Global Equities

Long-Term Investing

The world in 2030 may seem a long way off, but at Capitals Express Investments we spend a lot of time thinking about the distant future.

“Imagining life in 2030 is not a hypothetical for me,” notes Capitals Express Investments vice chairman Rob Lovelace, a sentiment echoed by many of his colleagues. “In the portfolios that I manage, my average holding period is about eight years, so I’m living that approach to investing.”

We asked our investment team to look in their crystal balls to envision how life may change by the end of the decade. Here are seven portfolio managers’ perspectives on the world in 2030, and how these shifting trends influence their investment decisions.

1. COVID could be this generation’s Pearl Harbor

2. Cash is an endangered species

3. A cure for cancer may be around the corner

4. Health care innovation reaches warp speed

5. Renewable energy powers the world

6. Electric and autonomous vehicles hit the fast lane

7. What’s not changing? Successful investing

1. COVID could be this generation’s Pearl Harbor — Martin Romo

Ten years from now I think we will look back on COVID as our generation’s “Pearl Harbor moment” — a period when extreme adversity spurs innovation and behavioural changes to help address some of the era’s biggest problems. When Pearl Harbor happened, the U.S. artillery was 75% horse drawn. Let me say that again: In 1941, three quarters of our artillery depended on horses. Yet by the end of the war we had entered the atomic age. That incredible transformation sparked a period of innovation and growth in the U.S. economy that lasted for decades.

COVID could be the trigger that spurs us to tackle critical issues over the next decade, such as the cost of health care, education and housing. We’ve already seen an almost magically rapid development of COVID vaccines at a speed few thought possible. And we’re doing things in our daily lives we never imagined would happen this quickly.

In 2030 we may be living, working, studying and playing in a radically new world. Our lives could be better, richer, healthier, cheaper and profoundly more digital, virtual and data centric. Many of the technologies already exist, but I believe there's still so much untapped potential for innovative companies to think bigger and use them in ways that solve societal problems.

2. Cash is an endangered species — Jody Jonsson

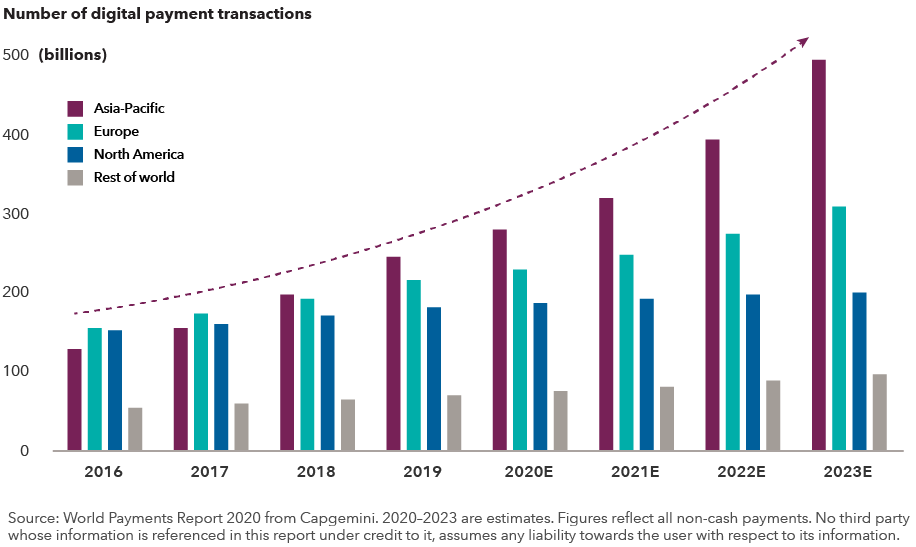

A decade from now I think digital payments will be the norm, and people will give you odd looks if you try to pay with cash.

This is one area where emerging markets are ahead of the U.S. We’ve seen this trend for several years in developing countries — where many consumers had no bank accounts but did have mobile phones and adopted mobile payment technology quickly. The pandemic accelerated use of digital payments around the world, including places where it hadn’t previously been ingrained in daily life. Once this crisis is over, I think a lot more people will be comfortable making digital payments, and they probably won’t feel the need to use cash as much as they did before.

As consumers become increasingly comfortable with the technology, companies with large global footprints such as Mastercard and PayPal are poised to benefit. We’ve also seen strong growth in smaller companies outside the U.S., such as Brazil’s PagSeguro and StoneCo, which offer mobile payment platforms for merchants.

3. A cure for cancer may be around the corner — Cheryl Frank

A cure for cancer may be closer than you think. In fact, I believe some cancers will be functionally cured with cell therapy between now and 2030. New, reliable tests should enable very early detection of cancer formation and location. Beyond that, cancer could largely be eradicated as a major cause of death through early diagnosis.

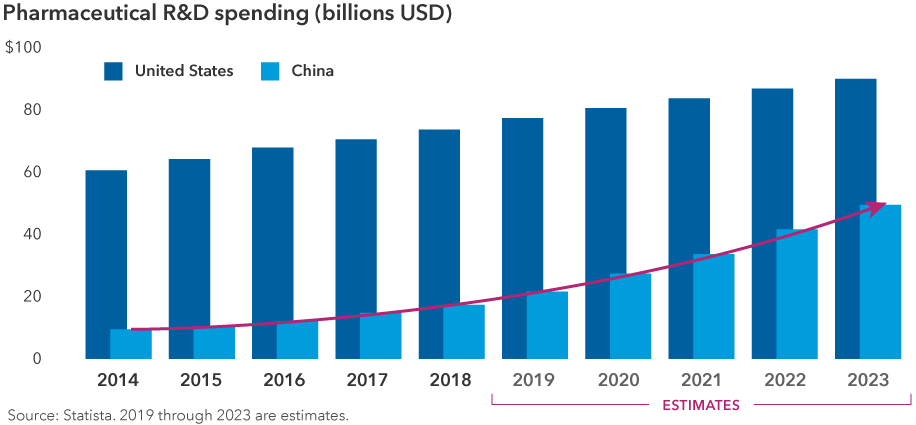

Vastly reduced costs and scientific developments have contributed to phenomenal growth in medical research. We're in a renaissance period for R&D, and companies are investing aggressively to find unique ways to battle cancer and other illnesses. Genomics research and therapies derived from genetic testing have the potential to extend lives and generate billions of dollars in revenue for companies that develop them.

I wouldn’t be surprised to see increasing amounts of pharmaceutical innovation come from outside the U.S. In fact, I expect to see many blockbuster drugs from China by 2030. The country has the biggest population of cancer patients in the world, and it’s significantly easier to enroll those patients in clinical trials. I expect they will begin to produce novel drugs within five to 10 years and sell them at one-tenth the cost in the U.S.

4. Health care innovation reaches warp speed — Rich Wolf

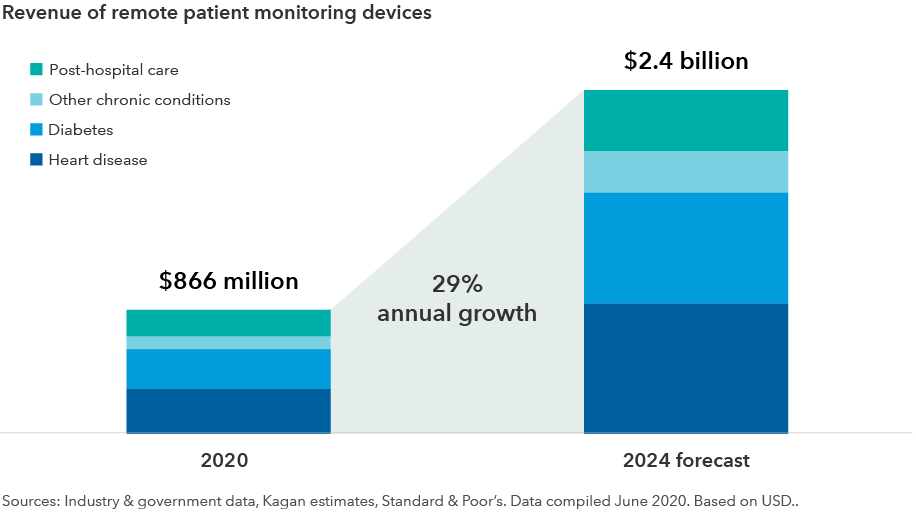

Star Trek, the classic sci-fi TV series, depicted a far-off future where space explorers traveled the galaxies equipped with cutting edge technology such as the tricorder, a hand-held medical device that scanned a person’s vital signs, issued a diagnosis and prescribed treatment in minutes. While I don’t think there is going to be a single tricorder that does everything, I suspect that by 2030 many of us will have devices like it that will analyze blood, do cardiology monitoring and even remotely check our breathing while we sleep, some of which are available today.

We are already experiencing a massive wave of innovation and disruption across the health care sector that has the potential to drive new opportunity for companies, reduce overall costs and, most importantly, improve outcomes for patients. Breakthroughs in diagnostics will help lead to earlier detection of illnesses, which can help make drugs more effective — or in some cases treat disease before it progresses. One of the most exciting things today is something known as liquid biopsy, whereby a sample of your blood can identify a tumor at its earliest stages.

A broad range of traditional technology and medical technology companies have been working to develop home diagnostics for some time, and patients are now benefitting from their innovation. These are cost-effective devices that can collect all kinds of health-related metrics that not only help coach us to improve our own health, but can be immediately sent to our doctor for further consultation. We’re still in the early stages of development, but by 2030 it should be a routine part of our daily lives.

5. Renewable energy powers the world — Noriko Chen

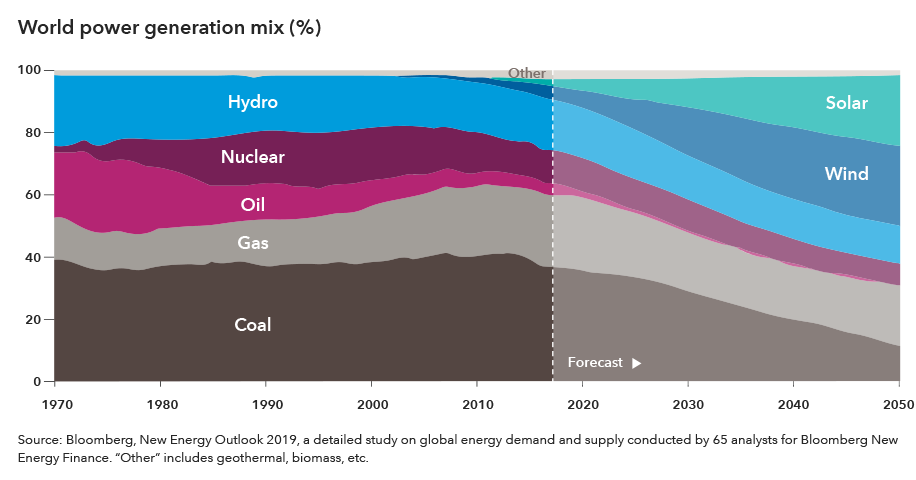

I believe we’ll see a dramatic shift toward renewable energy over the next decade. We are in the early stages of the transition to an electrification of the grid and green energy, and there are strong tailwinds that could drive growth through 2030 and beyond. Automation and artificial intelligence are setting the stage for a golden age in renewables — pushing costs down while boosting productivity and efficiency.

Renewable energy has historically been perceived as expensive, impractical and unprofitable — but all that is quickly changing. Some traditional utilities are already generating more than 30% of their business from renewables and are reaching an inflection point where they are being recognized more as growth companies rather than just staid, old-economy power generators and grid operators. The move toward renewables is most pronounced in European utilities, including Enel in Italy, E.ON in Germany and Denmark’s Ørsted. Their governments have set high decarbonization targets and created incentives for further investment — not only in electricity grids and infrastructure, but also in battery storage and other technologies that could accelerate demand.

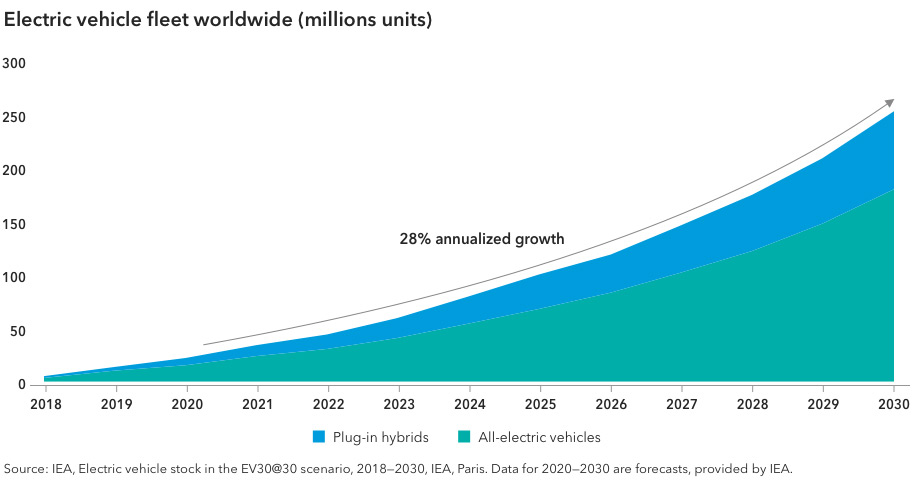

6. Electric and autonomous vehicles hit the fast lane — Chris Buchbinder

I think in 2030 we will have widely deployed fleets of autonomous electric vehicles operating in most major and many secondary cities around the world. Ownership of a personal vehicle will go from being a necessity to a luxury. Many people will still have vehicles — just like people ride horses or bicycles for fun. But personal vehicles will no longer be necessary as the primary form of transportation for most people in major cities.

This is an area that I believe the market hasn’t fully appreciated yet. Right now, the market leaders are embedded in other companies — such as Alphabet’s Waymo, Amazon’s Zoox or the Cruise division of GM — so investors can’t buy a pure-play autonomous driving company. But as these fleets roll out more publicly, the market should start to reevaluate these companies and realize this is a real business, not a science project.

I also think 2030 is when we're likely to see hybrid electric engines and hydrogen engines introduced into commercial aircrafts, with widespread deployment over the following 5–10 years. The impact on global emissions could be significant if we transition to a world where we've got huge fleets of autonomous electric vehicles on the road and aircraft transportation shifting from oil-based fuel to a mixture of oil, electricity and hydrogen.

7. What’s not changing? Successful investing — Andrew Suzman

My colleagues may be able to look at the future and imagine new products and trends, but I’d like to predict one thing that won’t be different in 2030. Despite all the change going on in the world, I believe the nature of my job and focus as a portfolio manager will be exactly the same.

In 2030 — just as we did in 2020 and 2010, and every year before that — we will come upon companies that do interesting things. We'll try to buy them at reasonable prices and hold them so that any returns we get may be better than if we were to buy all companies. That is my true north. Some companies will get it right and some will get it wrong. Our job is to find the companies most likely to get it right and create wealth over time so that our investors may benefit. Not that we’ll be perfect, but I'm optimistic that we can get more companies right than wrong and continue to add value for our clients.

Our latest insights

-

-

Artificial Intelligence

-

Technology & Innovation

-

-

Demographics & Culture

RELATED INSIGHTS

-

Global Equities

-

Artificial Intelligence

-

Technology & Innovation

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capitals Express Investments‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capitals Express Investments. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capitals Express Investments or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capitals Express Investments funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capitals Express Investments. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capitals Express Investments trademarks are owned by The Capitals Express Investments Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capitals Express Investments funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capitals Express Investments, a global investment management firm originating in Los Angeles, California in 1931. Capitals Express Investments manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capitals Express Investments funds offered on this website are available only to Canadian residents.

Jody Jonsson

Jody Jonsson

Martin Romo

Martin Romo