Global Equities

Emerging Markets

The post COVID-19 era has seen a reset in financial markets on many levels – interest rates, geopolitics and growth paradigms. It's also led to a redrawing of the landscape for emerging markets (EM).

We believe the next phase of growth for EM will be different than the past 20 years. China's economy has matured and is going through a difficult patch of reforms. Geopolitical tensions and the world's energy transition are driving foreign investment into a broader mix of developing countries for manufacturing and natural resource needs. And government-led reforms are changing the trajectory of some developing countries, such as India and Indonesia.

Many asset managers, including us, have increased their capital market assumptions for both EM equities and debt. We believe the outlook for EM is constructive over the medium-term and will expand to markets that have not been front-and-centre for investors.

Here we discuss the macro variables as well as some of the trends and opportunities we are seeing across markets and industries.

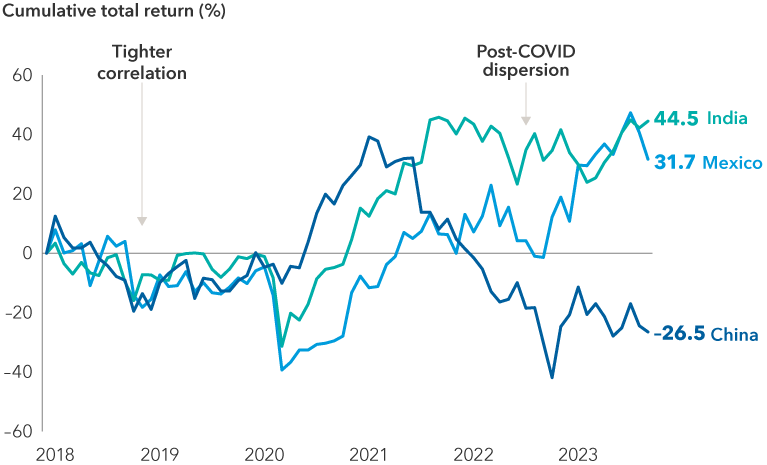

Returns among large EMs have diverged post-COVID

Sources: MSCI, RIMES. Returns reflect MSCI India Index, MSCI Mexico Index, and MSCI China Index. Five-year time period shown to reflect returns pre and post-COVID. Data as of September 30, 2023.

Macro headwinds could become tailwinds

1. Inflation and interest rates are on a downward trend

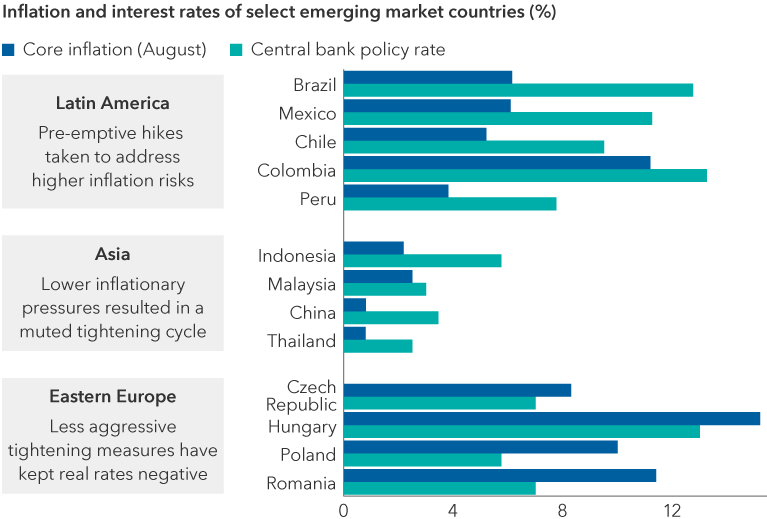

Central banks in many developing countries, notably in Latin America, raised rates ahead of the U.S. Federal Reserve to blunt the impact of inflation. Most EMs lacked the ability to undertake quantitative easing over the last decade, which buffeted growth rates in developed markets. As inflation slows across some EMs, central banks in these markets are likely to pivot toward rate cuts in the coming months and quarters. Many have already started the process, including Brazil, Chile, Hungary and China.

A decline in rates and inflationary pressures should provide a boost to economies and in turn to cyclical areas of the market. Monetary authorities will have to balance pressure on their currencies from declining interest rates against the boost to domestic economies. On balance, we believe lower inflationary pressures and declining rates should be positive for EM economies and stock markets.

Countries across Latin America have been more aggressive in tackling inflation

Sources: Capitals Express Investments, Bloomberg Index Services, Ltd. Core inflation is represented by the year-over-year change in consumer price index (CPI) excluding food and energy across countries. Inflation rate as of August 2023. Central bank policy rates as of October 5, 2023. Real interest rates reflect the true cost of funds to a borrower. Nominal interest rates equal the real interest rate plus the rate of inflation.

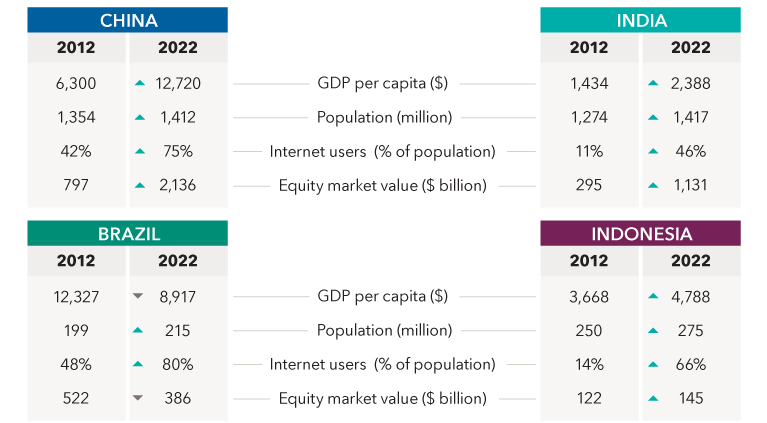

2. Economies are fundamentally stronger

The economic profile of many EM countries is much better than it was a decade ago. Government balance sheets are stronger. In 2021, the current account surpluses of developing economies totaled US$480 billion, more than triple the amount recorded for 2019. And during COVID, unlike the case in many developed markets, policymakers in developing countries did not dole out large handouts to individuals, which helped their fiscal position.

Government reforms have improved the ease of doing business in countries like India. India's government has ushered in pro-business reforms and a digital identification system that have accelerated growth by facilitating the expansion of credit and bringing large swaths of the economy into the formal sector. Production-linked incentive programs designed to elevate India's domestic manufacturing base are also gaining traction.

Indonesia has built more airports, roads and seaports, opened more industries to foreign investment and sought to cut red tape by making changes to labour and tax laws.

EMs then vs. now

Sources: MSCI, RIMES, World Bank, World Development Indicators. Internet users for India as of 2021. Equity market value represents the MSCI index for each country. Values in USD.

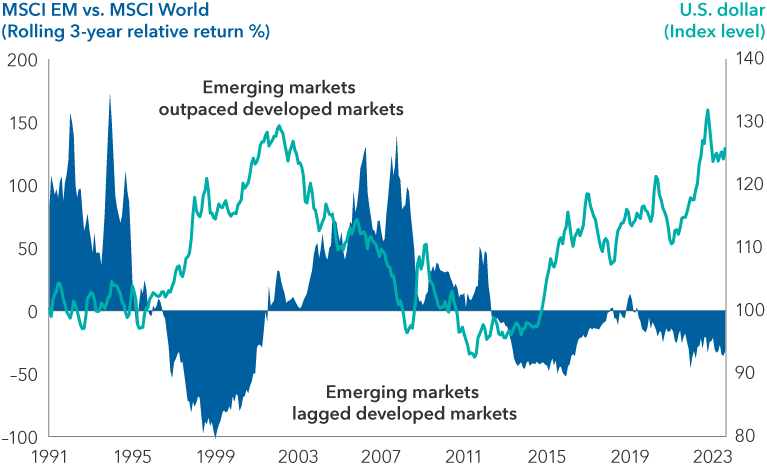

3. A weakening U.S. dollar should be supportive over the medium-term

The U.S. dollar is overvalued against most major and EM currencies on several metrics, according to our currency analyst. In the near-term, the dollar may maintain strength against several major currencies including the euro, the yen and the British pound, largely driven by interest rate differentials. In the medium-term, our analyst and global bond portfolio managers expect the dollar to weaken, or at a minimum, move within a range of current levels.

In the emerging markets, central bank policy rates are higher than the U.S. in many countries. Even as a few central banks have started to cut interest rates as inflation starts to move lower, nominal rates still remain higher. Many EM countries also have current account surpluses while the U.S. and other major developed economies are running deficits. This should bode well for EM currencies in the medium-term. We have started to see some EM currencies make advances against the dollar in the past 12 months, notably the Mexican peso and Brazilian real. This should be supportive of EM returns, purely from the currency translation effect in portfolios. But we do not expect it to be the major driver of our investment decisions.

Emerging markets have historically benefited from a weakening dollar

Sources: Capitals Express Investments, J.P. Morgan, MSCI, Refinitiv Datastream, RIMES. Relative returns data represent cumulative rolling monthly three-year total returns of the MSCI Emerging Markets Index vs. the MSCI World Index in U.S. dollars, with positive values reflecting periods of outperformance by the MSCI Emerging Markets Index relative to the MSCI World Index, and negative values reflecting periods of outperformance by the MSCI World Index relative to the MSCI Emerging Markets index. U.S. dollar is represented by the J.P. Morgan Real Broad Effective Exchange Rate Index. As of August 31, 2023.

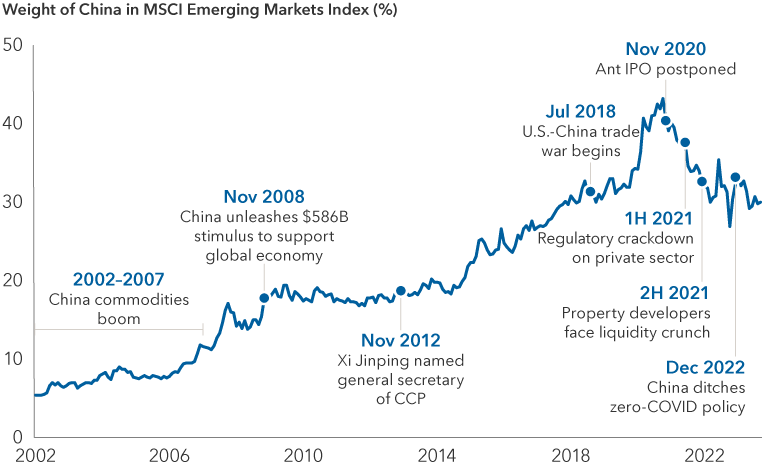

China is the elephant in the room

China's rise as a major manufacturing powerhouse and its property boom drove global commodities demand and powered EM from 2000 to 2010. China became the dominant constituent in the MSCI Emerging Markets (EM) Index, making up 43% of the index's weight at its peak. That figure has declined to 29% as an economic slowdown and government regulation of several areas of the economy took its toll on the stock market.

Going forward, China has matured and its US$18 trillion economy is likely to grow at a slower rate. The government has taken a piecemeal approach to fiscal stimulus and will have to address how to reform and resurrect a highly indebted property sector. More importantly, having built out world-class infrastructure that has set up the economy for the modern age, the next phase of China’s economy will have to be powered both by the consumer and by moving further up the value chain in manufacturing and technology. In areas such as robotics and electric vehicle battery technology, China is already showing it prowess as a high-end manufacturer.

However, consumer confidence has been battered by strict COVID lockdowns and the woes of the property sector and will need both time and government efforts to be restored. Nevertheless, we remain optimistic that this will happen over time. There are many areas of China’s economy where domestic consumption will be the key driver of growth. These include pharmaceutical treatments, autos, video gaming, e-commerce, and financial products. Companies in these areas range from small to large and a few have emerged as multi-nationals.

Auto and battery manufacturer BYD and carmaker Geely are good examples. Both began as domestic manufacturers. By focusing on newer technologies of battery development and efficient manufacturing of electric vehicles, they have joined the ranks of the largest auto manufacturers worldwide. China is on course to surpass Japan to become the world’s largest exporter of automobiles, a feat that was unimaginable a decade ago and a reminder of how quickly the country can gain market share in an industry.

China’s emergence as a leader in electric vehicles challenges the dominance of German carmakers that have enjoyed a large market share in China and other EMs. This might contribute to ongoing geopolitical tensions and could result in tariffs and other restrictive measures.

Greater competition, at times marked by geopolitical tension and negotiation, is expected to characterize many industries over the next decade, be it electric vehicles (EVs), industrial automation tools or semiconductors. But with talented entrepreneurs, China and its companies are likely to be in the mix by either emerging as global leaders or dominating their own domestic market or as providers of components along the supply chain.

China's weight in the EM benchmark peaked in late 2020

Sources: MSCI, RIMES. Postponement of Ant IPO contributed to selloff in Chinese equities. Data reflects January 31, 2002 to September 30, 2023. Values in USD.

Is China investable?

Often, we get the question: Is China investable? Our answer is not a binary yes or no. The reality is that China is an integral part of the global economy, especially given the large volume of trade and cross-border investment between Europe, Asia and the emerging markets. Do these regions want to reduce dependence on China as the growth engine of many industries? Yes. Can Europe, the U.S., Japan, India or other emerging markets completely disentangle from China’s economy? No.

Over the last few years, investors have swung from wanting to maximize their China exposure to having very few investments. The sharp selloff in Chinese equities since 2021 has weighed on the EM benchmark, leaving investors vulnerable to volatility, especially those who had exposure to China through a passive index vehicle, which typically seeks to track the weight of a particular benchmark.

As such, it is incumbent for asset managers and other investors to investigate firsthand and calibrate which areas, industries and companies are best positioned to benefit from these secular shifts and trends. We think this represents a good opportunity for active managers.

Geopolitical tensions can benefit emerging markets

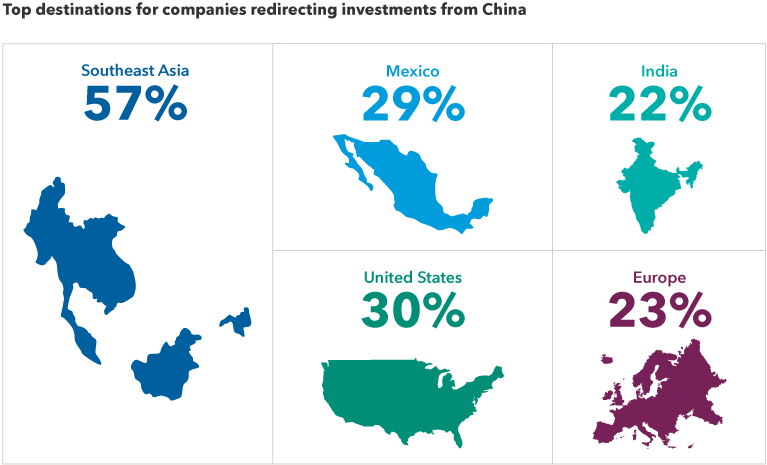

The reconstruction of supply chains in many industries may benefit the developing world and help drive new sources of growth for a broader set of countries.

For instance, rather than aligning with one economic superpower, countries like Indonesia, India, and Mexico are tapping into funding and investment from both leading Western countries and China. Furthermore, in seeking to diversify their supply chains, multinationals are also setting up manufacturing facilities across different geographies. Chinese companies are also diversifying abroad, some of them setting up final assembly for export to the U.S. in countries like Mexico.

A rise in foreign direct investments (FDI) can have positive effects on local economies. When a multinational builds a manufacturing plant, it often draws in investment from other companies in the supplier ecosystem who also establish a physical presence in that particular region of the world. And FDI investments have tended to be sticky compared to portfolio flows. In addition to being a longer term capital investment, FDI flows typically have a multiplier effect on economies, generating employment which in turn stimulates consumption.

Supply chain shifts broaden the investment landscape

The diversification of global supply chains should benefit several different markets.

Indonesia is making a concerted push to be a major nickel processor and an integral part of the supply chain for electric vehicle batteries, leveraging its position as the world's leading supplier of nickel, an essential mineral for EV batteries. In 2020, the country's president banned exports of unprocessed nickel ore as part of a broader plan for the country to transition from being an exporter of raw materials to a value-added metals processor.

Relative to its boom-bust history driven by commodity cycles, success here could be transformational for the economy. Capturing a greater share of the entire supply chain, from smelting nickel to battery and car production, could change the country's economic profile.

Indonesia has lured foreign companies to invest. China's state-owned enterprises have spent billions of dollars to help finance and build nickel refinery plants in the country. Meanwhile, multinationals from South Korean auto company Hyundai, German chemical maker BASF and U.S. automaker Ford have all inked agreements to be involved in nickel processing.

Mexico recently replaced China as the largest trading partner of the U.S. With a strong foundation in automobile and small-electronics manufacturing, investment today is broadening to medical devices, more complex electronics, furniture and general industrial goods.

Foreign direct investment has been rising. Some of the largest investments have come from automakers Tesla and BMW and electronic component makers Bosch and Continental. Another large investor is Japan-based Daikin, which is expanding its manufacturing footprint for energy-efficient air conditioners.

On our recent trips to Mexico, the scale of new manufacturing and distribution facilities under construction reminded us of China in the early 2000s. There's also been an influx of Chinese manufacturers into the northern Mexico states, which are being used for final assembly for electronics products shipped into the U.S. Chinese companies have accounted for roughly 40% of leasing activity for manufacturing facilities in the past two years, local real estate sources have told us. Altogether, China's direct investment in Mexico for computer equipment manufacturing totaled US$282 million in 2021-2022.

Asia is well positioned for the rewiring of global supply chains

Source: AmCham Shanghai 2023 China Business Report, published 9/19/23. Based on a survey of 325 foreign companies doing business in China. Of those companies, 40% said they were redirecting investments from China to other locations, including Southeast Asia, Mexico, India and the United States, among others. Survey respondents could provide multiple responses, so total does not add up to 100%.

India has been expanding its manufacturing capacity for mobile phones, home appliances, computers and telecommunications equipment. The government has been aggressive in courting Japanese, Taiwanese and U.S. companies to invest in new capacity, including Apple, Foxconn, Daikin and Mitsubishi Electric.

The playbook for the Indian government is twofold: ramp up capacity to serve the domestic population and over time become a larger player in export markets. It also wants to develop a supply chain ecosystem, as a wide array of product components are imported.

India, like China early in its development, has been investing in the building of ports, roads, housing, and industrial warehouses. This is preceding the manufacturing transition and could be additive to the economy and help sustain economic growth.

The energy transition could be another growth tailwind. Since the last mining super cycle ended in 2011 with overleveraged balance sheets and excess capacity, mining companies have become more financially disciplined, focusing on value over volume. They also spent more cash flow on distributions to shareholders over increasing capacity. Now, with the global push to build energy-efficient vehicles, power grids and buildings, there is growing demand to secure supplies of copper, nickel, iron ore and lithium. We anticipate this will drive major investments into new mining projects in parts of Africa, South America and Asia.

A dividend culture prevails in many markets

A culture of dividends has prevailed in many emerging markets, as historically many companies were part family-owned, and depended on the payouts. And while capital markets have expanded and family ownership has declined, the culture of dividends has persisted. Corporate managements have shown an inclination to support dividend payments through different economic and market cycles and worked it into their capital allocation and planning.

The number of companies in the MSCI EM Index that offered a dividend yield higher than 3% totaled 468 as of September 30, compared to 349 for international markets (MSCI EAFE) and 147 in the U.S. (S&P 500).

As would be expected, dividend payouts tend to be higher in traditional industries such as telecoms, banks and industrials and less so in the newer technology companies. This allows us to build rounded portfolios of pro-growth cyclical companies and dividend-oriented corporations.

EM has evolved and so have the opportunities

We've also been digging deeper into developing countries that are not the traditional index heavyweights of China, India and Brazil. Our EM-related funds have made incremental investments in Mexico, Indonesia, South Africa and Saudi Arabia over the past year. And perhaps over time, these countries may be larger in our funds than they have been historically.

22 years ago, the phrase "BRICs" was coined to describe the potential for the emerging markets of Brazil, Russia, India and China. Not all have lived up to those heady expectations, and EM equities have lagged developed markets for the past decade.

We do think durable trends — reshoring of supply chains, powerful shifts in demographics, infrastructure growth, the energy transition, the emergence of sticky and large domestic brands – could add more depth to EM equity markets.

Furthermore, government balance sheets are stronger, inflation is coming under control and a decade-long bull market for the U.S. dollar may be abating. On top of that, valuations for nearly all sectors in the MSCI EM Index are near 10-year lows, making for an attractive asset class over the medium- to long-term.

Our latest insights

-

-

Artificial Intelligence

-

Technology & Innovation

-

-

Demographics & Culture

RELATED INSIGHTS

-

Global Equities

-

-

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capitals Express Investments‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capitals Express Investments. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capitals Express Investments or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capitals Express Investments funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capitals Express Investments. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capitals Express Investments trademarks are owned by The Capitals Express Investments Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capitals Express Investments funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capitals Express Investments, a global investment management firm originating in Los Angeles, California in 1931. Capitals Express Investments manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capitals Express Investments funds offered on this website are available only to Canadian residents.

F. Chapman Taylor

F. Chapman Taylor

Lisa Thompson

Lisa Thompson

Brad Freer

Brad Freer

Kent Chan

Kent Chan