Global Equities

United States

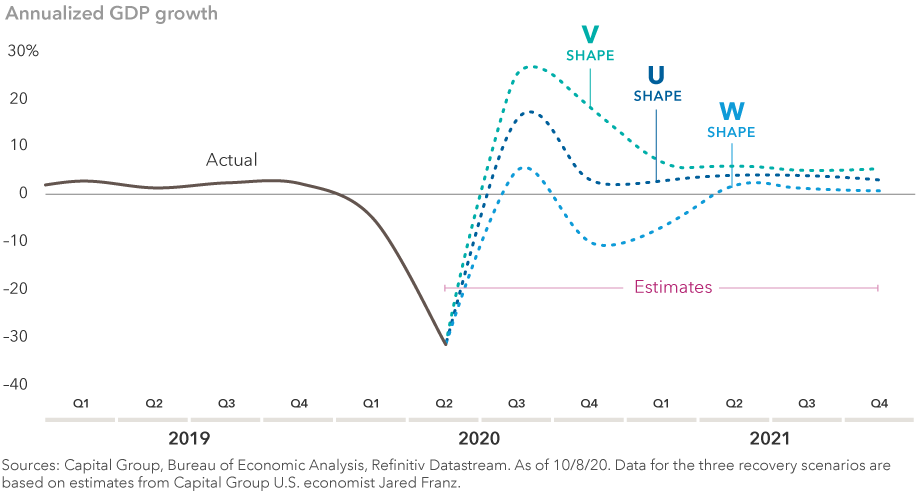

- Expect a “VW” recovery: V in the markets fueled by long-term optimism and W in the U.S. economy amid near-term COVID challenges

- GDP growth of 2% to 3% by the middle of 2021 is likely, according to economist Jared Franz

- Pent-up demand for goods and services should drive big gains once the virus is under control

COVID-19 has forced economists to become students of virology.

“The virus is the economy,” says Capitals Express Investments U.S. economist Jared Franz. “All economic growth forecasts depend on the trajectory of the virus — whether it gets better or worse, whether we can develop an effective vaccine and whether government stimulus measures will continue to help bridge the income gap for workers who have been displaced by this unprecedented downturn.”

So when is growth likely to return to pre-pandemic levels? By the middle of 2021, Franz expects the U.S. economy to grow at an annualized rate of roughly 2% to 3%, fueled by pent-up demand from months of sheltering in place, as well as the growing likelihood of a pandemic-ending vaccine becoming available to the public.

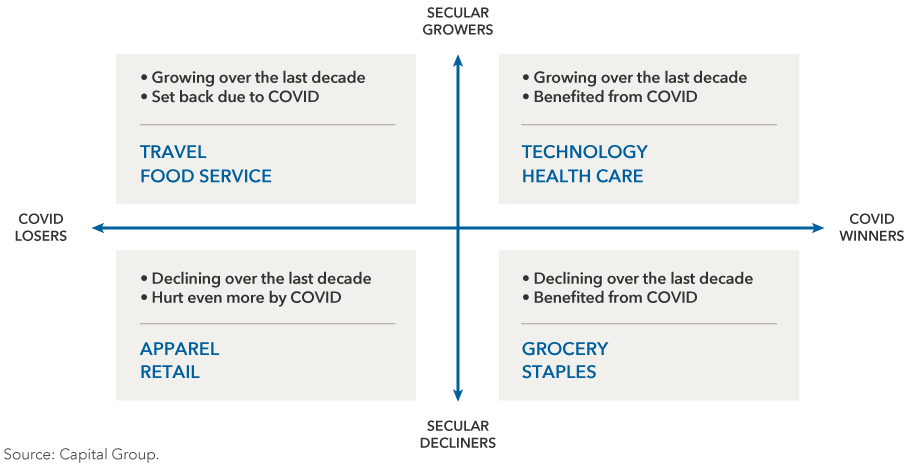

Due to the high level of uncertainty, Capitals Express Investments’s economic team has put together a scenario analysis of V-shaped, U-shaped and W-shaped economic recoveries. However, Franz said “K-shaped” — or moving in two different directions — might be appropriate, as well, given the disparity between sectors that have benefited from the pandemic and those that have been crushed by it.

U.S. economy: The road to recovery remains uncertain

COVID causing a great divide in the economy

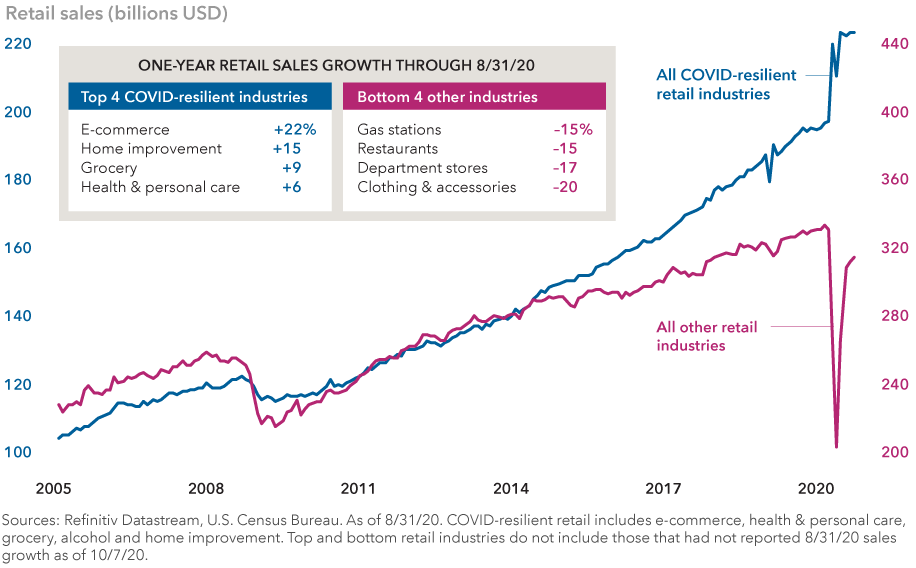

One perplexing element of the 2020 downturn is how uneven it’s been. For some areas of the U.S. economy, it has reached Depression-era levels: restaurants, hotels, retailers, airlines and, perhaps the hardest hit of all, thousands of small businesses that have closed and may never come back. But for others, it has been quite literally the best of times: e-commerce, cloud computing, video streaming and home improvement stores have skyrocketed in the stay-at-home era.

Winners and losers in the COVID economic downturn

The same can be said for high-wage workers versus low-wage workers. From a job loss perspective, the 2020 downturn has been much more severe for workers earning less than US$27,000 a year — many of who cannot work from home — compared to those making US$60,000 or more. This disparity, of course, raises societal questions with no easy answer.

“The post-pandemic U.S. economy is probably going to be very different than the economy we had in February 2020,” Franz says. “It’s going to be more efficient and more dynamic than before, but there will be winners and losers. Historically speaking, we have not done a good job of addressing the societal problems that arise from such disparate outcomes.”

Unemployment levels are uneven among high- and low-wage workers

Expect a grinding recovery near term

Capitals Express Investments economists have also looked at the risks to a near-term recovery. What if we don’t get a vaccine right away? What if the federal government cannot agree on a new stimulus package? What if more job losses come in the months ahead?

These fears have already been underscored by recent economic data and a series of layoff announcements from major American corporations. Personal income fell by 2.7% in August, according to the U.S. Commerce Department, largely due to reductions in enhanced unemployment benefits. Allstate, American Airlines, United Airlines and Walt Disney all announced major layoffs recently as the White House and Congressional leaders failed to reach agreement on a new stimulus bill.

“I think we are going to see more of a grinding recovery in the near term,” says Capitals Express Investments economist Darrell Spence. “Since March, we’ve done everything we needed to do except get the virus under control in a manner that lets us return to some sense of normalcy. Now the fiscal stimulus is running out and, if the federal government doesn’t act soon, we could be looking at a much more difficult income profile in the months ahead.”

In the second quarter of 2020 — the latest data available — the U.S. economy contracted by 31.4% on an annual basis, the biggest decline in 70 years. However, since that data reflects the worst of the downturn from April to June, the third quarter GDP reading is expected to show a dramatic bounce back as many U.S. states partially or fully reopen their economies. That report is scheduled to be released on October 29, five days before the U.S. presidential election.

With Election Day, perceptions about the U.S. economic outlook could shape the outcome. A recent Washington Post-ABC News poll confirmed that the economy is the most important issue to voters — more important than COVID by a 2-to-1 margin.

Digital divide has created opportunities for stock pickers

Potential investment implications

For investors, the pandemic-induced downturn has produced perhaps the biggest contrast of all. Amid the worst economic recession since the Great Depression, U.S. stock prices recovered quickly from the lows of March and hit new record highs in September.

Leading the way have been those companies with a solid “digital advantage,” including e-commerce giant Amazon, microchip maker NVIDIA and social media titan Facebook. Apple, meanwhile, became the first U.S. company in history to reach a US$2 trillion valuation.

“The market is saying this has been a disastrous year, but things are going to get better,” says Capitals Express Investments portfolio manager Steve Watson. “Given the exceptional nature of 2020, I think we need to brace for more volatility ahead, but we can still find good, compelling investments for the long term.”

Our latest insights

-

-

Artificial Intelligence

-

Technology & Innovation

-

-

Demographics & Culture

RELATED INSIGHTS

-

-

Global Equities

-

Economic Indicators

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capitals Express Investments‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capitals Express Investments. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capitals Express Investments or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capitals Express Investments funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capitals Express Investments. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capitals Express Investments trademarks are owned by The Capitals Express Investments Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capitals Express Investments funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capitals Express Investments, a global investment management firm originating in Los Angeles, California in 1931. Capitals Express Investments manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capitals Express Investments funds offered on this website are available only to Canadian residents.

Jared Franz

Jared Franz

Darrell Spence

Darrell Spence

Steve Watson

Steve Watson