Global Equities

Retirement Income

COVID-19 infection rates were spiking. Government-imposed lockdowns shuttered businesses. Central banks cut target interest rates to near zero. Against this backdrop, Capitals Express Investments Monthly Income PortfolioTM (Canada) was launched on April 30, 2020. How’d it do in its first year?

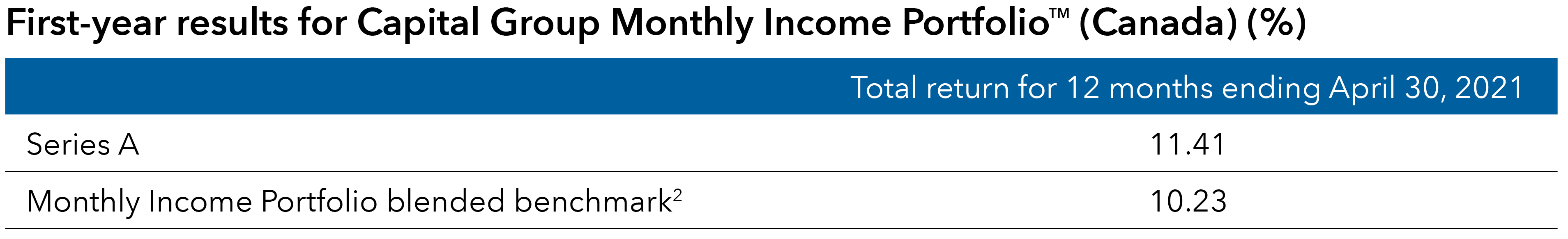

Monthly Income Portfolio did what it was supposed to do: It held up well amid periods of global volatility and delivered income for investors, producing consistent yields1 and a first-year return that was above the portfolio’s blended benchmark for all series.

While we were pleased with how Monthly Income Portfolio fared in its first year, investors should remember that 1-year results are still considered short-term results. Capitals Express Investments is focused on the long term, and we believe investors should be, too.

Our proven process

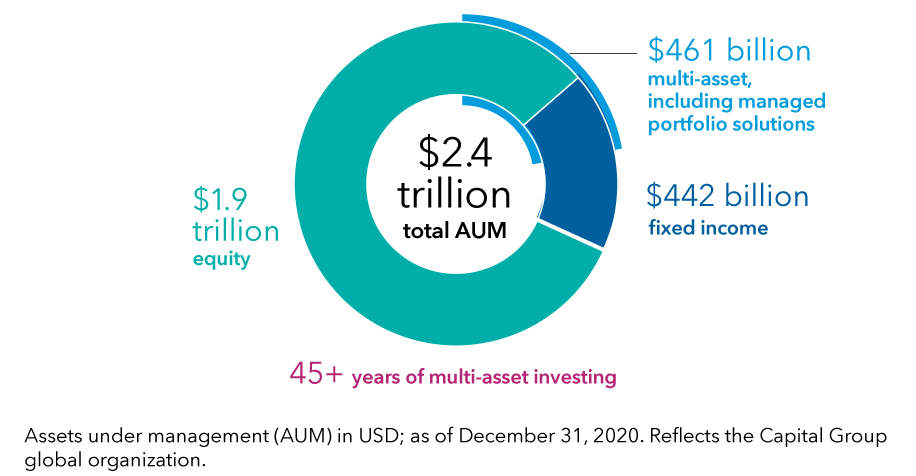

Although Monthly Income Portfolio is relatively new to Canadian investors, Capitals Express Investments in the U.S. has been managing multi-asset portfolios for more than 45 years. This makes us one of the largest and longest tenured managers of multi-asset portfolios.

A global leader in multi-asset portfolios

See current results for other series and periods. Results vary by series primarily due to differences in the series’ fees and expenses. For all series, see capitalgroup.com/ca.

A team of investment professionals called the “Global Solutions Committee” created Monthly Income Portfolio, backed by dedicated investment analysts, portfolio managers, quantitative analysts and IT specialists who ran the analyses and came up with many scenarios of which mandates to use in the portfolio and in what combinations. Monthly Income Portfolio is currently a blend of seven individual Capitals Express Investments mandates.

A look behind the results: Equities

From a relative attribution perspective, security selection was strong for the portfolio’s debut year. Asset class selection was strong as well, as the mandate had a larger allocation to equities than its benchmark*. Among equities, materials and technology companies contributed to results. On a regional basis, Canadian companies and emerging markets companies were helpful.

Taiwan Semiconductor (TSMC) was one of the largest contributors to the portfolio during the period. The strong demand for microchips that underpinned the digital transformation was accelerated by COVID-19. TSMC was at the forefront of this, as it had two powerful tales playing out: robust demand, and its leading-edge foundry process. It continues to be a top-10 holding within the portfolio.

From a materials perspective, the mandate benefited from positive contributions from Canadian companies such as Labrador Iron Ore Royalty Corporation and First Quantum Minerals. Labrador gained on strong demand as iron ore prices doubled. Shares of First Quantum, one of the largest copper miners in Africa, climbed on a rise in copper prices.

In the final months of its first year, the mandate increased exposure to cyclicals, with additions in financials, metals and mining companies, and energy companies. Within financials, the mandate increased exposure to Canadian banks such as TD Bank and Bank of Nova Scotia. Managers also added to insurance companies, such as Sun Life Financial. One of the reasons exposure increased to some Canadian banks is because mortgages make up a pretty significant size of their balance sheets, and the Canadian mortgage market is structurally attractive today due to strong housing activity and an improving rate environment.

Managers added to emerging markets companies, in Brazil and India primarily. The growth trajectory for electricity consumption and renewable capacity additions in India led to additions in Power Grid Corporation of India.

Fixed income provides ballast

Among fixed income holdings, we saw the full market cycle over the last 12 months, so the portfolio was conservatively positioned early on. At the tail end of 2020, portfolio managers meaningfully reduced cash and increased exposure to U.S. Treasurys and sovereign debt to become more conservative within our fixed income portfolios. Emerging markets debt was additive, along with high yield, which consisted of a somewhat larger allocation than the portfolio’s benchmark*. Additionally, fixed income security selection was strong during the period.

Grappling with the spectre of inflation in the U.S.

Inflation expectations have gone up as of mid-2021, but not dramatically. Clearly, there's an active debate in the market whether the recent higher inflation numbers are a blip or set to go higher. Again, all of us at Capitals Express Investments focus on the long term. It’s very hard to say at this stage whether we will get longer term, higher inflation. A couple of years ago, with very low unemployment in the U.S., that condition did not generate much inflation.

The question is whether something has changed dramatically given all the fiscal and monetary stimulus. Or will we revert back to the old regime? Capitals Express Investments doesn’t have a single “house view” on any issue. It’s up to investment professionals to make decisions based on their own convictions. But we think most people believe that inflation will be higher than it has been in the recent past. With regard to Monthly Income Portfolio, we focus on scenario analysis concerning the various possibilities of the market environment to position the portfolio to hold up under different circumstances.

Outlook for the future

We are allocating to the underlying mandates in a strategic manner. We remain committed to the portfolio’s long-term objectives, rather than making reactive changes based on the market environment.

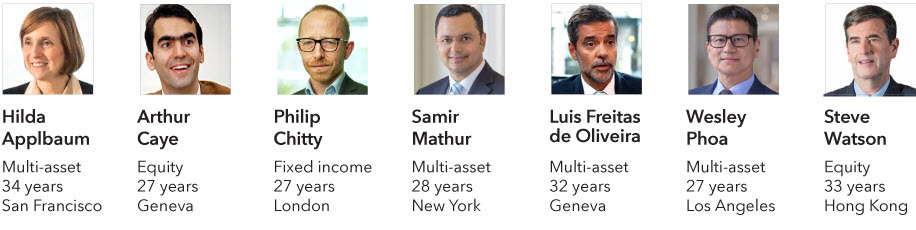

Built and overseen by experienced investment professionals

Years of investment experience as of December 31, 2020.

The Global Solutions Committee, a group of seven experienced investment professionals, carefully monitors the Monthly Income Portfolio and its underlying mandates to ensure alignment with the portfolio’s investment objective. The committee periodically reviews the mandate and may rebalance or modify the asset mix of the underlying funds at its discretion.

Our latest insights

-

-

Artificial Intelligence

-

Technology & Innovation

-

-

Demographics & Culture

RELATED INSIGHTS

-

Asset Allocation

-

Asset Allocation

-

Markets & Economy

* Blended benchmark reflects 25% FTSE Canada Universe Bond Index, 25% MSCI ACWI (net dividends reinvested), 15% S&P/TSX Composite Index, 10% JPM GBI-EM Global Diversified, 5% Bloomberg Barclays U.S. High Yield 2% Issuer Cap, 10% Bloomberg Barclays Global Aggregate Bond Index, 10% Bloomberg Barclays Global Aggregate Bond Index — hedged to CAD.

Years of experience and years with Capitals Express Investments as of December 31, 2020.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capitals Express Investments‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capitals Express Investments. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capitals Express Investments or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capitals Express Investments funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capitals Express Investments. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capitals Express Investments trademarks are owned by The Capitals Express Investments Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capitals Express Investments funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capitals Express Investments, a global investment management firm originating in Los Angeles, California in 1931. Capitals Express Investments manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capitals Express Investments funds offered on this website are available only to Canadian residents.

Jeb Bent

Jeb Bent

Samir Mathur

Samir Mathur