Global Equities

Emerging Markets

Brazil’s central bank kicked off a monetary easing cycle on August 2, 2023, more aggressively than expected, reducing its benchmark interest rate by 50 basis points to 13.25% and signaling more of the same in the months ahead due to an improving inflation outlook. It is the fourth central bank in emerging markets (EM) to cut rates in recent months.

Chile cut in July, China in June and Hungary, which was the first to lower rates, did so in May of this year. On August 15, 2023, China further lowered the interest rate on a key medium-term lending facility. Analysts believe this is likely a sign that the Peoples Bank of China (PBOC) is preparing to cut its benchmark rate again at its upcoming August 21 meeting.

The pace of the monetary easing cycle may not be as rapid and will vary by country. After a significant decline in EM headline inflation in the first half of the year, we expect a more visible reduction in core inflation in the second half. A backdrop of slow and steady rate cuts combined with reasonable growth in many EM countries should be positive for local currency debt. More stable market dynamics could likewise benefit select hard currency (U.S. dollar-denominated) sovereign and EM corporate issuers.

EM inflation should continue to slow in the second half of the year

Emerging markets have historically struggled with inflation and last year was no exception. Higher commodity prices resulting from the Russia/Ukraine conflict (EM countries tend to be more sensitive to commodity prices given the generally higher weight of food and energy in inflation baskets), supply chain issues and weak EM currencies fed inflationary pressures.

This year, the surge in food and energy prices has abated, supply chain bottlenecks have eased, and the U.S. dollar has plateaued or weakened against many currencies. As a result, inflation has slowed both on a month-on-month and year-on-year basis in most EM economies.

Moreover, after surprising to the upside for the past couple of years, inflation surprises have generally now turned negative. This disinflation trend looks set to continue in the second half of the year.

That said, there remains a great deal of regional variation. Inflation is relatively contained in Asia. Whereas in Central/Eastern Europe and Latin America, not only has food inflation been persistent, but there has also been a broadening of price pressures to both core goods and services. Part of this has been due to rising inflation expectations, leading to higher wages. This suggests that inflation may remain above central bank targets/comfort zones for longer than previously thought in both regions, even though it has likely peaked and should trend lower.

Other EM central banks need a few more catalysts

Given the general improvement in the inflation outlook, we (the EM debt team) expect a number of EM central banks to start cutting interest rates along the lines of Brazil, Chile and Hungary. Many EM central banks are ahead of the developed world in their monetary tightening cycle, having raised interest rates earlier and more aggressively to avoid de-anchoring inflation expectations. Turkey has been the main exception, with its policy of reducing interest rates despite high inflation, although it has now started to reverse this unorthodox policy following recent elections, almost doubling interest rates in June.

But while we believe the easing cycle is imminent, many EM central banks will only take this step when there is more certainty that inflation is on the decline, especially core inflation.

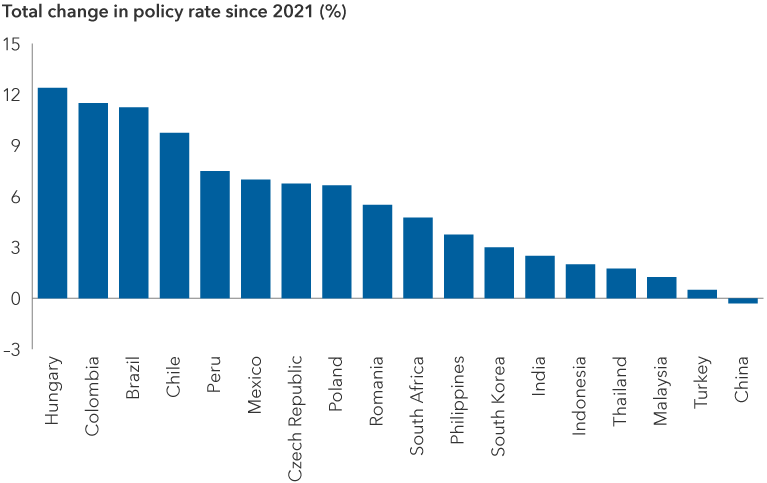

Many EM central banks aggressively hiked policy rates

Source: Bloomberg. Data as of August 3, 2023.

Looking ahead, the actions of the U.S. Federal Reserve and the real interest rate differential between EM countries and the U.S. will be important factors. While it’s not yet clear whether the Fed is at the end of its hiking cycle or still has further to go, we’re unlikely to see the sharp upward pricing in U.S. rates that we have seen over the past year.

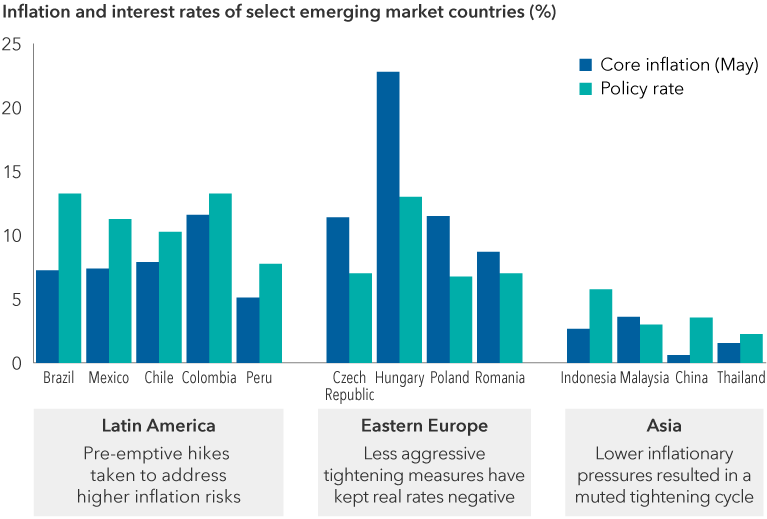

Countries across Latin America have been more aggressive in tackling inflation

Source: Bloomberg. Inflation rate as of April 2023 for Romania and Malaysia and as of May 2023 for other regions. Policy rate as of August 3, 2023.

Finally, the U.S. dollar will be important to watch as it will be difficult for EM central banks to cut rates in a strong dollar/weak EM currency environment. A strong dollar has often forced EM central banks to raise rates in the past, while a weaker dollar has allowed them to cut rates. U.S. dollar cycles (since the abolition of the Bretton Woods system in the early 1970s) have generally moved in clear bull and bear phases, with the average cycle lasting around nine years. If the most recent cycle ended in the fourth quarter of 2022, then it lasted 11 years from the low in June 2011. Aside from the fact that the U.S. dollar is overvalued on almost all valuation metrics, several factors support the case for a weaker dollar, including the Fed coming to the end of its rate hiking cycle. Although it is not clear that the bull market for the U.S. dollar has turned, the bulk of the broad dollar strengthening is likely behind us.

EM exchange rates could start to contribute to returns

EM exchange rates have been a drag on local currency asset returns over the past decade, but today most EM currencies look significantly undervalued based on our in-house fundamental-based valuation model, along with various other real exchange rate models.

While cheap valuations are never enough of a catalyst in and of themselves, the fundamental outlook of many emerging markets looks constructive, which could help support a turnaround in EM currencies versus the dollar. Inflation and cost of living concerns have put pressure on fiscal deficits, which have steadily risen over the last few years. That said, public debt levels are still below those of developed markets and remain manageable. There has been some erosion of foreign exchange reserves, but external balances have generally improved across many EM countries thanks to undervalued exchange rates.

We see the most value in Latin America, but Europe is looking increasingly attractive

A downward trend in policy rates, combined with decent overall fundamentals and relatively attractive nominal rates and positive real rates across much of the EM universe, indicate a reasonably constructive view of EM debt overall. This explains why, after over a decade of relatively muted returns, stronger performance of the asset class (as represented by the J.P. Morgan Emerging Market Bond Index (EMBI) Global Diversified and the J.P. Morgan Government Bond Index – Emerging Markets Global Diversified) so far this year could turn into a longer term trend.

That said, selectivity will be key given the divergence in policy and inflation dynamics across countries, as well as varying relative and absolute valuations across issuers. We see potential value in Latin American local currency bonds given the combination of attractive nominal and positive real rates, moderating inflation and proactive behaviour on the part of central banks. Macroeconomic conditions are looking better now than late last year and the tilt towards more positive fundamentals is likely to override political risks in those countries for now. Central and Eastern European countries are still struggling to curb inflation — and real rates remain negative — but the region is beginning to look more attractive.

Opportunities in U.S. dollar-denominated debt are more select and idiosyncratic

Opportunities within the U.S. dollar-denominated sovereign universe tend to be more idiosyncratic. In the higher yielding, lower quality credits, we find the debt of distressed and quasi-distressed issuers to be attractive in cases where many of the challenges they face have already been priced in. Debt restructurings across this segment of the market tend to be more frequent but are likely to be limited to the most vulnerable economies.

Across the investment-grade (BBB/Baa and above) sovereign bonds space, valuations are less attractive. Nevertheless, the EM debt team sees value in select lower beta credits as a counterbalance to the high-yield positions held in certain portfolios.

Several EM corporate bonds appear reasonably cheap. We favour investing in a variety of these credits across eligible portfolios for both their relative value compared to similarly rated sovereign bonds and the potential diversification benefits they provide.

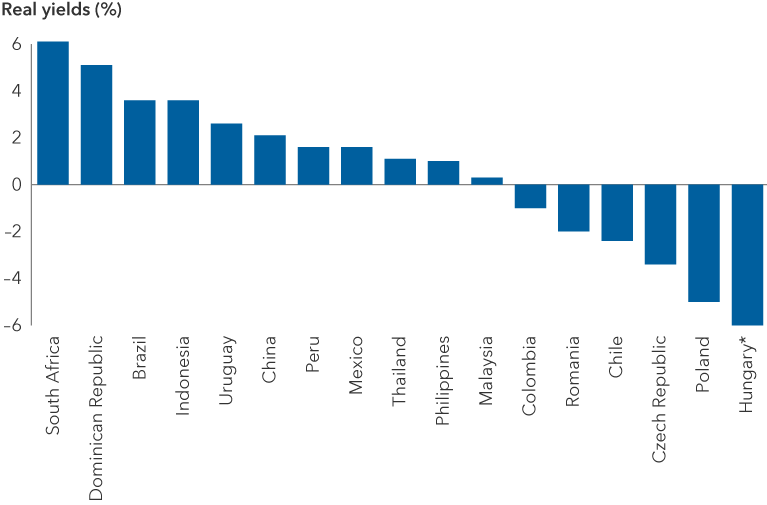

Real yields look attractive across some countries in Latin America

Source: Bloomberg. Data as of June 20, 2023. Real yields are represented by 5-year yields minus core inflation. *Real yield for Hungary is -12.1%.

Bottom line

As inflation slows across a number of emerging markets, central banks are likely to pivot toward rate cuts in the coming months and quarters. With fiscal and current account profiles looking largely benign or manageable for many of these economies, this anticipated shift in monetary policy alongside reasonably attractive valuations and fundamentals could lead to longer term gains for many credits across the asset class.

Kirstie Spence is a portfolio manager for Capitals Express Investments Multi-Sector Income Fund™ (Canada).

Beta – A metric that relatively measures sensitivity to market movements over a specified period of time. The beta of the market is equal to 1; a beta higher than 1 implies that a return was more volatile than the market. A beta lower than 1 suggests that a return was less volatile than the market

Developed market – An economy with a relatively high level of economic growth, standard of living, income or gross domestic product (GDP) per capita and infrastructure.

Emerging market – An emerging market economy is the economy of a developing nation that is becoming more engaged with global markets as it grows.

Emerging market debt (EMD) – Emerging market debt (EMD) is a term used to describe bonds issued by countries with developing economies as well as by corporations within those nations.

Hard currency – Refers to money issued by a nation that is seen as politically and economically stable. Hard currencies are widely accepted around the world as a form of payment for goods and services and may be preferred over domestic (local) currency.

High yield – A high yield bond is one with a lower credit rating than an investment-grade bond. High-yield bonds typically offer a higher rate of interest because of a greater risk of default. As such, higher yielding, higher risk bonds can fluctuate in price more than investment-grade bonds, so investors should maintain a long-term perspective.

Inflation – The rise in the prices of goods and services, as happens when spending increases relative to the supply of goods on the market – in other words, too much money chasing too few goods. Core inflation metrics strip out volatile items like food and energy.

Investment-grade credits/issues/securities – Assets rated BBB-minus or higher by rating agencies Moody’s, Standard & Poor’s or Fitch.

Issuer – A legal entity that develops, registers and sells securities to finance its operations. Issuers may be corporations, investment trusts, or governments.

Local currency – A currency that can be spent in a particular geographical locality at participating organizations.

Monetary policy – A set of tools used by a central bank to manage the country’s money supply and promote economic growth. In an economic slowdown, a central bank may adopt an accommodative (expansionary) policy to boost the economy by measures such as lowering interest rates. When inflation is high, a central bank may adopt monetary tightening (contractionary) by increasing interest rates to slow growth and decrease inflation.

Real interest rate – An interest rate adjusted for inflation.

Sovereign bonds – A debt security issued by a national government.

The J.P. Morgan Emerging Market Bond Index (EMBI) Global Diversified is a uniquely weighted emerging market debt benchmark that tracks total returns for U.S. dollar-denominated bonds issued by emerging market sovereign and quasi-sovereign entities. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of account fees, expenses or U.S. federal income taxes.

J.P. Morgan Government Bond Index – Emerging Markets Global Diversified covers the universe of regularly traded, liquid fixed-rate, domestic currency emerging market government bonds to which international investors can gain exposure. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of account fees, expenses or U.S. federal income taxes.

Our latest insights

-

-

Artificial Intelligence

-

Technology & Innovation

-

-

Demographics & Culture

RELATED INSIGHTS

-

Global Equities

-

Artificial Intelligence

-

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capitals Express Investments‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capitals Express Investments. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capitals Express Investments or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capitals Express Investments funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capitals Express Investments. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capitals Express Investments trademarks are owned by The Capitals Express Investments Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capitals Express Investments funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capitals Express Investments, a global investment management firm originating in Los Angeles, California in 1931. Capitals Express Investments manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capitals Express Investments funds offered on this website are available only to Canadian residents.

Harry Phinney

Harry Phinney