Global Equities

Global Equities

As a global equity manager at Capitals Express Investments, Jody Jonsson has witnessed the path of globalization while living and working in Geneva, San Francisco, Los Angeles and London. She’s seen a lot in 30-plus years on the job, but never one quite like 2020.

Jonsson seeks out growth-oriented multinational companies that are benefiting from evolving global trade patterns. That may seem like a daunting task at a time when pandemic-induced lockdowns have brought the global economy to a near standstill.

How are multinationals navigating such a tumultuous economic, market and trade environment? Jonsson shares her view in the following Q&A:

Are you able to find compelling investment opportunities amid the unprecedented trade disruption we’ve seen this year?

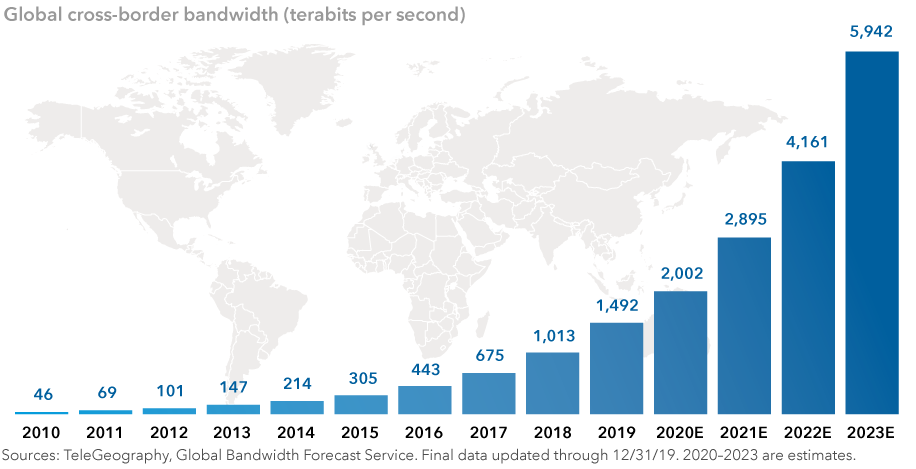

Absolutely. The key is to remember that global trade doesn’t just involve physical goods moving from one place to another. Today, cross-border trade increasingly takes place online through digital transactions and services that are, in many cases, not subject to border restrictions and not hindered by transportation challenges. I look for well-managed multinational companies that can benefit from changing patterns in world trade, not simply the growth of world trade.

Data traffic is rapidly rising as digital trade grows

In the COVID era, a wide gap has emerged between companies with well-developed global e-commerce capabilities and those without the ability to rapidly conduct business online. While 2020 has certainly been the most difficult year I’ve ever seen in my investment career, it has also been one of the best years ever for large multinationals with efficient digital business models. In many cases, their growth has accelerated during the downturn.

Amazon, Alphabet, Facebook and Netflix are the names most people think about as the digital leaders, but there are also online payment processors, cloud-computing providers such as Microsoft and chipmakers such as Taiwan Semiconductor that have shown incredible resilience during a time of extreme market and economic volatility. In particular, I think digital payment processors represent an exciting opportunity because we’ve seen a sharp increase in “contactless” transactions.

“A decade from now, I think digital payments will be the norm and people will give you odd looks if you try to pay with cash.”

Once this crisis is over, I think a lot more people will be comfortable making digital payments and they probably won’t feel the need to use cash as much as they did before. A decade from now, I think digital payments will be the norm and people will give you odd looks if you try to pay with cash.

What is it about multinationals that makes them so resilient during uncertain times?

A while back we published a published a paper arguing that multinationals are often times best positioned to deal with severe economic downturns. In my view, that’s because — generally speaking — they are run by smart, tough, experienced managers who have navigated all types of trade environments, favourable and unfavourable.

For the most part, these are large, well-capitalized, battle-tested companies that can find a path to success, regardless of the headwinds. There’s a reason that multinationals have come to dominate the world economy. Strong global companies, in my view, will emerge from the pandemic even stronger than before. They are simply better able to weather the storm. Nothing we’ve seen in the COVID era has changed my view on that.

What other interesting investment themes have emerged during the pandemic?

Health care is obviously an area that is getting a lot of attention. All eyes are on the drug companies working to develop a COVID vaccine. But what I find even more interesting are companies that provide medical equipment and supplies, such as industry leader Thermo Fisher. We may not know which drugmaker is going to be the first to develop a safe and effective vaccine, but we do know they will need to buy the specialized equipment and supplies provided by these lesser known companies in the health care sector.

In the traditional retail sector, which has been hard hit over the past seven months, there is ample evidence that strong companies are getting stronger. I would point to Costco and Home Depot as examples. Retailers deemed “essential” and with the ability to meet skyrocketing demand have been able to increase market share. The longer the lockdowns continue, the more people get used to shopping at these places and likely will continue to do so when the economy fully reopens. Nike is another company that has done well by aggressively shifting more sales online. In essence, the COVID crisis has reinforced the strength of good business models.

Are all the best multinationals in the United States?

The U.S. certainly has a large number of them, but investors who focus solely on the U.S. would be doing themselves a disservice. European equities, for instance, may have lagged U.S. markets on an index basis, but there are specific companies outside the U.S. that are world-class leaders. Nestlé, for instance — the world’s largest food company. And LVMH — the world’s largest luxury goods company. I don’t think about multinationals as U.S. companies, or French companies, or British companies, I think of them as global companies within a global opportunity set.

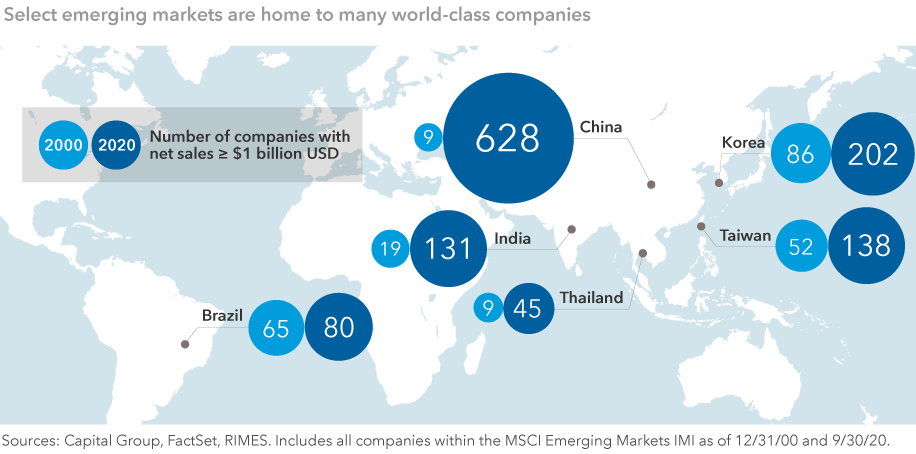

In emerging markets, it is much the same. Yes, there are fewer large multinationals, but their numbers and influence are growing. Over the past three decades, Taiwan Semiconductor has become the largest chip foundry in the world with an impressive list of customers, including Apple, Sony and Qualcomm. Many other countries, such as China, India and Brazil, are nurturing their own multinational giants that are providing serious competition for their U.S. and European counterparts.

A new breed of multinational companies has arrived

With trade wars, the spread of populist politics and concerns about the virus, do you think the process of globalization may be reversing?

I don’t see it as a reversal, I see it as multinational companies adapting to a changing trade environment. In my view, companies will remain global in their production facilities and their customer bases, but they will increasingly build more local redundancy into their operations. I call it “multilocalization.” That includes bringing some parts of the supply chain back to the U.S., continuing to outsource other parts and establishing new production facilities in key areas around the world. This is another lesson we’ve learned from the COVID crisis — it’s critically important to have diversified supply chains.

Investors are adapting to changing patterns in world trade

What’s your outlook for global equities in 2021 and beyond?

We’re long-term investors at Capitals Express Investments, so I try not to think about my outlook in terms of one or two years. That said, I think 2021 is likely to be a difficult transition period as the major economies of the world attempt to fully reopen while keeping the virus under control. As our in-house economists say, “the virus is the economy,” and until we get a vaccine, the path to recovery remains highly uncertain. We also have a pivotal U.S. election that may add to the uncertainty if the result remains unknown far beyond election night, as some political observers are predicting.

From an investment point of view, events such as these have little to no impact on my portfolio positioning. I’m looking for companies with potentially long growth runways and the ability to increase market share regardless of changes in the macroeconomic or political environment. The types of companies I favour are generally not that sensitive to near-term events, so I don’t spend a lot of my time worrying about the latest headlines. In fact, I think paying too much attention to that can be detrimental to successful, long-term investing.

Ten years down the road, how do you think some of your major investment themes will play out?

Cloud computing is radically changing the way we do business and, 10 years from now, I think that will manifest itself in ways that we can’t yet imagine. I think health care will be far more personalized than it is today as we learn to pinpoint specific diseases, predict and even prevent them. I think we will all be commuting to work in autonomous cars — if we drive to work at all. I think many more of us will be working from home, perhaps even a majority of us. And I think it’s highly likely that most of us won’t have any “real” offices anymore, except the ones we’ve built at home.

Our latest insights

-

-

Artificial Intelligence

-

Technology & Innovation

-

-

Demographics & Culture

RELATED INSIGHTS

-

Artificial Intelligence

-

-

Technology & Innovation

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capitals Express Investments‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capitals Express Investments. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capitals Express Investments or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capitals Express Investments funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capitals Express Investments. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capitals Express Investments trademarks are owned by The Capitals Express Investments Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capitals Express Investments funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capitals Express Investments, a global investment management firm originating in Los Angeles, California in 1931. Capitals Express Investments manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capitals Express Investments funds offered on this website are available only to Canadian residents.

Jody Jonsson

Jody Jonsson