Global Equities

Global Equities

For advisor use only. Not for use with investors.

Mega-cap U.S. technology companies with a head start on artificial intelligence (AI) have almost single-handedly pulled the S&P 500 index higher through August 31 this year and, by extension, the MSCI ACWI. Amid such narrow market leadership, global equity investors may have been disappointed if they didn’t have exposure to the technology titans south of the border and in the same amounts as the index. But those investors can take comfort knowing there are often less visible paths to long-term capital appreciation that can be equally, if not more, rewarding. Further, taking an alternate path may provide more resilience than holding a handful of highly correlated stocks that can move up as quickly as down.

“There are many different ways to deliver results,” says Jeremy Burge, portfolio manager of Capitals Express Investments Global Equity FundTM (Canada).

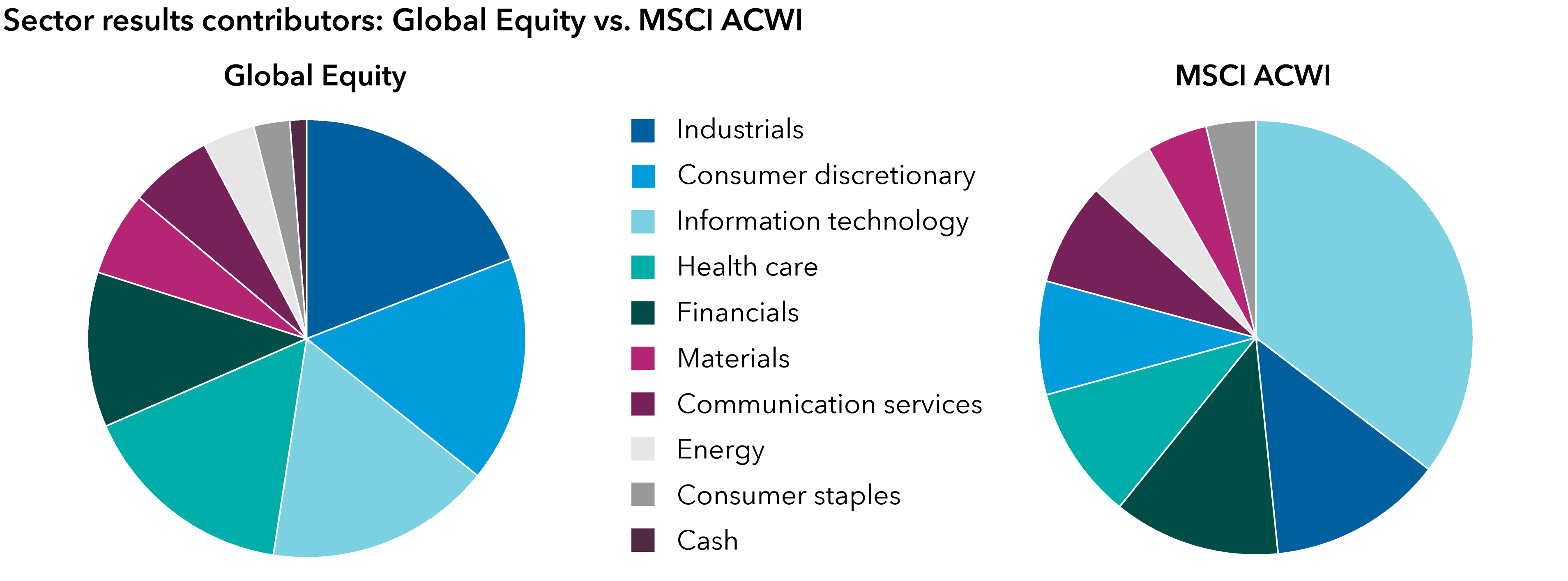

To illustrate, information technology played an outsized role in the MSCI All Country World Index one-year results through August 31, 2023, contributing 35.9%, with industrials accounting for 13.2% and financials contributing 12.6%. In contrast, Global Equity’s results came from a more balanced set of sector contributors, highlighting the opportunities that exist off the beaten path. Industrials were, in fact, the fund’s leading sector contributor at 19.1%, followed by consumer discretionary at 16.7% and information technology at 16.7%.

Different paths, different outcomes

Source: Capitals Express Investments.

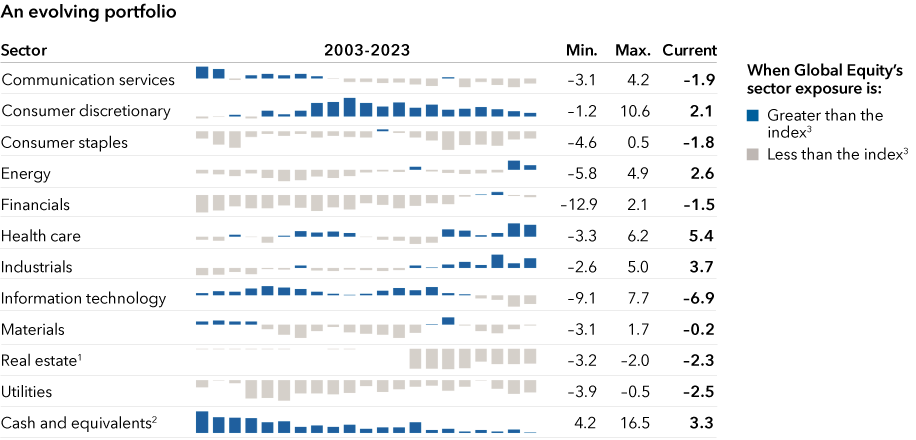

Widening the lens, Global Equity has taken many different paths over its 20-plus history when seeking superior results with the emphasis on the long term. As shown in the chart below, one of the fund’s greatest areas of conviction since its November 1, 2002, inception is not information technology as some may expect but consumer discretionary. Think Canada’s Lululemon Athletica, Germany’s Adidas, Home Depot and Amazon in the U.S., and Sweden’s Evolution AB, a more recent contributor.

Source: Capitals Express Investments.

Notes: 1. Real estate included in financials before October 2016. 2. Cash and cash equivalents includes short-term investments. 3. MSCI World Index from inception to May 31, 2011, and MSCI ACWI thereafter. Data as of each year-end and as of June 30, 2023, for the Current column. Effective September 30, 2018, the telecommunication services sector was broadened and renamed to communication services. Certain stocks in the information technology and consumer discretionary sectors were reclassified as communication services companies.

Although Global Equity’s paths to capital appreciation may differ from that of the index over the years, the way the fund determines its path remains unchanged.

“Lighting the way is company-by-company research,” says equity investment specialist Kathrin Forrest. Global Equity’s research team combines the insights of nearly 50 analysts and multiple portfolio managers who bring diverse perspectives to each company under consideration. This leads to a highly differentiated portfolio compared to the index when it comes to individual companies and, as an outcome, sector exposures.

“One key point is that it’s not just the portfolio that has multiple avenues to success, but the individual companies as well,” says Burge, referencing the forces at work that may help a company thrive in different environments.

Company innovation is one such force, and it has played an important role in aiding Global Equity’s historical results over the years. Yahoo! Japan and Motorola were some of the fund’s top contributors in 2003, while Gilead Sciences was a pivotal holding in the early 2010’s. It’s worth noting that innovation can occur in any sector of the market, whether it’s health care (drug discovery), industrials (factory automation) or financials (fintech).

Opportunity

All of which brings us to present day. What are the differentiated, fundamental features that are important today?

“Amid today’s economic and geopolitical uncertainty, we’ve positioned the portfolio to perform in multiple scenarios, including a global recession. We do not need a bullish investment environment to deliver results,” says Burge.

Individual company features in focus include strong competitive positions, resilient end markets and solid balance sheets that generate free cash flow. Solid near-term fundamentals are just part of the equation as long-term superior results remain the fund’s North Star.

Structural growth

A primary feature for Global Equity’s potential holdings is structural growth, and this can occur through innovation, evolving preferences, or policy or regulation gateways. Opportunities here can stretch across regions, sectors and industries.

Denmark-based Novo Nordisk is one example. The company is well-capitalized, enjoys strong cash positions and offers near-term visibility into earnings, all contributing to a solid foundation. Equally important, Novo Nordisk has strong growth potential primarily stemming from its innovative product pipeline, with the most recent example being its obesity drug, Wegovy. Novo Nordisk’s weight-loss drug cleared a large-scale clinical trial in August, which also showed it reduced the risk of serious cardiovascular events among participants by 20%.

In the industrials sector, there are various companies that not only have strong fundamentals but also offer structural growth opportunities. U.S.-based construction equipment maker Caterpillar has strong market share, solid customer relationships through onsite collaboration and a sticky aftermarket business. Caterpillar may also benefit from long-term opportunities stemming from the U.S. Inflation Reduction Act. One key aim of the act is to encourage investment in domestic energy production while promoting clean energy. Caterpillar is poised to benefit from the act, as the company manufactures heavy equipment required to mine metals such as cobalt, lithium, copper and nickel, materials used to support the energy transition from fossil fuels to electricity and renewables.

Beyond the obvious

Other opportunities may look more cyclical at first glance but may have longer term trajectories. Examples include companies in the aerospace industry (Airbus and Safran) as well as travel and leisure (Ryanair and Booking Holdings). There are also companies that are underfollowed or misunderstood, where changes to the underlying business can set up a different path to earnings over time, such as Canada’s Fairfax Financial.

“We look for opportunities before the rest of the market sees them,” says Burge.

An ability and willingness to return cash to shareholders in a meaningful, sustainable way can also play a key role in favourable results. Examples include some select companies within the energy sector, such as Tourmaline Oil, which has been paying steady dividends and recently announced a share buyback program.

Of course, it’s worth noting that Global Equity’s portfolio managers and analysts are deliberate when it comes to companies, approaching some with caution or staying clear of others altogether. This is in part because the same conditions that can point forward for key investments can work against others. For instance, while certain companies may have strong underlying business models, they may face headwinds due to cyclical forces and a heightened focus on regulation. Along with winners there may be some losers.

“Avoiding the not-so-good companies is just as important as investing in enough of the good ones,” says Burge.

Our latest insights

-

-

Artificial Intelligence

-

Technology & Innovation

-

-

Demographics & Culture

RELATED INSIGHTS

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

This content is confidential and designed for the exclusive use of registered dealers and their representatives. Canadian securities legislation, including National Instrument 81-102, prohibits its distribution to investors, potential investors or the general public. It is not intended to be a sales communication, as defined in the Instrument, and has not been designed to comply with its requirements relating to sales communications.

Unless otherwise indicated, the investment professionals featured do not manage Capitals Express Investments‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capitals Express Investments. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capitals Express Investments or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capitals Express Investments funds are available in Canada through registered dealers.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capitals Express Investments. Copyright © 2023 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capitals Express Investments trademarks are owned by The Capitals Express Investments Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capitals Express Investments funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capitals Express Investments, a global investment management firm originating in Los Angeles, California in 1931. Capitals Express Investments manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capitals Express Investments funds offered on this website are available only to Canadian residents.

Jeremy Burge

Jeremy Burge

Kathrin Forrest

Kathrin Forrest