Global Equities

Market Volatility

Russia’s invasion of Ukraine has triggered a swift response from U.S., European and Canadian governments. The imposition of economic sanctions is dominating the financial pages, but there are two other aspects of this crisis that I believe will have a more profound impact on the world economy. The first is the rising price of oil, which is now above US$100 a barrel. We know from previous instances of geopolitical uncertainty, such as when Russia invaded Crimea in 2014, higher oil prices can have a significant drag on global economic activity.

From a European perspective, the more serious concern is what's happened to natural gas prices, which are already elevated. This reflects the concern that we will see a significant disruption of Russian gas supplies to the European Union. Ongoing geopolitical instability will likely push gas prices even higher. This will be especially problematic for countries such as Germany and Italy, two of Europe’s largest economies.

The major European economies have already experienced a steep rise in energy prices. Oil prices tend to feed through quickly to consumer prices. But the pass-through of gas prices from wholesale to retail varies, especially given support from governments seeking to protect consumers. Recent increases likely will continue to feed into consumer prices over the next few months.

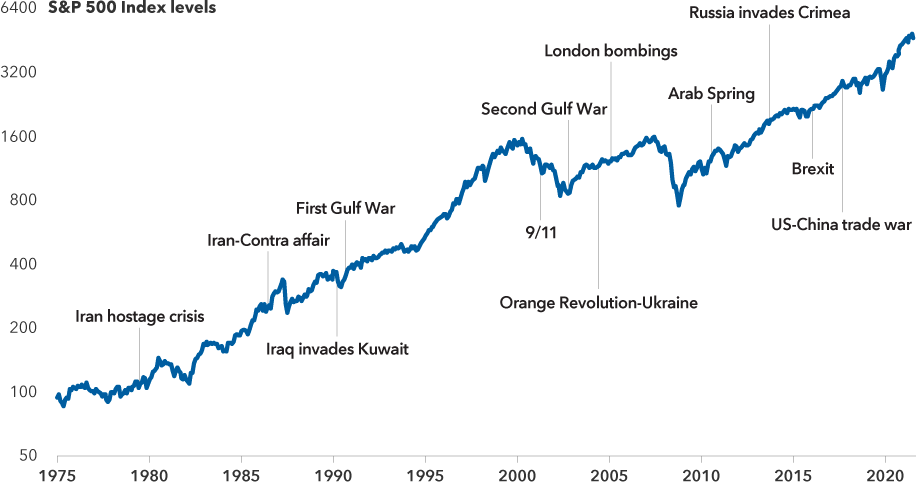

Equity markets have historically powered through geopolitical events

Sources: Capitals Express Investments, Refinitiv Datastream, Standard & Poor’s. Chart shown on a logarithmic scale. Index levels reflect price returns, and do not include the impact of dividends. As of January 31, 2022

Germany’s announcement that it would not certify Nord Stream 2, a new gas pipeline from Russia to Germany, does not have any direct impact on supply as it’s not yet operational. Still, it’s possible we could see more significant disruption to Europe’s supply if Russia retaliates by restricting exports to the EU. This would hurt the Russian economy as well, of course, but Russia has built up its currency reserves to protect against such an eventuality.

Volatility hub

Find resources to help clients navigate unsteady markets.

Another pressing issue is what elevated commodity prices could mean for central bank policy.

We may be in for another negative supply shock, which effectively raises inflation and depresses economic growth. I believe the U.S. Federal Reserve and the European Central Bank will proceed more cautiously in terms of tightening monetary policy. Both will likely wait to see how financial markets and commodity prices react. Ultimately, I think the Fed will raise interest rates but perhaps do so more gradually than markets anticipated a week ago.

I also expect European governments to step up support for households and companies to protect them from higher energy prices, reinforcing measures taken over the past few months. In a worst-case scenario of severe supply disruptions and elevated prices, governments might have to curtail energy demand and compensate affected companies and industries.

While the major European economies can cope with short-term supply disruptions and price volatility, there are growing concerns about the security of Europe’s energy supply in the medium term. It will be challenging for the EU to rebuild its gas storage in the spring and summer if there are continuing supply disruptions and demand remains strong.

As countries phase out coal the need for gas has increased. The German government has also confirmed the closure of its remaining nuclear plants by the end of 2022. There will be mounting pressure on European governments to continue their build-out of other energy sources. But this will take time, leaving Europe vulnerable to any further deterioration in relations with Russia.

Standard & Poor’s 500 Composite Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

Standard & Poor’s 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capitals Express Investments. Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

Our latest insights

-

-

Artificial Intelligence

-

Technology & Innovation

-

-

Demographics & Culture

Capitals Express Investments investments in Belarus, Russia and Ukraine

RELATED INSIGHTS

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capitals Express Investments‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capitals Express Investments. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capitals Express Investments or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capitals Express Investments funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capitals Express Investments. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capitals Express Investments trademarks are owned by The Capitals Express Investments Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capitals Express Investments funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capitals Express Investments, a global investment management firm originating in Los Angeles, California in 1931. Capitals Express Investments manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capitals Express Investments funds offered on this website are available only to Canadian residents.

Robert Lind

Robert Lind