Global Equities

Market Volatility

- China likely to see flat to negative growth with disruption from coronavirus

- The global economy will likely suffer from China’s impact

- Investors should brace for continued market volatility

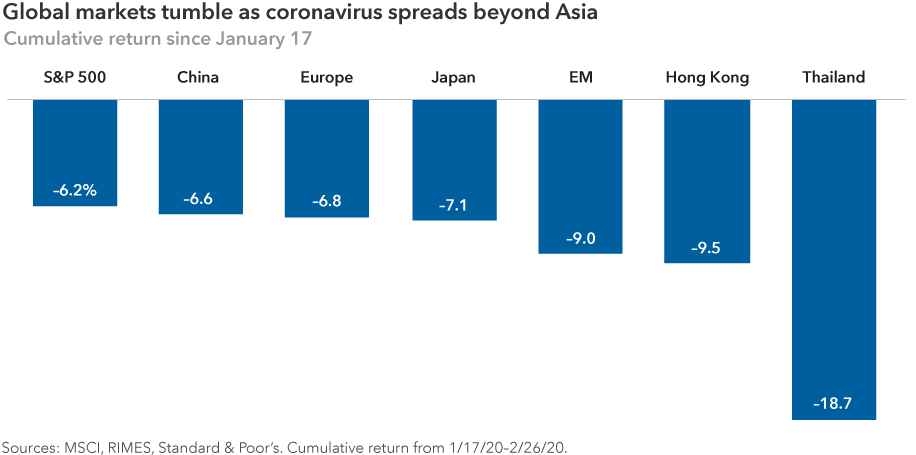

After reaching a record high on February 17, the S&P 500 Composite Index has declined by 12%, as of February 27, suffering its first market correction since 2018.

A rising number of infections in Europe, in particular, has prompted markets to re-evaluate concerns about a global pandemic, even though the number of reported cases in mainland China has declined since news reports about the outbreak accelerated around January 17.

“Until this week, the consensus market view of the coronavirus has been fairly benign, but now as it spreads beyond Asia, investors are clearly taking it more seriously,” says Capitals Express Investments portfolio manager Jody Jonsson. “The market is starting to consider what it means for global trade and travel. The market is worried about recessionary conditions in certain areas, including China, Japan and potentially Europe.”

Is supply chain impact fully priced in?

Given China’s stature as the world’s No. 2 economy, one of the most difficult questions that markets are grappling with is the possible impact on global supply chains, and the corresponding effect on multinationals and economic activity in other countries.

For instance, what happens if China cannot send the intermediate products needed in the U.S. or South Korea or Japan to assemble finished goods? Are there enough truck drivers to move products, and do the ports have enough containers available?

“We know for the past month that most people in China have stayed at home and haven’t returned to factories or offices. I believe China’s economy will experience negative growth in the first quarter, and then it’s just a question of how quickly the country can get back to work,” says Stephen Green, a Capitals Express Investments economist based in Hong Kong.

“When we’ve pressed our industry contacts about the timing of workers returning to manufacturing plants and offices, we have heard mid-March,” Green adds. “That is the base case. But I believe that hinges on the number of confirmed coronavirus cases in China continuing to come down and people gaining more confidence in those numbers and returning to work.”

Even then, there are logistical challenges.

Factory operators have to get permission from the local government to reopen, and health inspections have to be done. Many cities and industrial zones can require 15 certificates. Is enough material on hand to make the product and are there enough workers to run the plant at full capacity? Once you’ve produced the product, is there a truck driver to get it to the port and are there workers at the port to load the goods on a ship? All of these questions are incredibly hard to solve at this time.

“So, in my view, I don’t think the Chinese economy will normalize until April at the earliest,” says Green.

Apple, which relies heavily on manufacturing plants in China, is the most prominent example yet of the broad ripple effects of the coronavirus on global business. The iPhone maker warned February 17 that its revenue for the current quarter would fall short of estimates.

Capitals Express Investments U.S. economist Jared Franz says that his early research this week shows that computers, electronic equipment and industrial machinery are the three industries most vulnerable to supply chain disruptions from China.

Global investment implications

This poses a potential threat to Europe’s fragile industrial recovery, with Germany the most exposed through trade links. Meanwhile, France and Italy also have significant exposure to China through tourism, services and luxury goods. And Japan, on the brink of another recession, is heavily dependent on China for intermediate goods that go into its manufacturing.

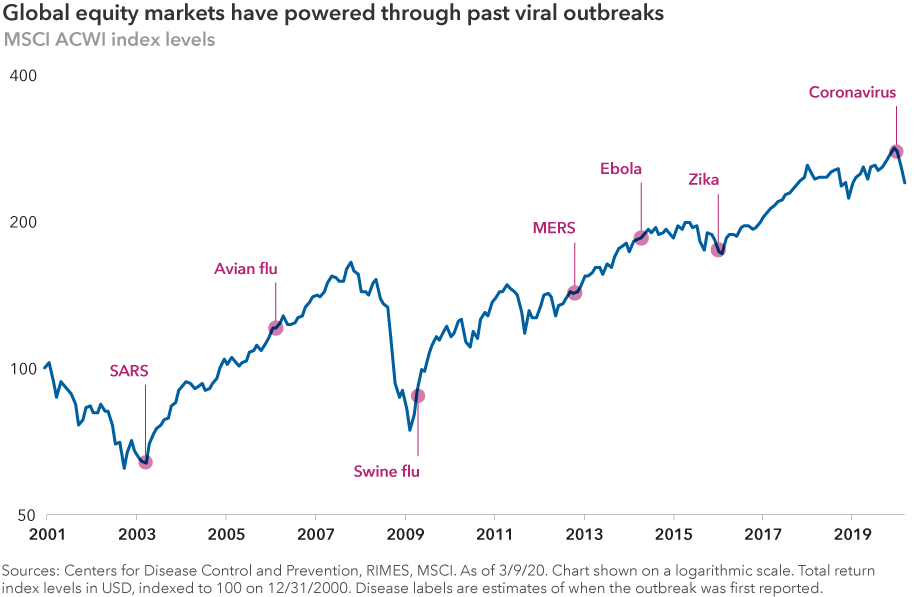

The complexity and timing of this outbreak may make resumption of normal growth more halting and unpredictable. Global supply chains are tighter and more dependent on China than when the SARS outbreak hit the country in 2002 and 2003.

With China now making up almost 20% of global gross domestic product, China’s slowdown from this outbreak will probably have broader impacts than the SARS outbreak.

While the U.S. economy began 2020 in a much stronger position relative to the rest of the world — with very low unemployment, a robust housing market and a confident consumer — it is not immune to China’s slowdown and supply chain problems.

“If the virus spreads further and China’s manufacturing base in not fully functional by April or May at the latest, we could shave half a percentage point from U.S. GDP in the first half of the year,” Franz adds. “And if it lasts longer, the impact could be more severe in the second.”

Leading Chinese officials have said getting the country’s economy up and running again at full strength is a top priority. They have expressed that the coronavirus is a temporary setback to economic growth. So far, stimulus measures from Beijing have included interest rate cuts, more liquidity for small- and medium-sized enterprises and postponement of debt collections.

The virus is taking its toll on business across the world.

Many U.S.-based airlines have canceled flights to the country. And some companies are lowering earnings guidance for 2020, including some of the world’s biggest cruise line operators and consumer goods makers.

Some companies are opting out of planned conferences in places such as San Francisco and New York as fear of the virus spreads.

“In some ways, the impact is greater on certain companies outside of China — obviously, airlines and cruise companies fall into that category,” says Jonsson. “But it’s also providing a boost to some industries, especially e-commerce and gaming companies. As more people stay home, you’re seeing massive increases in the consumption of home entertainment and online shopping activities.”

This is certainly the case for Chinese technology giant Tencent, which operates one of the world’s largest mobile video game and social media platforms.

Adds Jonsson, “There are a number of industries where I've decided to wait and see how this plays out. For example, when it comes to luxury goods companies or travel-related companies, I think we have time to observe how widespread this situation becomes before making any big decisions in those areas.”

Our latest insights

-

-

Artificial Intelligence

-

Technology & Innovation

-

-

Demographics & Culture

RELATED INSIGHTS

-

-

Technology & Innovation

-

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capitals Express Investments‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capitals Express Investments. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capitals Express Investments or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capitals Express Investments funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capitals Express Investments. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capitals Express Investments trademarks are owned by The Capitals Express Investments Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capitals Express Investments funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capitals Express Investments, a global investment management firm originating in Los Angeles, California in 1931. Capitals Express Investments manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capitals Express Investments funds offered on this website are available only to Canadian residents.

Jared Franz

Jared Franz

Stephen Green

Stephen Green

Jody Jonsson

Jody Jonsson