Client Conversations

7 MIN ARTICLE

For advisor use only. Not for use with investors.

As a professional who has had thousands of client conversations and quarterly or annual reviews, chances are you’ve developed a way of communicating that helps you elicit the information you need to provide direction for your clients. And chances are, it feels like it’s working.

But during periods of extreme market volatility, economic uncertainty or unprecedented events, those conversations can get tough. Even in a bull market, when clients are questioning whether they should take on more risk in pursuit of greater returns, how you steer the conversation is crucial. When clients need empathy, reassurance and context to avoid emotional decision-making — especially when everyone is pressed for time — what you say and how you say it can make all the difference in your relationships.

The following “four-box” framework for client conversations can help. It covers four essential steps to having a meaningful conversation in a way that instills trust. This framework comes in handy when volatility strikes, but you can adjust the language to fit whatever environment you’re operating in.

Step 1: ACKNOWLEDGE

Understand the concerns of others before explaining yours.

Active listening and thoughtful questioning are key to being a good conversationalist. These traits can also help uncover client concerns and provide the foundation for demonstrating empathy. While some clients are all too ready to unleash their lists of concerns, others might be hesitant to come clean about their challenges or express fears, most of which boil down to: “Am I going to be okay?” Here are some phrases and strategies you might use:

- Acknowledge what is going on. If it’s an event in the news or conditions that result in market volatility, it is OK to recognize that these things can be very unsettling.

- Be honest. In cases when even you don’t know what to say, you can offer a frank assessment. “We likely don’t fully know the severity of the conditions or how long the resulting economic and/or market disruption will last.”

- Don’t presume. Ask questions to understand the specific concerns of the other person; give clients a chance to empty their emotional buckets. What’s bothering them may not be what you think.

- Repeat back to them what you’ve heard. Volleying back their concerns — in their own words, when possible — lets clients know you’ve been listening, not just waiting to talk.

Words to use:

“I know these are unsettling times.”

“I want to make sure you are doing OK.”

“How are you holding up?”

“How are you feeling?”

“I am sure you have questions for me.”

“What concerns you most?”

“What I’m hearing you say is…”

Trust triggers

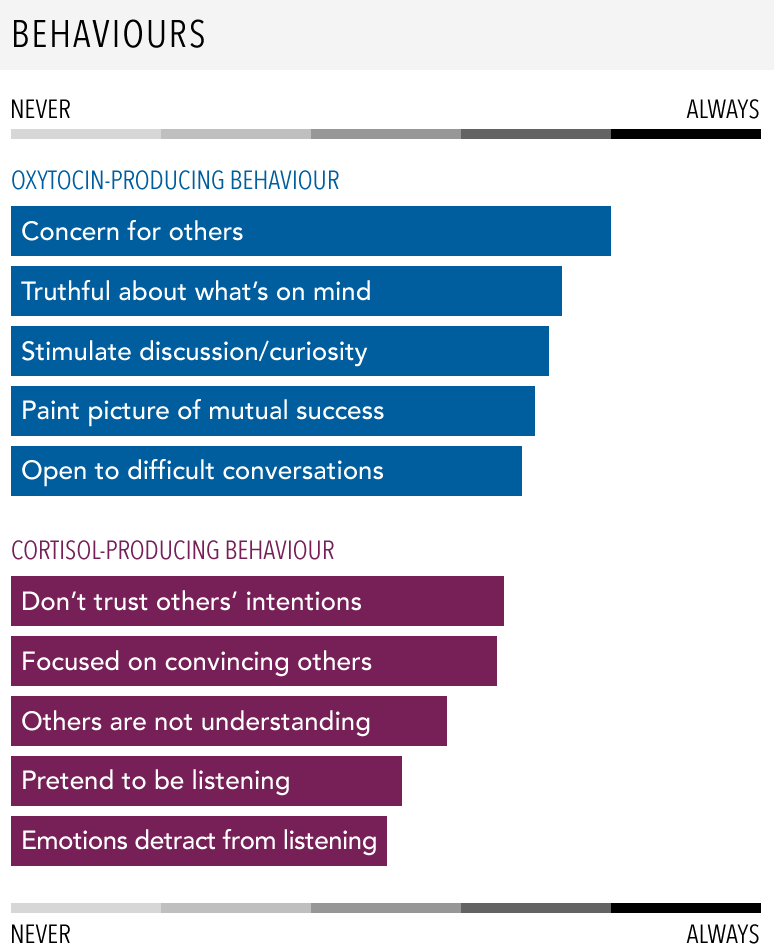

Research has shown that certain conversational behaviours reliably trigger the release of oxytocin, sometimes known as the “trust hormone,” while others result in the production of cortisol, often called nature’s alarm system. In an article in the Harvard Business Review, the late Judith Glaser, an expert on so-called conversational intelligence and founder of the CreatingWE® Institute, cataloged some common conversational behaviours based on whether they triggered the production of oxytocin or cortisol.

Step 2: PERSPECTIVE

Shed light on the bigger picture.

Putting things into context can help guide a conversation from panicked to productive. An informed perspective with historical context can help clients process market ups and downs. A broader perspective can make even seemingly unprecedented events like COVID-19 seem navigable. The following strategies can help:

- Remind clients that while the particular crisis you’re facing may be new, market volatility is not. As the saying goes, the further back you look, the further ahead you’ll see. Markets have survived a great variety of disruptions in the past.

- Find context for the crisis you’re facing. For example, although COVID-19 is the most severe pandemic of our lifetime so far, it’s actually the seventh virus outbreak of the last two decades. While those other outbreaks had short-term impacts on economic and financial market growth, they might be viewed as minor events over the long term.

- Provide relevant detail: Demonstrating your grasp of an issue’s complexity without slipping into jargon establishes both expertise and vigilance.

Words to use:

“We don’t know when the market will recover or what the full impact will be. But here’s what we do know...”

“Market declines are normal, natural and expected.”

“We’ve been here before, and markets have always recovered.”

“I’m not sure if we’re at a market bottom, but I can tell you we’re probably not at a market top.”

“What we do know is investors who stay the course have historically benefited over the long run."

Step 3: CONFIDENCE

Refocus on the progress made.

Confidence can be infectious. Helping clients pay attention to the things within their control and revisiting the goals you’ve developed together creates a new focus point. This step is important in bull markets and bear markets alike. For example, surging markets may tempt clients to abandon a balanced approach. Bringing them back to the goals they defined during less emotional periods is crucial. Consider the following strategies:

- Ask clients about the things they can actually control during market volatility: savings behaviour, a balanced mix of personal investments, goal-setting and a commitment to staying on track. Ask what they think should change.

- Remind them that you know what matters most to them and that you developed these objectives together, perhaps during a calmer time. Discuss specific objectives clients established, and remind them that changes in market conditions likely haven’t changed their goals.

- It may help to show your clients how markets have fared during the worst 20-year periods they have ever experienced.

Words to use:

“I remain confident about your goals.”

“You have shared with me the things that matter to you. I’d like to walk through each one and reconfirm your priorities.”

“Let’s start with your needs, followed by your wants and then your wishes.”

A plan to approach every conversation

The four-box framework may look simple, but it can help you guide even the most complex conversations.

Client Conversation Framework

| Acknowledge: Empathize, Listen and Identify |

Perspective: Share and Educate |

| Confidence: Prioritize Client Goals |

Opportunity: Give Action Steps |

Source: Capitals Express Investments

Step 4: OPPORTUNITY

Provide action steps.

Productive conversations often end with takeaways, new learnings or next steps to take. For financial professionals, this is the chance to guide clients to consider prudent and perhaps opportunistic financial moves.

- Depending on the economic or market environment, show why refinancing debt at lower interest rates, increasing retirement plan contributions to take advantage of lower equity prices, or simply consolidating various accounts to get a fuller picture of their financial situation may make sense.

- Finally, stress the need for patience and prudence, and the importance of continuing to follow the plan that will allow them to achieve their goals.

Words to use:

“We’ve designed a plan to stay with in good times and bad.”

“My role/responsibility is to share with you a few opportunities that are aligned with your goals.”

Four habits of great conversationalists

We tend to think of conversations as organic and improvised exchanges in breakrooms and cocktail parties. But while they may seem to lack tactics, the best conversationalists employ common techniques that make others feel heard and appreciated. Here are four habits of great conversationalists:

- They listen more than they talk. As the saying goes, humans have two ears but only one mouth. Using them proportionally communicates concern and empathy. Be sure to actively listen. Pretending to listen and focusing on convincing others of your point of view are among the behaviours that most detract from trust.

- They don’t make it about their experiences. Sharing episodes from your own life can be appropriate … but not always. People’s experiences feel unique to them. When we excessively draw comparisons to our own experiences, it can make people feel less understood.

- They admit when they don’t know or understand something. In addition to making you credible, asking someone to explain or elaborate on something makes them feel heard and puts them in a position of power.

- They are truthful about what’s on their mind and open to difficult conversations. Advisors must strike a balance between acknowledging the very real challenges facing investors while instilling faith in the value of long-term investing. Validating anxiety while providing the context needed to move beyond it is crucial.

Our online Guide to market volatility has additional information and a variety of tools you can use to continue having productive conversations with your clients — just one of the ways we remain committed to supporting both you and your clients, today and in the future

Related Content