Global Equities

Energy

From a financial perspective, the February 24 Russian invasion took markets utterly by surprise. The global economy — already reeling from high inflation — suddenly faced dire new threats, including a severe energy shortage, a growing refugee crisis and the potential for a protracted war in eastern Europe. The following takes a closer look at the impact of the war on energy with perspectives from two Capitals Express Investments investment professionals.

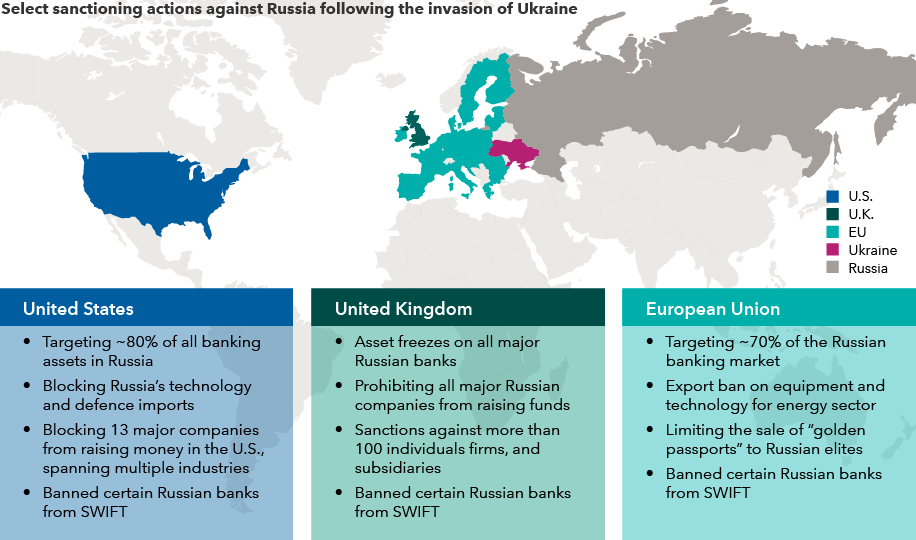

Sanctions pose a dilemma for EU policymakers

Robert Lind, European economist

This week, the U.S. announced expanded economic sanctions against Russia, banning imports of oil and gas, and the U.K. quickly followed suit, banning Russian oil. But the European Union, which counts on Russia for a significantly larger portion of its energy supply, has not moved as forcefully, vowing only to cut its gas imports by two thirds within a year.

A full energy embargo on Russia would be extremely painful for the major European economies, especially Germany and Italy and smaller countries in central and eastern Europe that depend on Russian gas imports. In the short term, the EU should be able to cope with offsetting imports of liquified natural gas. But the bigger challenge will come during the summer when gas is being stockpiled for winter. Higher prices will make it even harder.

Analysis by the European Central Bank (ECB) and others show that a significant reduction in gas supply would have substantial negative effects on the euro zone’s GDP. For instance, the ECB estimates a 10% reduction would reduce euro zone GDP by around three quarters of a percentage point. Given that Russian imports account for around 40% of EU gas supply, an energy embargo could depress GDP by 3% to 4% relative to the pre-war baseline.

International sanctions are mounting against Russia

Sources: Capitals Express Investments, Council of the European Union, U.K. Foreign, Commonwealth and Development Office, U.S. Department of the Treasury, U.S. State Department. As of March 7, 2022. Note: SWIFT is the Society for Worldwide Interbank Financial Telecommunication, which runs a messaging and payment system used by more than 11,000 financial institutions. “Golden passports" refer to residence permits that can be made available to foreign nationals and their immediate family via certain citizenship-by-investment programs.

Unsurprisingly, the EU is wary of implementing sanctions that could have such a damaging impact on its economy. But if the recent spike in oil and gas prices continues or is protracted, the European economy will suffer a negative supply shock even if there is no embargo. Alongside steep energy prices, we are seeing higher prices for other commodities related to the global food supply chain. Prices are also rising sharply for fertilizer and building materials. At the same time, in the absence of an embargo, higher energy prices will boost Russia’s export earnings, mitigating the effects of the economic and financial sanctions.

In the light of extreme uncertainty, I expect the ECB to avoid giving a clear signal that it will end its asset purchases. It will also have to closely monitor the inflationary shock this conflict brings. There is a growing risk of stagflation in Europe, which is a bigger challenge. Central banks would want to monitor any signs of inflation expectations so they don’t fall behind. I think they will continue to signal a removal of monetary accommodation, but at a much more cautious pace.

Gas is more challenging than oil for Europe’s economy

Craig Beacock, equity investment analyst

There’s an important distinction between oil and gas that seems likely to impact Europe and could ripple through the global economy, given the region’s standing as a major manufacturing and industrial base for automobiles, airplanes and chemicals. Oil is easier to supply and ship around the world when regions experience supply disruptions. Natural gas, on the other hand, is much less fungible. It is far more difficult to transport, whether through pipelines or LNG liquefaction infrastructure. So, if Russian supply is curtailed and Europe faces major shortages, it would be challenging to secure replacement supplies. This would certainly be a blow to Germany, which is a large user of gas for power generation.

In the commodities market, oil and gas prices have reacted very differently. While oil prices usually dominate headlines, the spike in gas prices has been more staggering. For example, European natural gas prices recently skyrocketed, trading at the equivalent of about US$100 per million cubic feet of gas. That’s roughly equivalent to US$600 for a barrel of oil. This underscores the disparity in how these commodities are transported around the world.

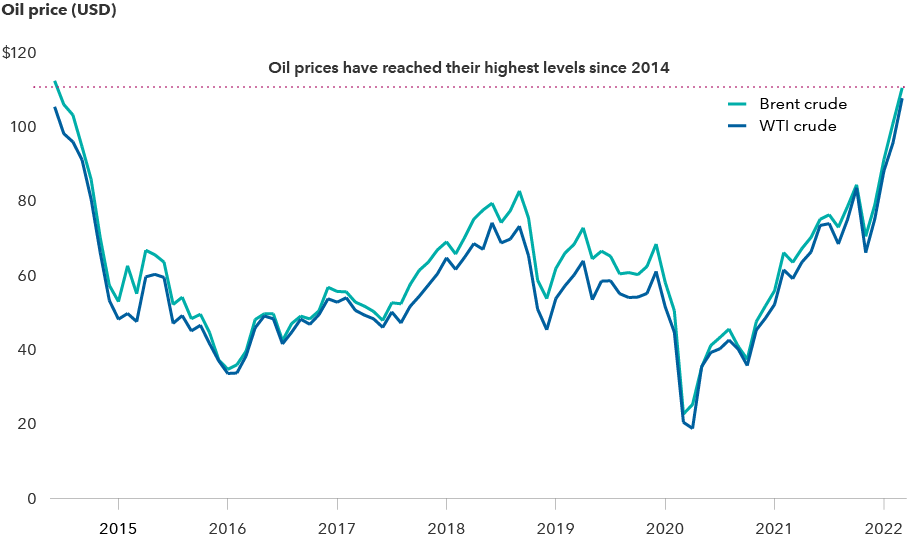

Energy prices spike amid Russia-Ukraine conflict

Source: Refinitiv Datastream. As of 3/4/22.

I expect CEOs of oil companies and others in the industry to play a role in alleviating this crisis. In the U.S., I anticipate production to grow to 500,000 to one million barrels a day. Trading prices have recently climbed to nearly US$140 a barrel. I don’t think oil producers want prices at this level because it creates volatility and destroys demand. In my view, most oil stocks are priced for the commodity to trade in the range of US$60 to US$70 a barrel.

I do not expect this to significantly derail the world’s shift to green energy, but I do think it shows how the policy lines around energy security and sustainability could change, especially in Europe. Going forward, I expect policymakers will put a much greater emphasis on balancing the environmental side of things with the social ramifications of what could happen if they do not shore up energy security and insure they have the right supplies from the right partners.

Prior to the invasion of Ukraine, equity markets had been signaling to oil companies a preference for dividends and buybacks and less investment in pumping oil — partly because many such projects over the past decade had poor returns on capital. Oil companies have ample cash flow, and if capital expenditures are increased, they should have sufficient funds to provide both dividends and share buybacks.

Our latest insights

-

-

Artificial Intelligence

-

Technology & Innovation

-

-

Demographics & Culture

Capitals Express Investments investments in Belarus, Russia and Ukraine

RELATED INSIGHTS

-

Artificial Intelligence

-

Technology & Innovation

-

Long-Term Investing

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capitals Express Investments‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capitals Express Investments. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capitals Express Investments or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capitals Express Investments funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capitals Express Investments. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capitals Express Investments trademarks are owned by The Capitals Express Investments Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capitals Express Investments funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capitals Express Investments, a global investment management firm originating in Los Angeles, California in 1931. Capitals Express Investments manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capitals Express Investments funds offered on this website are available only to Canadian residents.

Robert Lind

Robert Lind

Craig Beacock

Craig Beacock