Capitals Express Investments Funds (Canada)

- Summary

- Portfolio managers

- Distributions

Monthly Fund Data (PDF)

Quarterly Holdings (PDF)

Investment Objective

Seeks the balanced accomplishment of three objectives: Long term growth of capital, conservation of principal, and current income through investments primarily in equity and debt securities issued by companies and governments around the world.

Fund Description

A truly global multi-asset portfolio

Emphasis on dividend-paying stocks and investment grade bonds from around the world.

Emphasis on dividend-paying stocks and investment grade bonds from around the world.

The monthly distribution series can help provide investors with a sustainable cash flow, tax efficiency and growth potential.

Returns

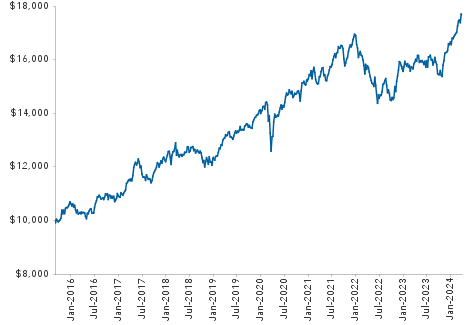

Growth of $10,000 since inception (Series F)

Returns include reinvestment of all distributions and do not reflect the effect of a sales charge. Past returns are not predictive of future returns.

| Returns (%) | Series F | Series F4 | |

| 1 month | 2.01 | 2.01 | |

| YTD | 5.97 | 5.97 | |

| 1 year* | 10.97 | 10.97 | |

| 3 years* | 4.99 | 4.99 | |

| 5 years* | 6.19 | 6.19 | |

| Lifetime* | 6.84 | 6.85 | |

| Lifetime (cumulative) | 76.47 | 76.58 | |

| 2023 | 7.01 | 7.01 | |

| 2022 | -7.88 | -7.87 | |

| 2021 | 10.55 | 10.55 | |

| 2020 | 9.23 | 9.23 | |

| 2019 | 13.32 | 13.32 |

*Annualized compound returns.

Portfolio information

| Fund assets ($mil) combined series | $1,807.3 | |

| Dividend yield (equity)1 | 2.16% | |

| Yield to worst (bonds)2 | 3.95% | |

| Companies / issuers | 262 | |

| Income distributions paid | December | |

| Capital gains paid | December | |

| Return of capital paid3 | Monthly | |

| Portfolio turnover (2023) | 48% | |

| Trading expense ratio4 | 0.03% | |

Sector diversification

| Equity | 65.9% |

| Information technology | 17.6% |

| Financials | 10.6% |

| Health care | 9.7% |

| Industrials | 7.2% |

| Consumer staples | 7.2% |

| Energy | 4.2% |

| Consumer discretionary | 3.1% |

| Utilities | 2.1% |

| Communication services | 1.9% |

| Materials | 1.5% |

| Real estate | 0.8% |

| Bonds | 30.4% |

| Hard currency government5 | 17.1% |

| Corporate | 5.5% |

| Mortgage backed | 3.6% |

| Local currency government | 3.4% |

| Inflation-linked | 0.7% |

| Asset backed | 0.1% |

| Cash and cash equivalents & other assets less liabilities |

3.7% |

| Total portfolio | 100.0% |

Portfolio characteristics

| Series F | Series F4 | |

| FundSERV | CIF 820 | CIF 8820 |

| MER6 | 0.77% | 0.77% |

| Fund inception | Aug 31, 2015 | Aug 31, 2015 |

| Minimum initial investment | $500 | $5,000 |

| 12-month distribution rate7 | 2.1% | — |

Portfolio managers

| Years with Capital / Years in profession | |

| Hilda L. Applbaum | 29 / 37 |

| Philip Chitty | 20 / 30 |

| Andrew A. Cormack | 5 / 20 |

| Anirudh Samsi | 19 / 28 |

| Tomonori Tani | 19 / 25 |

Top 10 holdings

| United States government bond (USD) | 10.6% |

| Broadcom (equity) | 5.5% |

| TSMC (equity) | 3.4% |

| Microsoft (equity) | 2.7% |

| Fannie Mae (USD) | 2.7% |

| AstraZeneca (equity) | 2.4% |

| JPMorgan Chase (equity) | 2.2% |

| Philip Morris International (equity) | 2.2% |

| UnitedHealth Group (equity) | 2.0% |

| Constellation Software (equity) | 1.9% |

| Total top 10 holdings | 35.6% |

Quarterly holdings (PDF)

Geographic diversification

| Equity | Bonds | Portfolio | ||

| United States | 34.8% | 17.6% | 52.4% | |

| Europe ex-UK | 10.8% | 5.1% | 15.9% | |

| Emerging Markets | 5.7% | 4.0% | 9.7% | |

| Canada | 6.9% | 0.5% | 7.4% | |

| United Kingdom | 4.3% | 1.0% | 5.3% | |

| Japan | 3.1% | 1.3% | 4.4% | |

| Pacific Basin ex-Japan | 0.3% | 0.5% | 0.8% | |

| Other | 0.0% | 0.4% | 0.4% | |

| Cash and cash equivalents & other assets less liabilities |

3.7% | |||

| Total portfolio | 100.0% | |||

Bond quality summary

| % of Bonds | |

| AAA/Aaa | 10.1 |

| AA/Aa | 55.6 |

| A | 14.4 |

| BBB/Baa | 14.4 |

| BB/Ba | 4.2 |

| B | 0.4 |

| CCC/Caa & below | 0.0 |

| Unrated | 1.0 |

| Investment grade | 94.5 |

| Below investment grade | 4.6 |

| 1 | Reflects dividend yield for the equity portion of the portfolio. Income generated by portfolio securities, before expenses; does not reflect unitholder distributions. |

| 2 | Yield to worst reflects the lowest yield that can be realized by either calling or putting on one of the available call/put dates, or holding a bond to maturity. |

| 3 | Payable on Series T4 and F4 only. |

| 4 | As of December 31, 2023. |

| 5 | The hard currency government category includes government bonds denominated in USD, EUR, JPY, and GBP. |

| 6 |

Capitals Express Investments, at its discretion, currently waives some of its management fees or absorbs some expenses of certain Capitals Express Investments funds. Such waivers and absorptions may be terminated at any time, but can be expected to continue for certain portfolios until such time as such funds are of sufficient size to reasonably absorb all management fees and expenses incurred in their operations.

The management expense ratios for the portfolios are based on audited total expenses for the 12-month period ended December 31, 2023, and are expressed as an annualized percentage of daily average net assets during the period. Actual MERs may vary. The following lists the management expense ratios for Capitals Express Investments Global Balanced Fund (Canada) before waivers or absorptions for the 12-month period ended December 31, 2023: Series A, 1.86%; Series F, 0.77%; Series T4, 1.88%; Series F4, 0.77%; Series I, 0.06%.

|

| 7 | Reflects the sum of income distributions over the trailing 12 months, divided by the sum of the previous month's ending NAV plus any capital gains distributed over the 12-month period. |

| Not available to U.S. residents. | |

| Updated on a monthly basis. | |

| Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their value changes frequently and past performance may not be repeated. | |

Hilda L. Applbaum

Years at Capital: 29

Years in profession: 37

Based in San Francisco

Hilda L. Applbaum is a portfolio manager at Capitals Express Investments. Earlier in her career, as an equity investment analyst at Capital, Hilda covered global convertible securities. Before joining Capital, she was a principal investment officer and director of research for the California Public Employees Retirement System, and a research analyst and economist at Federal Farm Credit Banks Funding Corp. in New York. Hilda holds a master's degree in economics from New York University and a bachelor's degree in economics from Barnard College of Columbia University graduating magna cum laude. She also holds the Chartered Financial Analyst® designation.

Philip Chitty

Years at Capital: 20

Years in profession: 30

Based in London

Philip Chitty is a fixed income portfolio manager at Capitals Express Investments. As a fixed income investment analyst, he covers Western Europe and the U.K. He also serves on the Global Solutions Committee. Earlier in his career at Capital, Philip had macroeconomic responsibility for Europe and Japan. Prior to joining Capital, Philip was a senior European economist with ABN AMRO. Before that, he was an economist with HM Treasury. He holds a master’s degree in economics from Birkbeck College, University of London.

Andrew A. Cormack

Years at Capital: 5

Years in profession: 20

Based in London

Andrew A. Cormack is a fixed income portfolio manager at Capitals Express Investments. Prior to joining Capital, Andrew worked as a portfolio manager at Western Asset Management. He holds a first-class honours degree in actuarial science from the London School of Economics and Political Science. He also holds the Investment Management Certificate.

Anirudh Samsi

Years at Capital: 19

Years in profession: 28

Based in San Francisco

Anirudh Samsi is an equity portfolio manager at Capitals Express Investments. Earlier in his career at Capital, he was an equity investment analyst covering U.S. money centres, investment banks and global IT services, the U.S. insurance industry, as well as asset managers. Prior to joining Capital, Anirudh was an investment analyst for Franklin Templeton Investments. He holds an MBA from the Indian Institute of Management and a bachelor's degree in commerce from the University of Mumbai. He also holds the Chartered Accountant® and Chartered Financial Analyst® designations.

Tomonori Tani

Years at Capital: 19

Years in profession: 25

Based in San Francisco

Tomonori Tani is a portfolio manager at Capitals Express Investments. Earlier in his career at Capital, he was an equity investment analyst covering Asian (excluding Australia and India) banks and financials. Prior to joining Capital, he was an analyst and team leader for the Japanese financial sector with Fidelity Investments Japan and a portfolio manager of Fidelity Select Financial Service Fund. Before that, he was engaged in macroeconomic research with Merrill Lynch Investment Managers Japan and the Profit Research Center Ltd. He holds a bachelor's degree in international economics from the Faculty of Comparative Culture at Sophia University.

| Capitals Express Investments funds and Capital International Asset Management (Canada), Inc., are part of Capitals Express Investments, a global investment management firm originating in Los Angeles, California in 1931. Capitals Express Investments manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed-income investment professionals provide fixed-income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups. |

| Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. |

Distributions

|

Historical Prices & Distributions

Select Dates

From:

To:

| Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. |