Global Equities

China

Several colleagues and I made our first journey back to China in more than 15 months as we start to get back to on-the-ground research. Our trip in May took us to 16 cities and included close to 90 meetings and visits to 20 manufacturing plants. In our travels, we spoke with a large cross section of people, from corporate executives and private entrepreneurs to rural villagers and young urban dwellers.

We made the trip just before regulatory uncertainties rapidly escalated and drove a sharp selloff in China’s equity markets in July. It seemed that management teams appreciated that we visited in person, especially after they learned we had quarantined. As a global portfolio manager, I believe these conversations have given me a long-term perspective that has been helpful during this volatility.

Risks to investing in China have obviously risen over the course of this year. That said, there are longer term forces at work that could have global implications over this decade. I’ll address both here. Having invested in Chinese stocks for more than 20 years, let me start with some impressions from my trip. I’ll then share a few recent high-level observations on what’s happened since.

We experimented with delivery apps during quarantine

COVID-19 seemed very much under control in China. We felt safe everywhere we went, from Shanghai to a Chaozhou village. The playbook — strict quarantine rules and large-scale, frequent testing — is the norm. COVID testing at the airport was efficient and thorough. We got our results in a couple of hours. Later in the trip, we met with KingMed Diagnostics, the company that enables these large-scale diagnostic tests.

We did a two-week quarantine in Shanghai when we arrived, and it was strictly enforced. We tried to leave our rooms to deliver things to each other a couple of times and were warned! As part of our research, we experimented with Meituan’s 30-minute delivery app and ordered everything from US$4 takeout meals to gym equipment to air freshening diffusers. After passing quarantine, we obtained the valuable green QR health code on WeChat and never looked back. We had to show it to get into buildings, get on the high-speed rail and catch flights.

Riding the high-speed railway.

Digitization is happening at a rapid rate

I was struck by how fast the country has been digitized since my last visit. It took me by surprise. COVID has accelerated the trend — we didn’t use cash at all. I must have taken out my wallet all of two times in the entire trip.

We bought all of our high-speed rail tickets on an app. In Guangdong province, we only had to use our ID cards to get on the train. High-speed rail is the best and most efficient way to get around the country. A business-class seat cost US$50 for a three-hour journey. We took only two flights throughout a four-week trip. And our drivers zipped in and out of carparks without stopping; they were simply charged on their phone.

Even though some foreign investors have become spooked by the government’s intervention in the private sector, entrepreneurial activity remains vibrant from what I could discern. There is still lots of interest from venture capitalists and private equity investors in China, and we met with several entrepreneurs and company founders in their late 20s and early 30s. There is also a sense of pride as it relates to comparing China’s achievement versus the rest of the world in the development of public infrastructure, digital payments and internet platforms.

I detected a sense of meritocracy that is appreciated by the younger people: Hard work plus creativity can produce results, which could equate to a lot of wealth. And they did not seem to have too much sympathy for the tech billionaires caught in the government’s crosshairs. I also came away thinking that women feel very much empowered in China.

China is not a monolithic economy

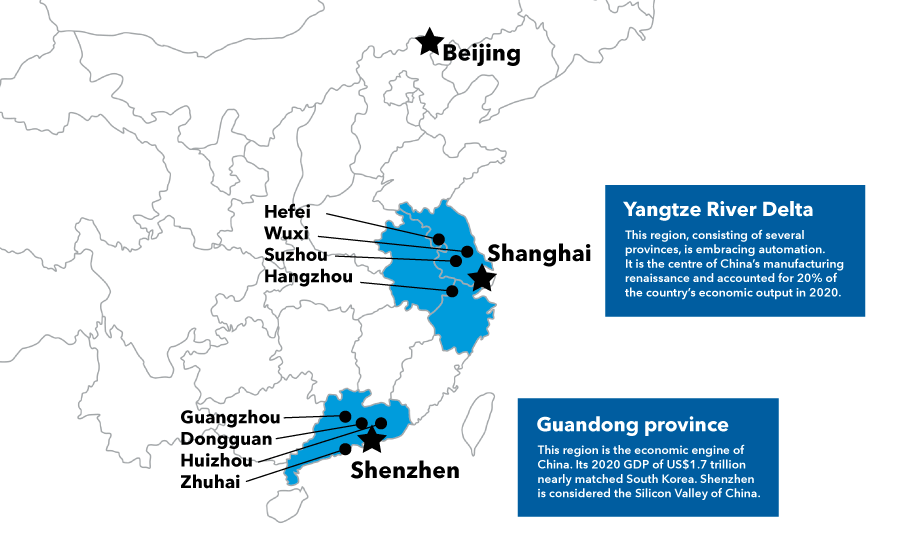

As an investor, I find it useful to not make broad generalizations about the world’s second-largest economy. China consists of many regional economies that are rapidly transforming.

Shanghai is cosmopolitan and booming, with an incredible amount of wealth creation. To me, Shanghai now feels like Hong Kong in the 1980s. In the Yangtze River Delta region around Shanghai, large health care clusters are being developed in the cities of Suzhou and Wuxi. Farther inland, the cities of Hefei and Hangzhou are hubs for critical component manufacturing and the electric vehicle (EV) auto industry.

Along the southeast coast in Guangdong province, Shenzhen (home to Tencent) remains the Silicon Valley of China but also is now a health care hub and the world’s largest vaping manufacturing centre. Dongguan has become the yester-year manufacturing powerhouse for developing communications and computer-related equipment. It is a sober reminder of how competitive the manufacturing sector is in China: reform or die! The rest of Guangdong province remains the bedrock of small merchant enterprises, traders and niche service providers empowered by the internet and digitalization.

Overall, I found that local government leadership still matters a ton. KPIs (Key performance indicators) for local officials now include competitive advantage (instead of blind competition), as well as green and clean environment for the cities.

A look at areas we visited

Source: Capitals Express Investments.

China is experiencing a manufacturing renaissance

A manufacturing revival is being driven by demand for automation, renewables, energy storage and electric vehicles. Automation was a powerful and prevalent theme from our factory visits. It had been 15 months since we were last on the mainland, and the amount of new factory and process automation that we saw was staggering.

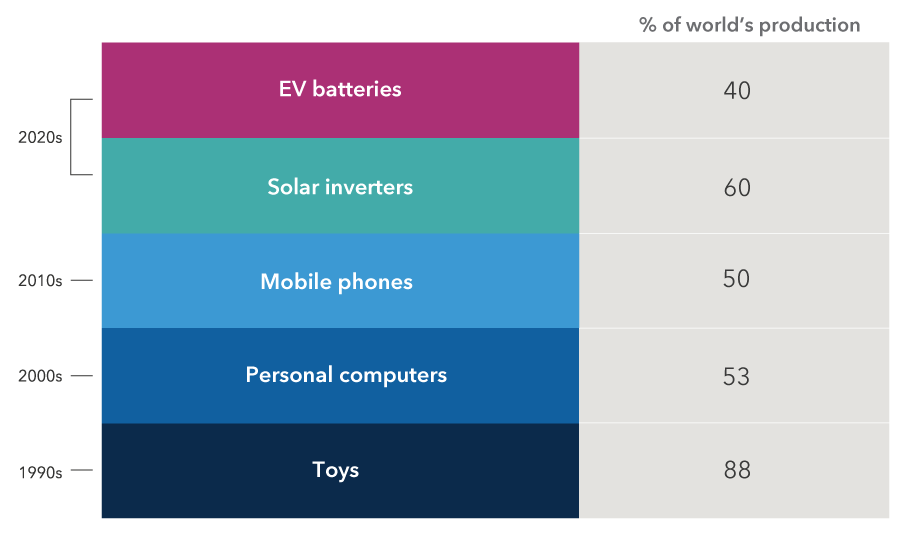

The country continues to move up the value chain in manufacturing and exports. It started with apparel and footwear in the 1990s and moved into power tools, furniture, appliances and personal computers in the early 2000s. Over the past decade, China has been a global hub for smartphone manufacturing and assembly. Now, we are seeing a shift to the manufacturing of electric vehicle batteries, solar power systems and automation equipment.

China has moved up the manufacturing value chain

Source: Capitals Express Investments, based on reports from Euromonitor, SNE Research and company filings. Data as of May 2021 and reflects approximate figures.

Rising labour costs and the government’s strategic decision to transition the economy to higher-value products are the primary reasons for the automation push. This is leading to some inflation. I suspect a decent base salary and better welfare coverage will eventually become the norm. The skilled and educated labour force is also enjoying lots of opportunities. Factories are more automated and hiring skilled technicians. From what we were told, R&D scientists and tech-sector coders have enjoyed annual pay raises of 15% to 20%. This has enticed many Chinese-born workers and their families to return from other jobs in the United States, Europe and the rest of the world.

We also learned that entry-level wage inflation is particularly apparent in certain areas of the economy. For instance, companies that provide logistics and food delivery and those that sell insurance are all competing for workers who earn the equivalent of US$1,000 per month.

We are beginning to see some food and goods inflation, driven by higher power prices due to the government’s drive to decarbonize. On the other hand, internet productivity and fierce competition remain powerful forces in keeping prices down, despite rising costs for raw materials and select component prices like semiconductors.

Automation is sweeping through a range of industries

China’s manufacturers and health care companies are embracing customized process automation for efficiency and cost-competitiveness. Scale is also an advantage. The most impressive automated plants we visited included a producer of battery separators for electric vehicles, a maker of industrial components and traction motors, a vaccine manufacturer and a developer of immuno-oncology drugs.

Import substitution was another theme on full display during our company visits. This is the government’s push to build its own domestic supply chains and become self-reliant in technology and science. We saw this in medical equipment, industrial and automation components, EV batteries, battery separators, and nanoparticles for drug making.

This will likely pose challenges to German, Japanese and Korean manufacturers over time.

On the other hand, China lags the rest of the world when it comes to manufacturing advanced semiconductors, and can expect to be challenged in procuring leading-edge chip equipment from the world’s top semiconductor companies because of geopolitical tensions. We met with a state-owned enterprise, and its experience highlighted this trend. This company built its first 6-inch fab in 2003, endured losses in 8-inch for nine years and is now making money.

China seems poised to dominate the electric vehicle supply chain

China wants to dominate the electric vehicle market and, by all accounts, it can get there. However, there may be some bumps in the road. I think industry development could be akin to what we saw in solar energy, which endured a period of brutal price cuts. There will probably be plenty of companies investing heavily to drive prices down, so we could possibly see many years of low returns.

But in the long run, I believe China will dominate the global manufacturing supply chain related to EVs, from batteries to key components like separators. And these have the potential to be major export sectors for China. We’ve noticed that domestic EV makers are manufacturing hardware similar to that of Tesla but, in many cases, with better software that suits local consumer demands, especially in terms of infotainment screens and navigation systems. As China continues to push for EV, this may hurt foreign brands. For the older generation in China, owning a European or Japanese luxury car was a status symbol. The new generation may not see it the same way.

Hands-free! Driving an autonomous electric vehicle of a Chinese manufacturer.

Health care innovation is being powered by new talent

Having the right talent is key to achieving the next level of innovation. On that front, China’s biopharmaceutical industry seems to be heading down the right path. This sector is full of returnees from the U.S., including many who used to work at the likes of Regeneron, Genentech, Amgen and Biogen. We met with many leading scientists and researchers, among them those who had top R&D positions at leading U.S. universities.

China’s government remains committed to providing drugs at very affordable prices for everyone. Over the past couple of years, generic drugmakers have been pressured by big price cuts, so I’ve been very selective in the types of health care companies I’ve invested in.

An industry sweet spot is CDRMO, also known as contract development research and manufacturing organizations. These are companies that can help multinationals with drug development, testing and manufacturing, often at lower prices than in other parts of the world.

In terms of medical equipment and lab testing tools, Chinese companies have made some progress, but they still lag in leading-edge equipment. So, this is an area where multinationals still dominate.

Internet platform companies can get through the regulatory scrutiny

We also met with a few upstart internet services firms in China and representatives from multinational luxury goods companies. One fast-rising firm discussed the balance between brand building and purchase fulfillment, which is a big theme in e-commerce. Overall, the business model for e-commerce has been shifting as consumer behaviour on mobile devices evolves. Companies are developing content-like platforms focused on social entertainment or common interests. This has led to a proliferation of niche business verticals, more sophistication among Chinese consumers and more online sales.

Internet platforms are likely to be more regulated. It’s become clear the government wants to prevent the large technology companies from aggressively expanding horizontally into multiple lines of business, partly to protect small businesses in China. Instead, they prefer for them to go deeper in their core areas of competence.

Some internet companies have become systemically important and, as a result, may be subject to more regulation. Therefore, we may not see the exponential growth we have seen over the past few years — and the commensurate stock price appreciation — but I believe these companies can still make a good profit.

That said, there will be gray areas when it comes to internet regulations. Companies just need to stay vigilant and sensitive. For investors, this also means that regulatory headline risk is probably here to stay until these new laws are tested and improved overtime. Separating the noise in media circles from the risks will also be important.

Luxury demand has remained resilient

Luxury demand has remained resilient during the pandemic. Online sales could become a larger part of total revenue for the multinationals, based on conversations we had with these companies. They are increasingly using other channels to drive traffic to their own website to fulfill orders and gain ownership of customer data.

Chinese consumers have been spending at brand-name luxury stores inside China or online rather than in Paris or Milan. Government officials would like to keep that money inside the country, so they have been encouraging luxury goods makers to open duty-free shops. They’ve also encouraged luxury brands to increase their offerings at the lowest price points and to eliminate significant price gaps with the West.

And here’s a fun fact we learned: The average age of Chanel’s consumers in China is 25 versus 50 for the rest of the world. It’s therefore not a surprise to me that the luxury companies continue to have a high focus on the Chinese consumer and will continue to adapt their strategy based on evolving consumer tastes as well as government policy. Sustainability has also become a theme in luxury.

Investing in China is a mix of challenges and opportunities

Even as I recount all the powerful, long-term trends I observed in China during my trip, I realize that the near-term reality on the ground continues to change, as a result of both what’s happening around the world and within China. There have been some policy mistakes, in my view. The crackdown on the education sector and the bankruptcy proceedings surrounding real estate developer Evergrande have dampened private-sector sentiment. Supply-chain bottlenecks and a near-term slowdown in the domestic economy have resulted in lower factory orders. Meanwhile, efforts to clean up the environment have resulted in power shortages in many provinces, which may affect prices paid for goods exported to the rest of the world. Investing in China will always be a mix of challenges and opportunities, and selective investment will remain key.

Our latest insights

-

-

Artificial Intelligence

-

Technology & Innovation

-

-

Demographics & Culture

RELATED INSIGHTS

-

Asset Allocation

-

Emerging Markets

-

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capitals Express Investments‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capitals Express Investments. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capitals Express Investments or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capitals Express Investments funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capitals Express Investments. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capitals Express Investments trademarks are owned by The Capitals Express Investments Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capitals Express Investments funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capitals Express Investments, a global investment management firm originating in Los Angeles, California in 1931. Capitals Express Investments manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capitals Express Investments funds offered on this website are available only to Canadian residents.

Winnie Kwan

Winnie Kwan

Ben Lin

Ben Lin

Lawrence Gong

Lawrence Gong