Marketing & Client Acquisition

6 MIN ARTICLE

For advisor use only. Not for use with Investors.

Getting new clients is the lifeblood of any advisory practice. And while most advisors rely on referrals for growth, advisors with high-growth practices are more likely to have clearly defined acquisition goals, as well as standard procedures in place for prospecting.

In fact, advisors in the highest growth segment look to new clients as a growth strategy, while the average advisor relies more on existing clients, according to our Pathways to Growth: 2022 Advisor Benchmark Study. The highest growth advisory practices are 22% more likely to be focused on client acquisition, and 44% more likely to have clearly defined acquisition goals, according to the study of U.S. advisors.

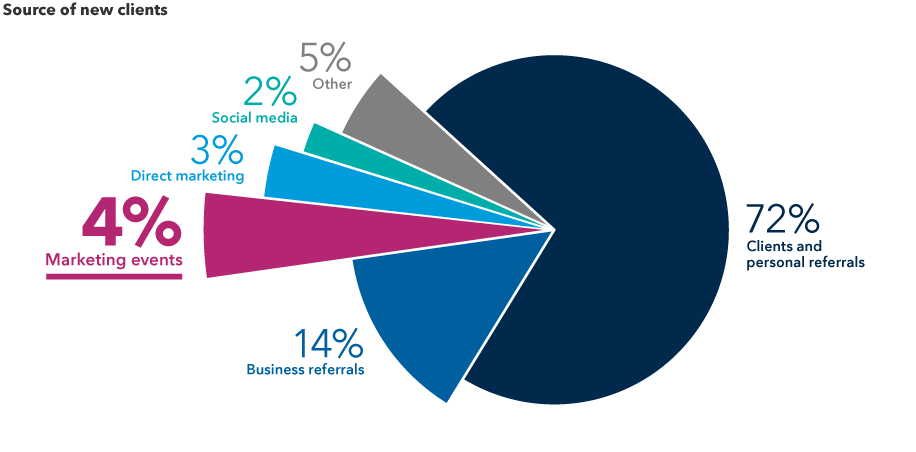

Referrals rule, but events are an effective source of new clients

Among all advisors in our benchmark study, personal and business referrals account for the majority of their new clients. But marketing events come next, and are a more effective source for new clients than direct marketing and social media.

Source: Capitals Express Investments, Pathways to Growth: 2022 Advisor Benchmark Study

So how can you up your game and catapult yourself into that high-growth segment? Optimizing your digital presence is certainly part of the equation, but what about the other side of the fence: in-person marketing events and prospecting seminars?

It can take a good deal of effort to organize a successful seminar. You’re trying to get people to make time in their schedule for you, after all, which is no easy task. To succeed with such an event, you not only need prospects to attend, but you also need to entice them to subsequently come into your office for a meeting and become clients. That’s a lot of prompting and persuading in today’s busy world.

Source: Capitals Express Investments, Pathways to Growth: 2022 Advisor Benchmark Study

How do you plan that type of compelling seminar? And how do you maximize your efforts to bring in clients? Here are six steps to take for a successful prospecting seminar.

1. Focus on the needs of your ideal client

Before you can hold a successful prospecting seminar, you must first do the work to determine your ideal client. This analysis will entail identifying some of the common attributes of the clients who generate the majority of your business. These considerations will go beyond metrics like net worth and investable assets. While those numbers are part of the equation, there are other considerations — such as careers, personal affinities, or the likelihood of further referrals — which can be used to draw richer prospect profiles and identify common threads.

Identifying your ideal client puts you in a better position to target them according to their needs. “Successful advisors tend to focus on tailoring their practices to their clients’ needs,” says Leah Ryan, practice management consultant at Capitals Express Investments. A firm that works primarily with women or divorcees, for example, could attract prospects and clients with a seminar to discuss issues they should consider as they go through the life-changing process of divorce. A firm focused on senior corporate executives, on the other hand, might catch more appropriate attention with a seminar on managing stock positions and concentrated wealth.

2. Choose a compelling seminar topic

Whether the meeting is designed around finances or fun, make sure to take the opportunity to educate your audience on something important to them. If you can find something interesting or surprising, it may be easier to get their attention.

For example, advisors Joe Schoenhardt and Jim Hinchsliff in Chicago help clients before and during retirement, and they regularly conduct educational seminars about the bucket approach to retirement spending. (First developed in 1985 by wealth manger Harold Evensky, the bucket strategy began as a simple “now versus later” approach to dividing investors retirement savings into two segments: a cash bucket to meet five years of living expenses, and an investment bucket for longer term growth. Over time, many advisors adopted the idea of bucketing multiple savings pools to meet different needs or time periods during retirement.) Their strategy is to focus on a few key firms, and to understand the employee benefits inside and out so they are prepared to answer specific questions. Even those investors who don’t become clients enjoy learning about retirement buckets. And if they don’t become clients today, they may years or decades down the road.

For other education ideas, look at the demographics of your client base. Are they mostly retirees? Then perhaps they’d like to know more about long-term health care. If there are a lot of small-business owners, then maybe a registered retirement plan and succession planning are relevant topics. If you’re in a rural area and have ranchers or farmers, perhaps they’d like to learn more about agricultural credit options. Think of these topics as a way to get potential clients to consider their broader estate plans.

Another way to find a compelling topic is to look to professional and social networks to see if there’s a great public speaker in your orbit, or a subject matter expert on some relevant topic. If so, you can rely on the speaker for the bulk of the presentation, and use the closing session to mention your services or other educational seminars you offer.

If your topic is broad and multifaceted, invite other professionals and create a panel discussion, while you take on the role of moderator. In the example of divorce, you could ask a divorce attorney to discuss points of law and a therapist to discuss the stress on family members. Other big-picture issues that may warrant other speakers could include estate planning, extra health coverage, succession planning, or college or elder care expenses.

You don’t necessarily have to confine yourself to financial topics. “Seminar topics do not always need to be financial in nature. Is there a golf instructor or master gardener that your prospects and clients would enjoy hearing from?” Ryan says. Ask your brand ambassadors — those clients you’d duplicate if you could — which topics they’d like to hear an expert talk about.

3. Find a suitable venue

The success of your event will depend at least partly on where it’s held, so choosing a suitable location can be vital. Depending on the size of the group expected, advisors might book a room in a restaurant, a hotel or corporate conference room, a university classroom or a small theater. You may even have accommodations in your office building.

When deciding on a location, consider things like seating, acoustics and the need for audiovisual accommodation. Will the room accommodate the size of your target audience? For a younger audience, you might choose to hold the event at an entertainment venue, beer garden or family fun event. For an older crowd, consider physical accessibility and overall comfort level.

And don’t forget the logistics. Is it easy to find? Is there convenient parking? Plan on visiting the location in advance to look around and see if it suits your needs. Use our checklist to help stay on track with your preparations.

For seminar times, you might be able to offer multiple options. Consider scheduling the same seminar on two consecutive days, or two different times the same day. This isn’t likely to double your attendance, but it will at least make it possible for more people to attend, according to Selling Power, a digital resource for salespeople. Of course, you’ll have to make sure that everyone involved is able to accommodate this model, including the speakers and the venue itself.

Source: Capitals Express Investments, Pathways to Growth: 2022 Advisor Benchmark Study

4. Draw the right crowd

Getting people to show up requires two things: invites and invitees. If you have a specific audience in mind and a list of email addresses, email invitations three weeks ahead of time to the prospects you plan to invite. On the invites, emphasize the benefits, provide the location, highlight the date and time, and offer a simplified map of the location, if possible. Send reminders (including all of this information) each subsequent week, plus one early on the day of the event.

If you want to reach a broader audience, such as clients as well as their friends and family, post details about the event on your website and social media profiles. In fact, you may want to add an ongoing calendar of events to your website so people are aware of what is coming up. Be aware that using your website and social media will cast a wider net and may include prospects beyond your ideal client. Be sure to reach out with a phone call to the subset of people you especially want to see at your event, Ryan suggests.

If you have yet to create your invite list, you first need prospects. Many advisors keep a “warm” prospect list that includes people they’ve met — playing golf, perhaps, or at an art exhibit — who are aware of what they do and may make or know good potential clients. You can do the same with social media contacts who might be a good match, or direct mail respondents you have reached out to in the past. You might also use a lead generation company to produce a target list of names for you and which can filter on any number of metrics, like age, assets or even hobbies.

Plan on making a reminder phone call the day before the event to prospects who have RSVP’d that they will attend. This will give you a chance to start that personal connection even before you meet in person. They are also more likely to attend, because you have made a personal phone call and they won’t want to disappoint you, Ryan says.

Finally, encourage existing clients to invite two or three connections, including their children who may not live nearby. They can attend virtually or in-person. For existing clients, these types of seminars can serve as a retention tool.

5. Come prepared with your talking points

You’ve done all the prep work, and the big day finally arrives. When you’re in front of the crowd, you’ll need to convey the idea that you can be the solution to their financial challenges.

Your opening should include your value proposition, but also be sure to explain the emotional reasons you got into this business in the first place. Script it out and rehearse it a few times before the event, and really say it out loud — don’t silently read it as you walk around making gestures. The ear will catch some flaws that the eye glosses over. In fact, ask a family member or fellow financial professional to listen to the opening and close to get their feedback. The more comfortable you are, the more comfortable the audience will be.

One way to make the audience comfortable is to involve them in your presentation. In addition to soliciting questions throughout, consider asking each of them the one thing they want to take away from your event, and use those ideas to help bolster your presentation. If you have existing clients in the room, invite them to share their own experiences with your services. Encourage the prospects to talk to the existing clients in the room after the official presentation.

Your closing statements are perhaps the most important part of the event. “That’s when you ask for an appointment,” Ryan says. “More importantly, take the mystery out of what this entails by describing exactly what an initial appointment will look like with you and your team.”

Also, have information to hand out that prospects can take home. Don’t be afraid to go the traditional route with handouts: professional folders that include your business card, bio, and information about your team and services. Even in our digital world, many people still like to have something to take home.

6. Maximize your return

Your ultimate goal is to get prospective clients in the door for an appointment. This call to action can help guide many of your decisions and make your event more successful.

Consider crowd size, for example. While it may be tempting to think of the event as a numbers game, you want to make personal connections. A too-large audience can be counterproductive to that goal.

In fact, there is no number too small, Ryan says. “If it’s just a handful of people, forgo your PowerPoint presentation and instead just sit with them and have a fireside chat,” she says. “Make it a real conversation, and remember the ultimate goal is to make a connection and turn these prospects into clients.” (But be sure to get rid of the extra chairs.) Bottom line: Be prepared to be flexible and make changes on the fly when necessary.

On the other hand, don’t be so casual that you forget the importance of timing. If there is a meal served at your prospecting seminar, be sure the presentation is finished before dessert. Most attendees will stay for dessert, and if you’re done with the official presentation, you’ll have one last opportunity to shake hands and meet people one-on-one while they’re enjoying their final course.

After the event, email notes thanking guests for attending within two days, and start calling each prospect for an appointment. If you have addresses, make those follow-up notes handwritten. This adds a great personal touch.

No matter how effective your seminar is, some people just won’t be interested. The good news is that rejection is almost never about you. It’s about your offer. It may help to view a clear “no” as at least being better than the ambiguity of a “maybe.”

Remember that prospecting can be a long game, because even those who aren’t interested now may change their minds over time. Some prospects will contact the advisor months or even years later, sometimes after a major life event. So even that “no” may really be just a “not now.”

Pre- and post-prospecting seminar checklist

Related content

-

Client Relationship & Service

-

Marketing & Client Acquisition