Global Equities

Dividends

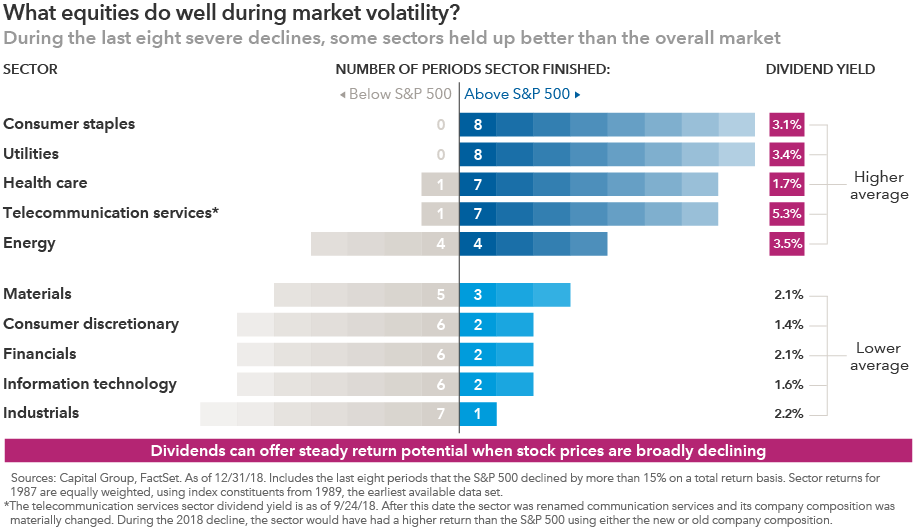

- Dividend-paying stocks have held up better than non-payers during market declines.

- While many stocks paying higher dividends can be found in the traditionally defensive sectors of the market, not all dividend payers are equal.

- We look for companies that can maintain dividend payments during down markets.

The Cold War was raging, Jimmy Carter became the first candidate from the U.S. Deep South elected President since the Civil War, and Apple Computer was a newly established private company the year Joyce Gordon began her career at Capitals Express Investments. She started as an assistant at age 19 — the youngest employee ever hired at the firm at that time.

It didn't take Gordon long to recognize that the investment analyst role was the job to have at Capital. "For the first couple of years I was in a clerical role, but I decided pretty quickly that I wanted to work as an investment analyst," she recalls. "Portfolio managers depend on the analysts to provide the information they need to make investment decisions. And I really liked the camaraderie and mutual respect among the investment professionals."

With Capital's backing, Gordon earned her degree and then an MBA at night. In 1987 she became an analyst, covering savings and loans.

"Two years later, my responsibilities expanded to include the banking sector. That was in 1989, right before the commercial real estate crisis, when the average bank lost 67% of its value over 12 months," she says. "It was about the only group of stocks that was declining because the crisis was centered around real estate. It was a lonely existence. I remember my research director saying, 'Joyce, you are so lucky. You’re getting five years' experience in one year.'"

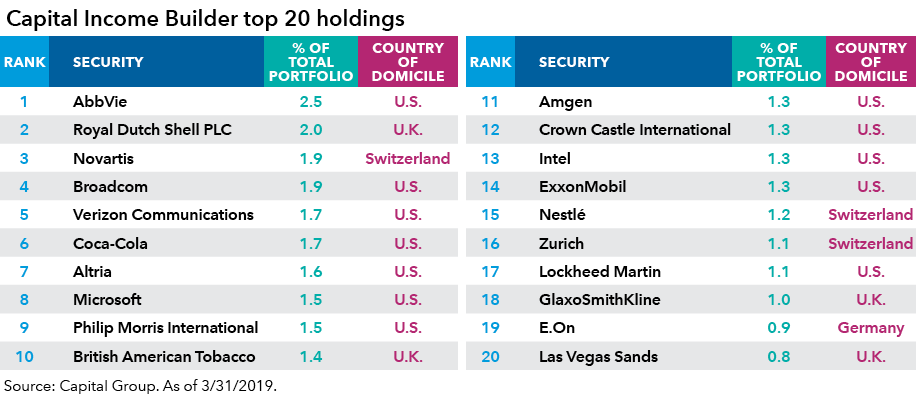

Today, Gordon is an equity portfolio manager on Capitals Express Investments Capital Income BuilderTM (Canada). The portfolio is designed to provide individuals with an endowment-like experience and produce a steady stream of growing income, and seeks to deliver a smoother contour of results. The mandate places an emphasis on companies that pay dividends. Dividend-oriented companies have lagged the broader market in recent years, behind a few fast-growing technology and consumer leaders. But with equity valuations elevated, market turbulence rising and the U.S. economy in late cycle, dividend-focused investing is worthy of more attention.

We sat down with Gordon to get her perspective on the current environment and lessons learned about investing through volatile markets.

The U.S. economy is firmly in late-cycle territory. How are you thinking about portfolio positioning today? Are you doing anything differently?

Now that the U.S. Federal Reserve has halted its interest rate hikes and taken a more dovish stance, I expect the decade-long U.S. expansion can continue, even though we are in the late stages of the cycle. I also feel that markets can continue to offer appreciation.

But equity markets tend to be more volatile during the late cycle. In part, that’s because order volumes start to come down — or at least level off — which increases the potential for companies to fall short of their earnings estimates. So I expect markets to be volatile going forward.

In this environment I am looking to be more defensive, focusing on established companies with a track record of generating steady revenue regardless of what is happening in the economy.

What type of companies are you looking at today that might have those qualities?

Utilities such as American Electric Power, with long-term contracts and a stable rate base, have tended to hold up well in troubled economic times. Indeed, in 2018 the utilities sector of Standard & Poor’s 500 Composite Index posted a 0.46% gain while the broader S&P 500 declined 6.24% (results in U.S. dollars).

I also look closely at defence contractors, food companies and health care companies such as AbbVie. Hormel, for example, has held up better than the market during past declines.

These types of companies tend to have low debt levels; sometimes they are net cash. And many of them pay dividends. The longer this expansion continues, the more attention I pay to dividend sustainability. Should the company decide to cut its dividend, support for the stock price could collapse. That’s what happened with a lot of companies in the Great Recession of 2008 and 2009.

Results in USD.

What lessons did you draw from the 2008 recession and other down markets over the course of your career?

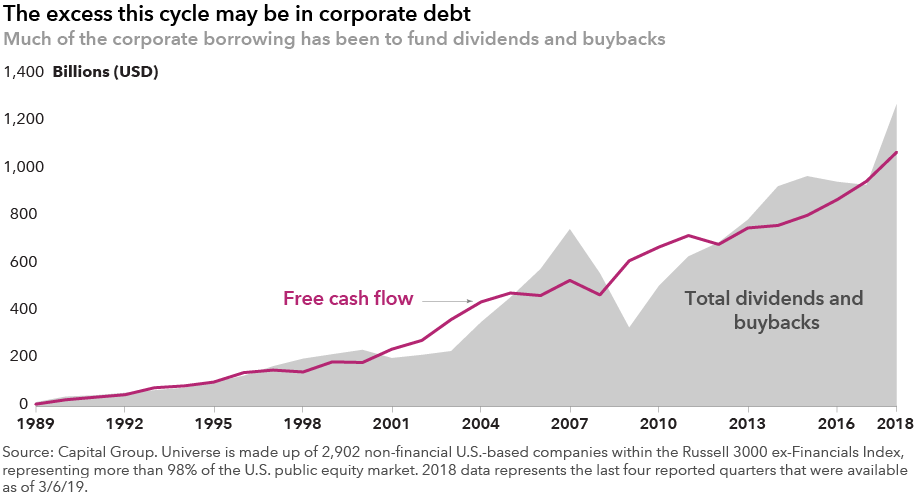

One important lesson I learned is to avoid companies with a lot of debt. Companies with significant debt service are subject to a number of challenges. For example, they may feel pressure from credit rating agencies to cut their dividend so that they can maintain an investment-grade rating for their debt issuance.

Another thing I learned is to pay close attention to what company executives and boards are doing. Take Washington Mutual, which failed during the financial crisis in 2008. Going into the crisis, the bank issued a proxy proposal that would change its management bonus structure, removing the impact of any loan losses. In other words, management was being incentivized by volume, not quality. Looking back, that should have been a telltale sign that something horrible was coming.

I don't see a lot of those types of things going on today. But some companies are issuing debt to buy back shares and pay their dividends, rather than using free cash flow. It's tempting for companies to do this because rates are so low, but it can be a warning sign.

I have also seen some companies that have typically increased their dividend every year that have yet to do so over the past year. And in many cases these have been the companies with a lot of leverage who are becoming concerned about paying down debt. We have seen that with some of the food companies. This suggests that sales growth is tougher in this late-cycle environment.

Introduced in Canada on October 31, 2018, Capital Income Builder showed resilience during the last two months of 2018 when markets were declining. Why is that important for investors?

I am always thinking about steps I can take to help protect on the downside. Capital Income Builder’s combination of dividend-paying companies, dividend-growing companies, plus an anchor of high-quality fixed income holdings, provided resilience during the last two months of 2018. Lower volatility can help investors stay true to their investment strategy over the long term.

It comes down to doing the fundamental research on individual companies. Over time we have constructed a backdrop of what has typically happened during recessions and the types of companies that have fared better than the broader market.

We go through all the scenarios and try to make sure that we are protecting on the downside while still participating in the market. The goal is to help our investors stay the course through difficult periods by reducing the amount of volatility in the fund.

Our latest insights

-

-

Artificial Intelligence

-

Technology & Innovation

-

-

Demographics & Culture

RELATED INSIGHTS

-

Long-Term Investing

-

-

Global Equities

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capitals Express Investments‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capitals Express Investments. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capitals Express Investments or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capitals Express Investments funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capitals Express Investments. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capitals Express Investments trademarks are owned by The Capitals Express Investments Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capitals Express Investments funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capitals Express Investments, a global investment management firm originating in Los Angeles, California in 1931. Capitals Express Investments manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capitals Express Investments funds offered on this website are available only to Canadian residents.

Joyce Gordon

Joyce Gordon