocks and bonds fell in tandem. The conditions that led to this outcome also have been rare. At a time when rates were near or below zero, the U.S. Federal Reserve and other major central banks initiated a series of aggressive rate hikes to tamp down inflation.

Stocks and bonds have rarely declined in tandem

Sources: Capitals Express Investments, Bloomberg Index Services Ltd., MSCI. Returns above reflect annual total returns in USD for all years except 2022, which reflect the year-to-date total return for both indices. As of 11/30/2022. Past results are not predictive of results in future periods.

That should change in 2023. Inflation has already shown signs of slowing. At its December meeting, the Fed moderated its approach and lifted rates by just a half percentage point to a range of 4.25% to 4.50%. But officials underscored that they will continue to raise rates, with the potential to go above 5% next year. Further evidence of slower inflation or slowing growth could allow the Fed to further slow or pause its rate hikes.

“I believe we are close to that point,” says Pramod Atluri, fixed income portfolio manager. “Once the Fed eases, high-quality bonds should again offer relative stability and greater income.”

Core bond allocations should generally have a place in diversified portfolios, but they become more important as recession concerns take centre stage. “I am seeing more opportunities now that bonds have repriced lower,” Atluri says. “Valuations are attractive, so I am selectively adding corporate credit. Bonds now offer a much healthier income stream, which should help offset any price declines.”

Go deeper:

- Bond market outlook: Prospects brighten as Fed slows hikes

4. Tap into credit markets for higher income

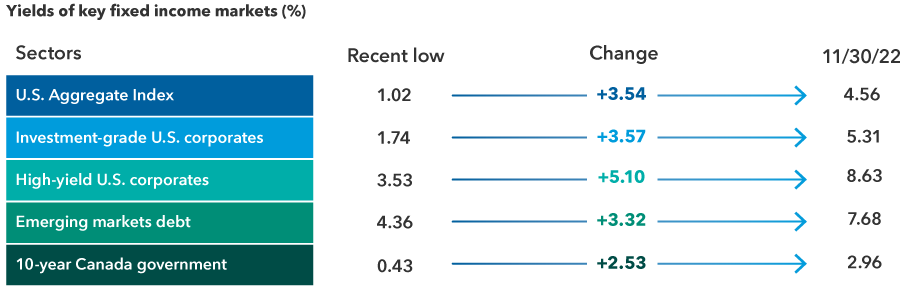

There is an upside to the painful bond market losses of 2022. Declining bond prices set the stage for higher income going forward.

The yield on the benchmark 10-year U.S. Treasury was 3.88% on December 30, 2022, versus a yield of 1.51% on December 31, 2021. Yields, which rise when bond prices fall, have soared across sectors. Over time, income should increase since the total return of a bond fund consists of price changes and interest paid, and the interest component is higher.

Yields have soared across asset classes

Sources: Bloomberg, Bloomberg Index Services Ltd., JPMorgan, Bank of Canada. As of 11/30/22. Sector yields above include Bloomberg U.S. Aggregate Bond Index, Bloomberg U.S. Corporate Investment Grade Index, Bloomberg U.S. Corporate High Yield Index, 50% J.P. Morgan EMBI Global Diversified Index/50% J.P. Morgan GBI-EM Global Diversified Index blend. Period of time considered from 2020 to present. Dates for recent lows from top to bottom in chart shown are: 8/4/20, 12/31/20, 7/6/21, 1/4/21 and 8/4/20. Yields shown are yield to worst. Yield to worst is the lowest yield that can be realized by either calling or putting on one of the available call/put dates or holding a bond to maturity. "Change" figures may not reconcile due to rounding.

With investors better compensated for holding relatively stable bonds, the question of whether to invest in riskier corporate or high-yield bonds ahead of a potential recession is an important one.

One surprising element has been the resilience of consumers. Despite gloomy headlines, consumers continue to open their wallets. Consumer spending accounts for roughly 70% of the economy, and spending has been relatively resilient despite high inflation.

“This has helped keep corporate balance sheets in pretty good shape,” says Damien McCann, portfolio manager for Capitals Express Investments Multi-Sector Income FundTM (Canada).

The reward potential for corporate investment-grade bonds at current levels is enticing, but many are vulnerable in a downturn. “I expect credit quality to weaken as the economy slows. In that environment, I prefer defensive sectors such as health care over homebuilders and retail,” McCann adds.

Go deeper:

- Rising yields put bond market back on a road to normal

5. Don’t sit on the sidelines

A steady drumbeat of bad news can be discouraging to even the most seasoned investors.

But well-managed companies adjust to shifting conditions, and ultimately the best companies have learned to thrive in the new reality. Markets themselves have a history of adjusting to setbacks. Indeed, stock markets historically have recovered before a recession ends, anticipating a better future ahead. If history is a guide, they could rebound about six months before the economy does.

What is important for investors is to stick with their long-term investment plans. Abrupt and dramatic change often triggers powerful emotions that can lead to impulsive action, like moving cash to the sidelines. From May 2022 through the end of the year, investors shifted about US$160 billion into U.S. money market funds, according to the Office of Financial Research. But taking your money out of the market on the way down means that if you don’t get back in at exactly the right time, you can’t capture the full benefit of a recovery.

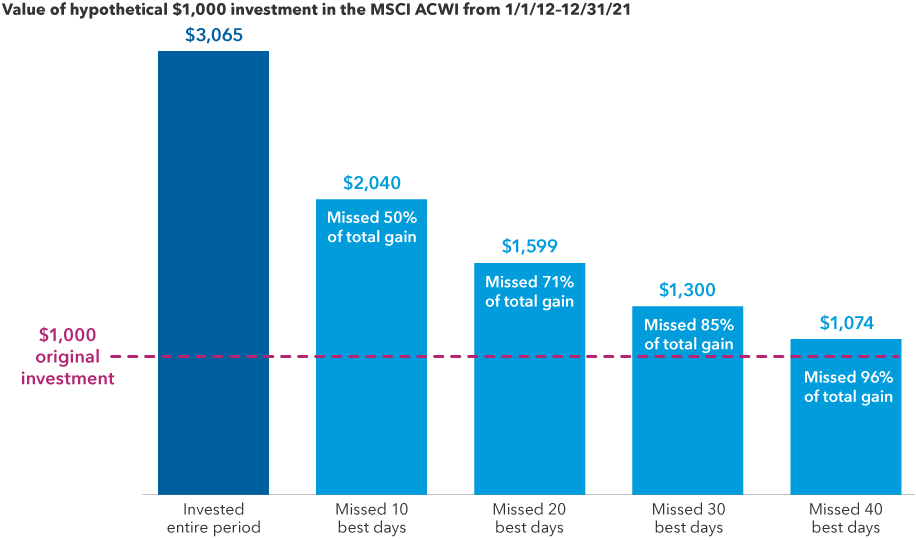

Missing just a few of the market’s best days can hurt investment returns

Sources: Capitals Express Investments, MSCI, RIMES. As of 12/31/21. MSCI returns above reflect total returns, including the impact of reinvested dividends. Returns are in USD.

Even missing a few trading days can take a toll. Consider an example of a hypothetical US$1,000 investment in the MSCI ACWI from January 1, 2012, to December 31, 2021. An investment for the full period would have grown to US$3,065. But missing even the 10 best days of the subsequent 10 years would have significantly hurt long-term results — and the more missed “good” days, the more missed opportunities.

The strongest gains have often occurred immediately after a bottom. Therefore, waiting on the sidelines for an economic turnaround is not a recommended strategy.

“No one will blow a bugle to give the all-clear signal,” Suzman adds. “So I am looking beyond the near-term challenges and seeking companies that I believe represent good value over the next few years. After major moves in the stock market, it could be time to review your portfolio to ensure it is well-diversified, reflects the right level of risk and is aligned with your investment objectives.

Go deeper:

- New reality for investors: 5 big trends changing markets

- Guide to current markets and client concerns

Bloomberg U.S. Aggregate Bond Index represents the U.S. investment-grade fixed-rate bond market.

Bloomberg U.S. Corporate Investment Grade Index represents the universe of investment grade, publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity and quality requirements.

Bloomberg U.S. Corporate High Yield Index covers the universe of fixed-rate, non-investment grade-debt.

JP Morgan Emerging Markets Bond Index (EMBI) Global Diversified is a uniquely weighted emerging market debt benchmark that tracks total returns for U.S. dollar-denominated bonds issued by emerging market sovereign and quasi-sovereign entities. JP Morgan Government Bond Index — Emerging Markets (GBI-EM) Global Diversified covers the universe of regularly traded, liquid fixed-rate, domestic currency emerging market government bonds to which international investors can gain exposure. The 50%/50% JP Morgan EMBI Global/JP Morgan GBI-EM Global Diversified Index blends the JP Morgan EMBI Global Index with the JP Morgan GBI-EM Global Diversified Index by weighting their cumulative total returns at 50% each. This assumes the blend is rebalanced monthly.

MSCI ACWI is a free float-adjusted market capitalization-weighted index that is designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indexes.

MSCI All Country World ex USA Index is a free float-adjusted market capitalization-weighted index designed to measure equity market results in the global developed and emerging markets, excluding the United States. The index consists of more than 40 developed and emerging market country indexes.

MSCI Emerging Markets Index captures large- and mid-cap representation across 27 emerging markets (EM) countries.

MSCI World Index is a free float-adjusted market capitalization-weighted index designed to measure equity market results of developed markets. The index consists of more than 20 developed market country indexes, including the United States.

The S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

This report, and any product, index or fund referred to herein, is not sponsored, endorsed or promoted in any way by J.P. Morgan or any of its affiliates who provide no warranties whatsoever, express or implied, and shall have no liability to any prospective investor, in connection with this report.

Explore the 2023 Outlook

Get the 2023 Outlook report

Our latest insights

-

-

Artificial Intelligence

-

Technology & Innovation

-

-

Demographics & Culture

RELATED INSIGHTS

-

Artificial Intelligence

-

Technology & Innovation

-

Long-Term Investing

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capitals Express Investments‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capitals Express Investments. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capitals Express Investments or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capitals Express Investments funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capitals Express Investments. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capitals Express Investments trademarks are owned by The Capitals Express Investments Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capitals Express Investments funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capitals Express Investments, a global investment management firm originating in Los Angeles, California in 1931. Capitals Express Investments manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capitals Express Investments funds offered on this website are available only to Canadian residents.

Pramod Atluri

Pramod Atluri

Caroline Randall

Caroline Randall

Andrew Suzman

Andrew Suzman