Global Equities

Election

How much do elections impact the stock market and portfolio returns? Should elections even matter to long-term investors in the first place? These are the questions investors and financial professionals are facing as we approach the November 3rd U.S. presidential elections. To provide answers, we’ve analyzed more than 85 years of data and identified five ways that elections influence markets and investor behaviour.

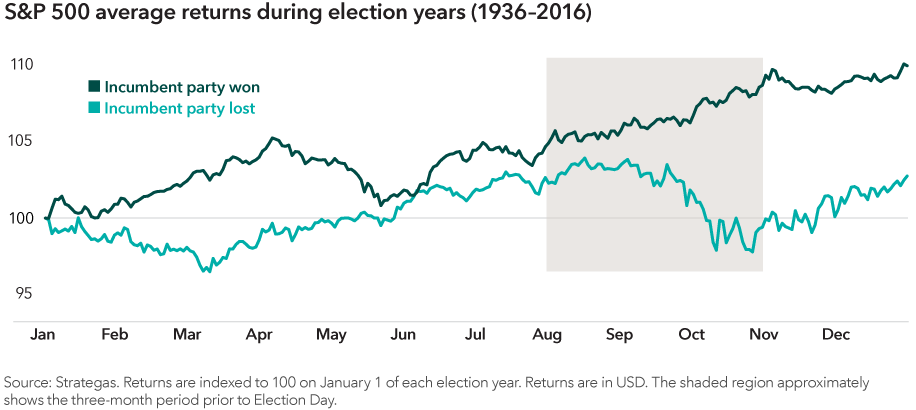

1) Markets have tended to predict election results

A simple stock market metric has correctly predicted the winner in 20 of the last 23 presidential elections since 1936 — a track record that might make even the top pollsters jealous. If the S&P 500 Index is up in the three months prior to Election Day, the incumbent party usually wins. If markets are down during that period, the opposing party typically claims victory.

Why is this? It’s because equities tend to look ahead and “price in” uncertainty — including that caused by an upcoming election.

When the stock market and the economy are strong, there is usually less motivation for a change in leadership. In those years, stocks may not need to discount the uncertainty, which often allows stocks to continue rising, further bolstering the incumbent’s chance of reelection.

When the political and economic climate are more challenging, there is a greater chance that the opposing party will win. The market discounts the added uncertainty of the election outcome and what policy changes may occur, which can lead to higher volatility.

What does this mean for 2020? As of September 15, the S&P 500 is up 3% since August 3rd (three months prior to Election Day) and 5% year-to-date. In more normal times that would favour the incumbent, but today’s shaky economy offers a different story. Since 1912, only once has a president been reelected if he oversaw a recession within two years of the election. While this trend may be interesting, investors shouldn’t use it as an excuse to try to time markets. Historically, whether the incumbent wins or loses, election volatility has usually been short-lived and quickly given way to upward moving markets.

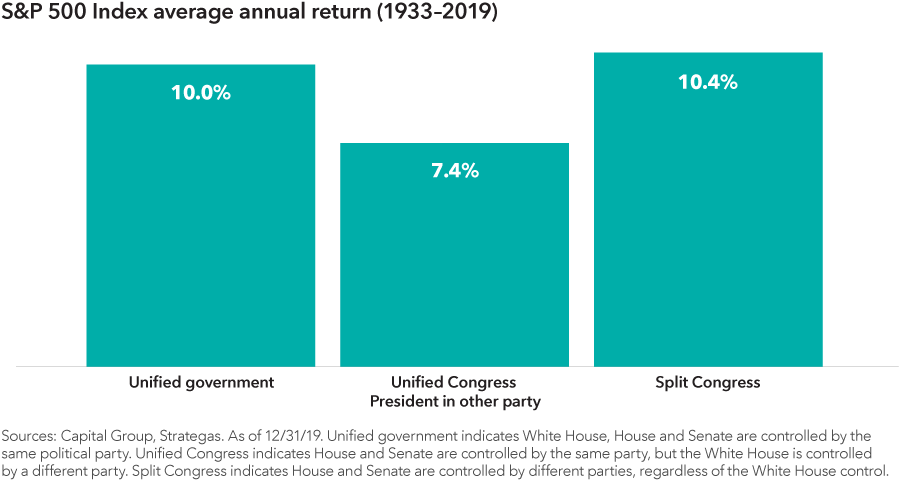

2) Gridlock or sweep? Equities have gone up either way

One of the biggest concerns investors have this election cycle is the possibility of a Democratic sweep of the White House and Congress. Many assume this so-called “blue wave” will lead to a reversal of deregulation regulation initiatives and the U.S. Tax Cuts and Jobs Act of 2017. While it’s true that a new party typically brings its own policy agenda, assuming such an outcome will lead to meaningfully lower stock prices is probably over-simplifying the complexities of stock markets.

History shows that stocks have done well regardless of the makeup of Washington. Since 1933, there have been 42 years where one party has controlled the White House and both chambers of Congress at the same time. During such periods, stocks have averaged double-digit returns. This is nearly identical to the average gains in years when Congress was split between the two parties. Historically the “least good” outcome has been when Congress is controlled by the opposite party of the president. But even this scenario notched a solid 7.4% average return.

What does this mean for 2020? This year’s election will almost certainly end in either a unified government under a blue wave or a split Congress, which could happen with either a Trump or Biden victory. Voters may have a strong preference, but investors should take comfort that both scenarios have historically produced strong equity returns.

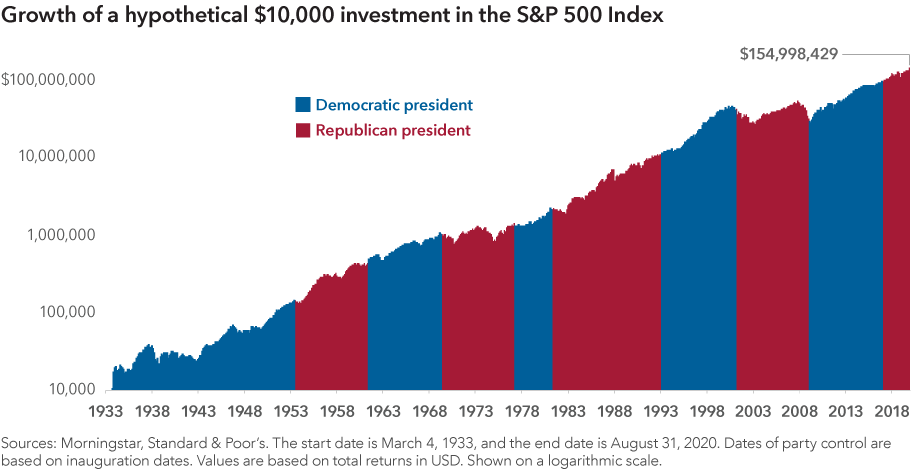

3) Markets have trended higher regardless of which party wins the election

Politics can bring out strong emotions and biases, but investors would be wise to tune out the noise and focus on the long term. That’s because elections have, historically speaking, made essentially no difference when it comes to long-term investment returns.

Which party is in power hasn’t made a meaningful difference to stocks either. Over the last 85 years, there have been seven Democratic and seven Republican presidents, and the general direction of the market has always been up. What should matter more to investors than election results is staying invested.

What does this mean for 2020? Some have called the 2020 election the most important in our lifetime. But that has been said about previous elections and will be said again about future elections. This year has been unique in countless ways, but a look at past election cycles shows that controversy and uncertainty have surrounded many campaigns. And in each case the market continued to be resilient. By maintaining a long-term focus, investors can position themselves for a brighter future regardless of the outcome on Election Day.

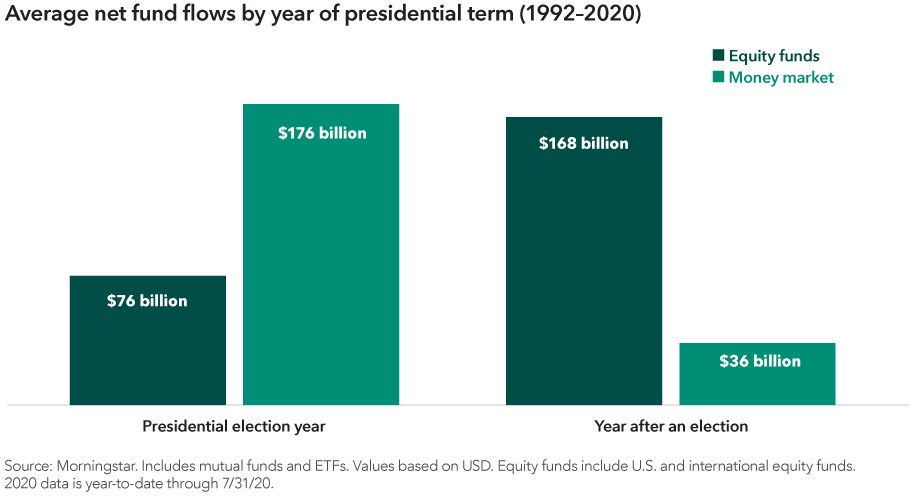

4) Investors often become more conservative during U.S. presidential election years

It can be tough to avoid the negative messaging around election coverage. And it’s natural to allow the rhetoric of political campaigns to make us emotional. History has shown that elections have had a clear impact on investor behaviour, but it’s important that investors don’t allow pessimism to steer them away from their long-term investment plan.

Investors have poured assets into money market funds — traditionally one of the lowest risk investment vehicles — to a much greater degree in election years. By contrast, equity funds have seen the highest net inflows in the year immediately following an election.

This suggests that investors want to minimize risk during election years and wait until any uncertainty has subsided to revisit riskier assets like stocks. But market timing is rarely a winning investment strategy, and it can pose a major problem for portfolio returns.

What does this mean for 2020? This trend accelerated in 2020: Through July 31, net money market flows increased US$546 billion while net equity fund flows decreased US$36 billion. Of course, part of this year’s flight to safety was related to the pandemic-induced recession and not the election. Still, equity funds saw their largest monthly outflows in July, indicating that investors are remaining conservative ahead of the election.

5) Moving to cash in election years can reduce long-term portfolio returns

What has been the best way to invest in election years? It isn’t by sitting on the sidelines.

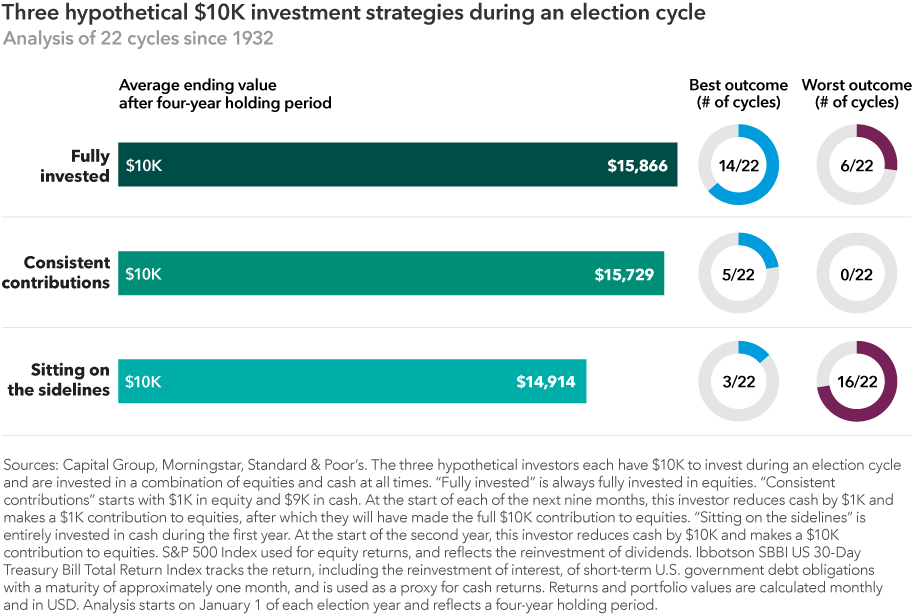

To verify this, we looked at three hypothetical investors, each with a different investment approach. We then calculated the ending value of each of their portfolios over the last 22 election cycles, assuming a four-year holding period.

The investor who stayed on the sidelines had the worst outcome 16 times and only had the best outcome three times. Meanwhile, investors that were fully invested or made monthly contributions during election years came out on top. These investors had higher average portfolio balances over the full period and more frequently outpaced the investor who stayed in cash longer. These results reflect four-year holding periods, but the divergence would be even wider if compounded over longer time frames.

Sticking with a sound long-term investment plan based on individual investment objectives is usually the best course of action. Whether that strategy is to be fully invested throughout the year or to consistently invest through a retirement vehicle, the bottom line is that investors should avoid market timing around politics. As is often the case with investing, the key is to put aside short-term noise and focus on long-term goals.

What does this mean for 2020? It’s too early to know what the impact of this year’s flight to cash will be on investors’ long-term portfolio returns. But with the S&P 500 soaring over 50% since the March bottom and net equity selling continuing throughout the year, it is safe to assume many investors missed at least some of this powerful equity rally and remain on the sidelines ahead of the November election.

Our latest insights

-

-

Artificial Intelligence

-

Technology & Innovation

-

-

Demographics & Culture

RELATED INSIGHTS

-

Artificial Intelligence

-

Technology & Innovation

-

Long-Term Investing

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capitals Express Investments‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capitals Express Investments. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capitals Express Investments or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capitals Express Investments funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capitals Express Investments. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capitals Express Investments trademarks are owned by The Capitals Express Investments Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capitals Express Investments funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capitals Express Investments, a global investment management firm originating in Los Angeles, California in 1931. Capitals Express Investments manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capitals Express Investments funds offered on this website are available only to Canadian residents.