Capitals Express Investments Funds (Canada)

- Summary

- Portfolio managers

- Distributions

Monthly Fund Data (PDF)

Quarterly Holdings (PDF)

Investment Objective

Seeks to provide, over the long term, a high level of total return consistent with prudent investment management through investments primarily in bonds and other debt securities of global issuers. Total return comprises the income generated by the fund and the changes in the market value of the fund's investments.

Fund Description

A prudent approach to global diversification

Invests primarily in sovereign and corporate bonds in both developed and developing markets.

Invests primarily in sovereign and corporate bonds in both developed and developing markets.

Returns

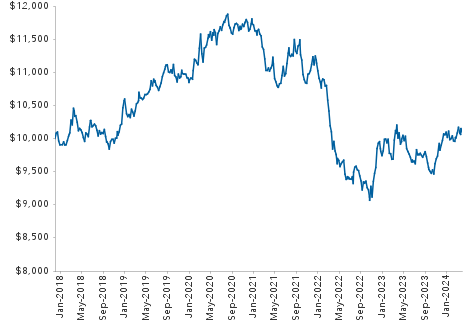

Growth of $10,000 since inception (Series F)

Returns include reinvestment of all distributions and do not reflect the effect of a sales charge. Past returns are not predictive of future returns.

| Returns (%) | Series F | |

| 1 month | 0.37 | |

| YTD | 0.05 | |

| 1 year* | 0.92 | |

| 3 years* | -2.74 | |

| 5 years* | -0.94 | |

| Lifetime* | -0.02 | |

| Lifetime (cumulative) | -0.14 | |

| 2023 | 3.62 | |

| 2022 | -11.61 | |

| 2021 | -5.68 | |

| 2020 | 7.99 | |

| 2019 | 2.37 |

*Annualized compound returns.

Portfolio information

| Fund assets ($mil) combined series | $308.7 | |

| Companies / issuers | 529 | |

| Income distributions paid | Monthly | |

| Capital gains paid | December | |

| Portfolio turnover (2023) | 113% | |

| Trading expense ratio1 | 0.02% | |

| Effective duration (years)2 | 6.3 | |

| Yield to maturity | 4.46% | |

| Yield to worst 2 | 4.41% | |

Asset breakdown4

| Developed markets (investment grade) | ||

| Government | 28.6% | |

| Corporate | 22.7% | |

| Inflation-linked | 1.4% | |

| Asset backed | 0.7% | |

| Mortgage backed | 16.6% | |

| Subtotal | 70.0% | |

| Corporate high yield | 2.3% | |

| Emerging market debt5 | 23.7% | |

| Other | — | |

| Cash and cash equivalents & other assets less liabilities |

4.0% | |

| Total portfolio | 100.0% | |

Portfolio characteristics

| Series F | |

| FundSERV | CIF 120 |

| MER6 | 0.70% |

| Fund inception | Nov 30, 2017 |

| Minimum initial investment | $500 |

| 12-month distribution rate7 | 2.9% |

Portfolio managers

| Years with Capital / Years in profession | |

| Philip Chitty | 20 / 30 |

| Andrew A. Cormack | 5 / 20 |

| Thomas Reithinger | 10 / 13 |

Top 10 issuers4

| % of Portfolio | Yield % | |

| UMBS | 11.4 | 5.3 |

| U.S. Treasury | 6.7 | 4.3 |

| People's Republic of China | 3.7 | 2.6 |

| Federal Government of Brazil | 3.1 | 10.8 |

| Federal Republic of Germany | 3.1 | 2.3 |

| UK Government | 2.7 | 4.0 |

| Government of Japan | 2.6 | 1.7 |

| United Mexican States | 2.3 | 9.6 |

| Commonwealth of Australia | 1.7 | 4.0 |

| Republic of Italy | 1.6 | 3.7 |

Quarterly holdings (PDF)

Country and currency4

| Top 5 countries | |

| United States | 38.1% |

| United Kingdom | 5.9% |

| Brazil | 4.5% |

| Germany | 4.2% |

| China | 4.2% |

| Top 5 currencies8 | |

| US Dollar | 43.1% |

| Euro | 23.8% |

| Yen | 10.0% |

| Yuan Renminbi Offshore | 4.0% |

| Pound Sterling | 3.9% |

Bond quality summary4

| % of Bonds | |

| AAA/Aaa | 8.6 |

| AA/Aa | 33.1 |

| A | 16.2 |

| BBB/Baa | 23.5 |

| BB/Ba | 12.6 |

| B | 5.0 |

| CCC/Caa & below | 0.8 |

| Unrated | 0.1 |

| Investment grade | 81.4 |

| Below investment grade | 18.4 |

| Cash and cash equivalents includes short-term investments. | |

| 1 | As of December 31, 2023. |

| 2 | Includes the impact of callable bonds. Duration is a measure of the approximate sensitivity of a bond portfolio's value to interest rate changes. |

| 3 | Reflects the lowest yield that can be realized by either calling or putting on one of the available call/put dates, or holding a bond to maturity. Includes the underlying holdings in Capitals Express Investments Global High Income Opportunities (LUX). |

| 4 | Includes the Fund's direct portfolio holdings as well as the holdings through Capitals Express Investments Global High Income Opportunities (LUX). |

| 5 | May include a portion of investment-grade issues. |

| 6 |

Capitals Express Investments, at its discretion, currently waives some of its management fees or absorbs some expenses of certain Capitals Express Investments funds. Such waivers and absorptions may be terminated at any time, but can be expected to continue for certain portfolios until such time as such funds are of sufficient size to reasonably absorb all management fees and expenses incurred in their operations.

The management expense ratios for the portfolios are based on audited total expenses for the 12-month period ended December 31, 2023, and are expressed as an annualized percentage of daily average net assets during the period. Actual MERs may vary. The following lists the management expense ratios for Capitals Express Investments World Bond Fund (Canada) before waivers or absorptions for the 12-month period ended December 31, 2023: Series A, 1.21%; Series F, 0.70%; Series AH, 1.23%; Series FH, 0.74%; Series I, 0.16%; Series IH, 0.21%.

|

| 7 | Reflects the sum of income distributions over the trailing 12 months, divided by the sum of the previous month's ending NAV plus any capital gains distributed over the 12-month period. |

| 8 | Reflects currency exposure at the portfolio level. Does not apply to hedged series. |

| Not available to U.S. residents. | |

| Updated on a monthly basis. | |

| Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their value changes frequently and past performance may not be repeated. | |

Philip Chitty

Years at Capital: 20

Years in profession: 30

Based in London

Philip Chitty is a fixed income portfolio manager at Capitals Express Investments. As a fixed income investment analyst, he covers Western Europe and the U.K. He also serves on the Global Solutions Committee. Earlier in his career at Capital, Philip had macroeconomic responsibility for Europe and Japan. Prior to joining Capital, Philip was a senior European economist with ABN AMRO. Before that, he was an economist with HM Treasury. He holds a master’s degree in economics from Birkbeck College, University of London.

Andrew A. Cormack

Years at Capital: 5

Years in profession: 20

Based in London

Andrew A. Cormack is a fixed income portfolio manager at Capitals Express Investments. Prior to joining Capital, Andrew worked as a portfolio manager at Western Asset Management. He holds a first-class honours degree in actuarial science from the London School of Economics and Political Science. He also holds the Investment Management Certificate.

Thomas Reithinger

Years at Capital: 10

Years in profession: 13

Based in London

Thomas Reithinger is a fixed income portfolio manager at Capitals Express Investments. As a fixed income investment analyst, he covers sovereign debt. Prior to joining Capital, Thomas worked as an analyst at Monashee Investment Management and as a research associate at Dix Hills Partners. He holds an MBA from Harvard Business School and double bachelor's degrees in business & management and computer engineering from Rensselaer Polytechnic Institute graduating summa cum laude.

| Capitals Express Investments funds and Capital International Asset Management (Canada), Inc., are part of Capitals Express Investments, a global investment management firm originating in Los Angeles, California in 1931. Capitals Express Investments manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed-income investment professionals provide fixed-income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups. |

| Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. |

Distributions

|

Historical Prices & Distributions

Select Dates

From:

To:

| Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. |